- Singapore

- /

- Energy Services

- /

- SGX:B9S

CosmoSteel Holdings Limited's (SGX:B9S) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- CosmoSteel Holdings to hold its Annual General Meeting on 31 January 2023

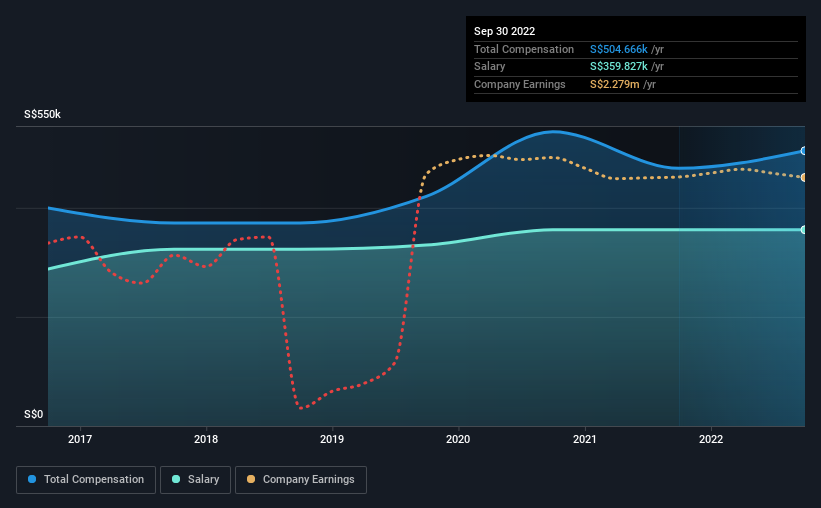

- CEO Jack Ong's total compensation includes salary of S$359.8k

- Total compensation is 52% above industry average

- CosmoSteel Holdings' EPS grew by -3.4% over the past three years while total shareholder return over the past three years was 58%

CEO Jack Ong has done a decent job of delivering relatively good performance at CosmoSteel Holdings Limited (SGX:B9S) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 31 January 2023. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for CosmoSteel Holdings

Comparing CosmoSteel Holdings Limited's CEO Compensation With The Industry

At the time of writing, our data shows that CosmoSteel Holdings Limited has a market capitalization of S$35m, and reported total annual CEO compensation of S$505k for the year to September 2022. That's just a smallish increase of 6.8% on last year. In particular, the salary of S$359.8k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Singapore Energy Services industry with market capitalizations below S$264m, we found that the median total CEO compensation was S$332k. This suggests that Jack Ong is paid more than the median for the industry. What's more, Jack Ong holds S$4.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | S$360k | S$360k | 71% |

| Other | S$145k | S$112k | 29% |

| Total Compensation | S$505k | S$472k | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. There isn't a significant difference between CosmoSteel Holdings and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at CosmoSteel Holdings Limited's Growth Numbers

Over the last three years, CosmoSteel Holdings Limited has shrunk its earnings per share by 3.4% per year. It achieved revenue growth of 17% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has CosmoSteel Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with CosmoSteel Holdings Limited for providing a total return of 58% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The overall company performance has been commendable, however there are still areas for improvement. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for CosmoSteel Holdings (2 make us uncomfortable!) that you should be aware of before investing here.

Important note: CosmoSteel Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:B9S

CosmoSteel Holdings

An investment holding company, sources and distributes piping system components in Singapore, Brunei, Vietnam, and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success