- Australia

- /

- Professional Services

- /

- ASX:SIQ

Insider Action On 3 Undervalued Small Caps In The Asian Market

Reviewed by Simply Wall St

The Asian market has been navigating a complex landscape, with recent trade tensions and economic indicators painting a mixed picture for investors. As small-cap indexes show resilience amid broader uncertainties, the focus turns to identifying opportunities that may be overlooked yet hold potential value. In this context, understanding insider actions can provide valuable insights into which companies might be poised for growth despite prevailing challenges.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.7x | 1.1x | 36.47% | ★★★★★★ |

| Atturra | 28.9x | 1.2x | 36.96% | ★★★★★☆ |

| Hansen Technologies | 289.5x | 2.8x | 23.79% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 47.53% | ★★★★★☆ |

| Puregold Price Club | 9.2x | 0.4x | 27.60% | ★★★★☆☆ |

| Dicker Data | 19.5x | 0.7x | -37.47% | ★★★★☆☆ |

| Sing Investments & Finance | 6.9x | 3.5x | 44.62% | ★★★★☆☆ |

| Smart Parking | 72.6x | 6.4x | 47.13% | ★★★☆☆☆ |

| Integral Diagnostics | 169.0x | 1.9x | 40.32% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.7x | 22.19% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Nanosonics (ASX:NAN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nanosonics is a healthcare company specializing in infection prevention solutions, notably through its innovative disinfection technology for medical equipment, with a market cap of A$1.53 billion.

Operations: Nanosonics generates revenue primarily from its healthcare equipment segment, reporting A$183.97 million in the latest period. The company has shown a gross profit margin of 77.42%, with operating expenses heavily focused on general and administrative costs, which amount to A$98.44 million, and research and development expenses at A$33.05 million.

PE: 88.3x

Nanosonics, a company with promising growth potential, reported A$93.6 million in sales for the half-year ending December 2024, up from A$79.64 million the previous year. Net income rose to A$9.76 million from A$6.17 million, showcasing strong financial performance despite relying on external borrowing for funding. Insider confidence is evident with recent share purchases by management within the past six months, signaling belief in future prospects as revenue guidance was revised upwards to 11%-14% growth for early 2025.

- Navigate through the intricacies of Nanosonics with our comprehensive valuation report here.

Assess Nanosonics' past performance with our detailed historical performance reports.

Smartgroup (ASX:SIQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Smartgroup is a company that provides outsourced administration and vehicle services, with a market cap of approximately A$1.01 billion.

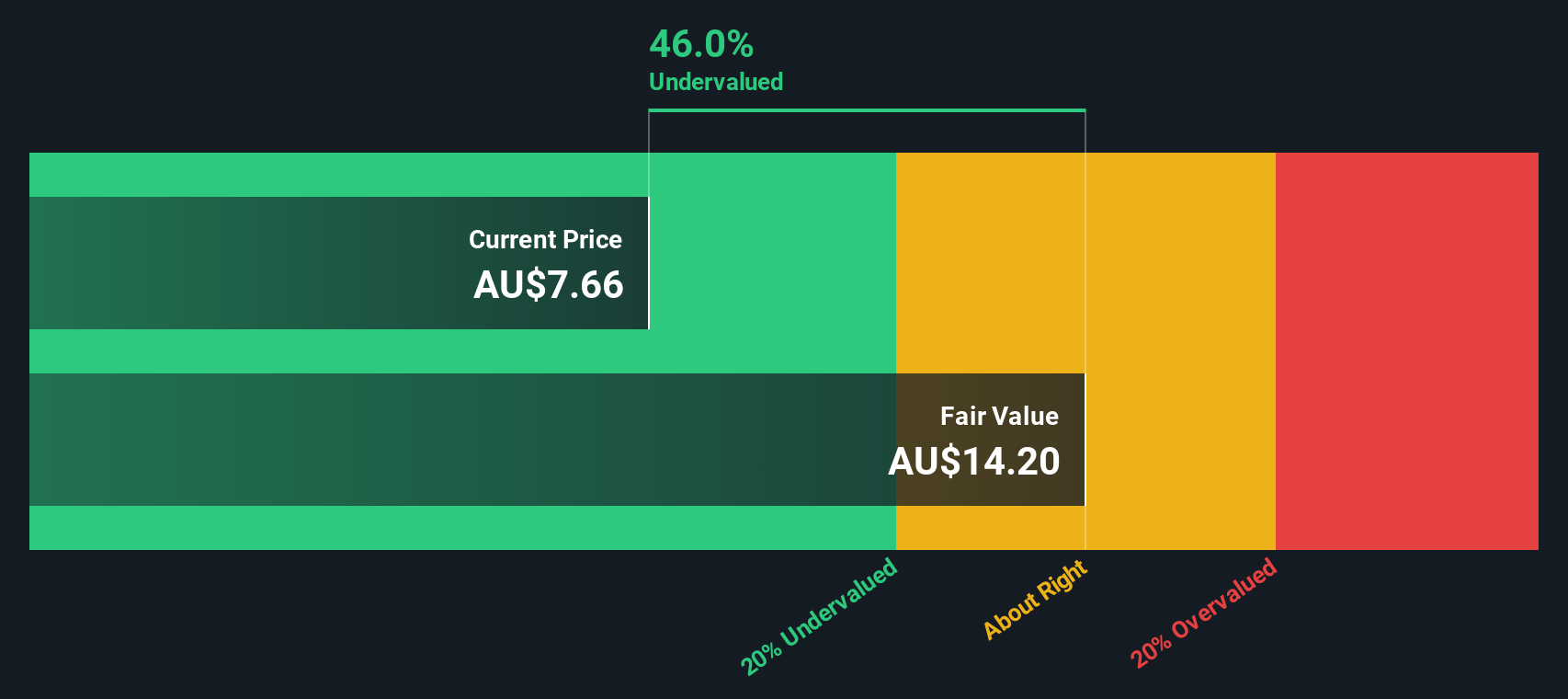

Operations: Smartgroup primarily generates revenue through its Outsourced Administration segment, with Vehicle Services contributing a smaller portion. The company's gross profit margin has shown variability, reaching 60.83% at one point but recently recorded at 54.88%. Operating expenses are significant and include general and administrative costs, which have been increasing over time.

PE: 14.3x

Smartgroup, a small company in Asia, recently caught attention with insider confidence demonstrated by John Prendiville purchasing 70,000 shares for A$584,000. This move suggests potential value in the company's growth trajectory. For 2024, Smartgroup reported sales of A$305.84 million and net income of A$75.6 million, both up from the previous year. The company declared dividends totaling A$41.37 million in March 2025, underscoring its commitment to returning capital to shareholders amidst steady earnings growth projections of 3.5% annually.

- Click to explore a detailed breakdown of our findings in Smartgroup's valuation report.

Understand Smartgroup's track record by examining our Past report.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Value Rating: ★★★☆☆☆

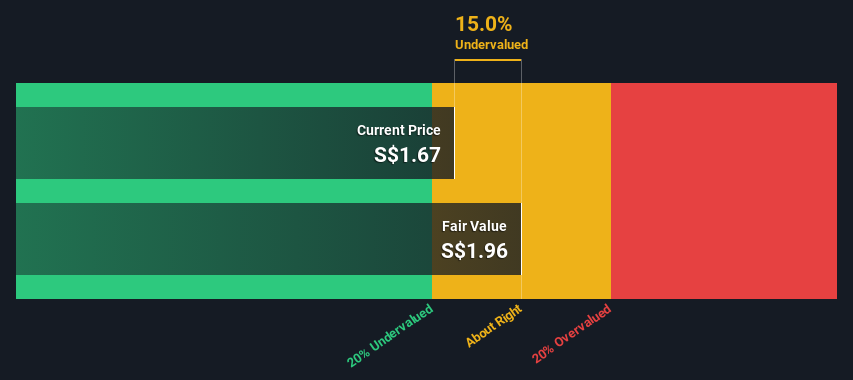

Overview: UOB-Kay Hian Holdings is a financial services firm primarily engaged in securities and futures broking and other related services, with a market capitalization of approximately S$1.57 billion.

Operations: The company generates revenue primarily from securities and futures broking services, with a recent quarterly revenue of SGD 631.69 million. Over the observed periods, the net income margin has shown an upward trend, reaching 36.21% in September 2024 before slightly declining to 35.49% by December 2024. Operating expenses are a significant component of costs, with general and administrative expenses consistently comprising a large portion of these expenses across multiple periods.

PE: 7.0x

UOB-Kay Hian Holdings, a financial services firm, has shown promising earnings growth with net income rising to S$224.22 million for 2024 from S$170.36 million the previous year. This increase is reflected in their dividend announcement of S$0.119 per share, payable in June 2025. Despite relying solely on external borrowing for funding, insider confidence is evident as insiders have increased their stock holdings recently, suggesting belief in its potential despite higher risk exposure compared to customer deposits-based funding models.

Turning Ideas Into Actions

- Get an in-depth perspective on all 61 Undervalued Asian Small Caps With Insider Buying by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIQ

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives