- Singapore

- /

- Capital Markets

- /

- SGX:CHJ

Benign Growth For Uni-Asia Group Limited (SGX:CHJ) Underpins Its Share Price

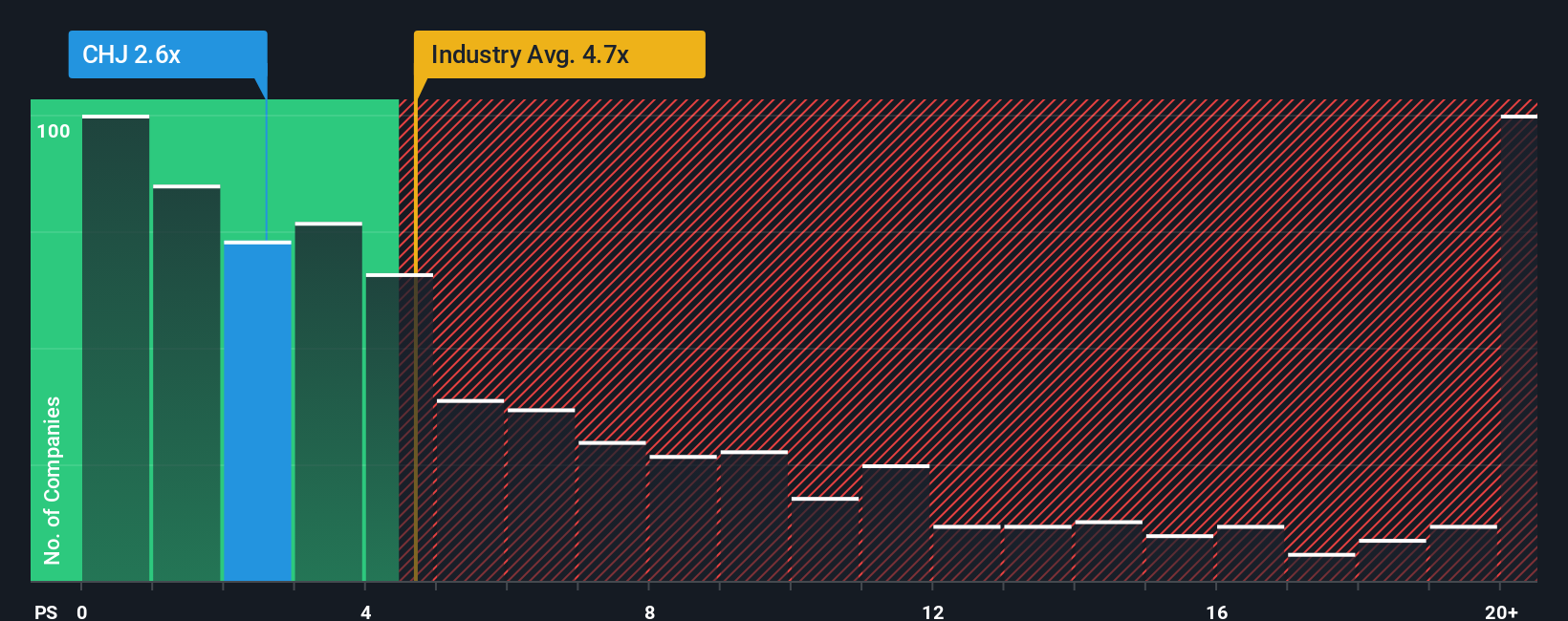

Uni-Asia Group Limited's (SGX:CHJ) price-to-sales (or "P/S") ratio of 2.6x may look like a very appealing investment opportunity when you consider close to half the companies in the Capital Markets industry in Singapore have P/S ratios greater than 13.7x. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Uni-Asia Group

What Does Uni-Asia Group's P/S Mean For Shareholders?

For example, consider that Uni-Asia Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Uni-Asia Group will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Uni-Asia Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. The last three years don't look nice either as the company has shrunk revenue by 71% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 8.6% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Uni-Asia Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Uni-Asia Group confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Uni-Asia Group (of which 2 shouldn't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CHJ

Uni-Asia Group

Operates as an alternative investment company in Japan, Asia, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success