- Singapore

- /

- Capital Markets

- /

- SGX:BLS

Shareholders Of Hotung Investment Holdings (SGX:BLS) Must Be Happy With Their 81% Return

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Hotung Investment Holdings Limited (SGX:BLS) share price is up 18% in the last 5 years, clearly besting the market decline of around 3.8% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 9.2% in the last year , including dividends .

See our latest analysis for Hotung Investment Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Hotung Investment Holdings actually saw its EPS drop 7.1% per year.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. Given that EPS is down, but the share price is up, it seems clear the market is focussed on other aspects of the business, at the moment.

There's no sign of growing dividends, which might have explained the resilient share price. And the -13% compound annual revenue reduction might be interpreted as a sign that Hotung Investment Holdings' best days are behind it. So this one is a tough nut to crack, and we'd be cautious of the stock. However, further research might explain the share price gain.

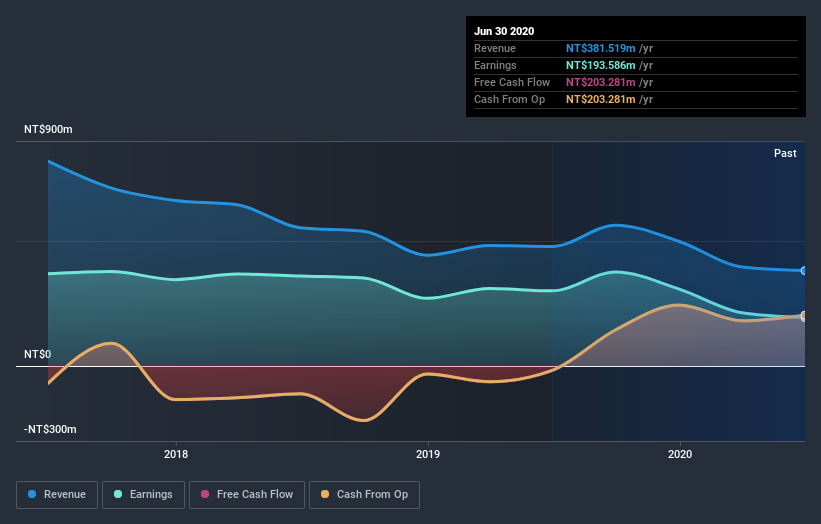

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Hotung Investment Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Hotung Investment Holdings, it has a TSR of 81% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Hotung Investment Holdings shareholders have received a total shareholder return of 9.2% over the last year. And that does include the dividend. However, the TSR over five years, coming in at 13% per year, is even more impressive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Hotung Investment Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

We will like Hotung Investment Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

When trading Hotung Investment Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hotung Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BLS

Hotung Investment Holdings

An investment holding company, operates as a venture capital investment company in Taiwan, China, Israel, the United States, the United Kingdom, and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026