Asian Penny Stocks Spotlight: E-Commodities Holdings And 2 More To Watch

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and economic uncertainty, the Asian market continues to capture investor interest with its diverse opportunities. Penny stocks, often seen as relics of past market eras, still hold potential for growth by offering affordability and access to smaller or emerging companies. By focusing on strong financials and solid fundamentals, these stocks can present unique opportunities for investors seeking value in the ever-evolving landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.87 | HK$2.34B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.24 | HK$782.38M | ✅ 4 ⚠️ 2 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.32 | HK$178.22M | ✅ 2 ⚠️ 4 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.10 | HK$1.75B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.175 | SGD34.86M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.68 | HK$53.61B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, along with its subsidiaries, is involved in the processing and trading of coal and other products, with a market capitalization of HK$2.22 billion.

Operations: The company's revenue is primarily derived from HK$35.22 billion in trading of coal and other products, along with HK$4.92 billion from providing integrated supply chain services.

Market Cap: HK$2.22B

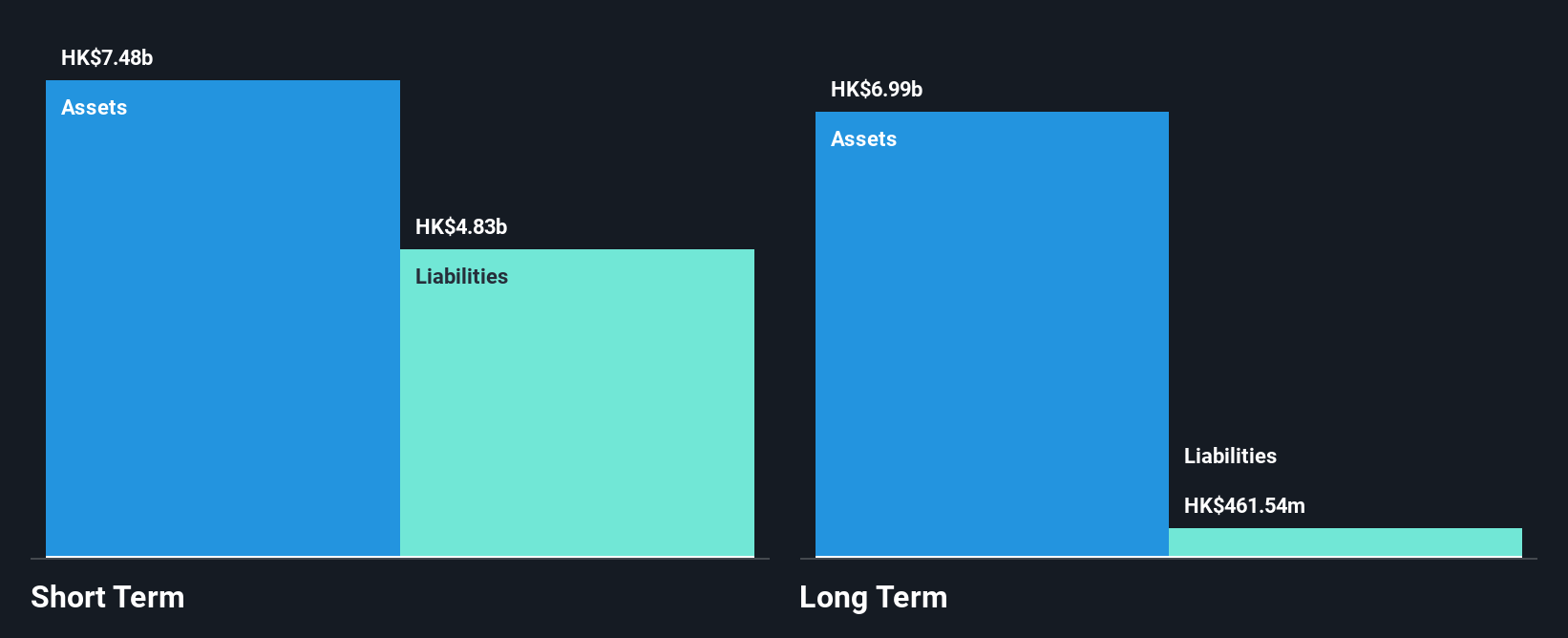

E-Commodities Holdings Limited presents a mixed picture for investors considering penny stocks. The company has shown robust management experience and reduced its debt-to-equity ratio significantly over the past five years, now maintaining more cash than total debt. However, recent earnings growth has been negative, with profit margins declining from 5.2% to 2.4%. Despite trading below estimated fair value and having stable weekly volatility, the sustainability of its high dividend yield is questionable given limited free cash flow coverage. Short-term assets comfortably cover liabilities, but overall returns remain modest with a low return on equity at 10.8%.

- Click here to discover the nuances of E-Commodities Holdings with our detailed analytical financial health report.

- Gain insights into E-Commodities Holdings' historical outcomes by reviewing our past performance report.

Straco (SGX:S85)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Straco Corporation Limited, with a market cap of SGD367.85 million, develops and operates tourism-related businesses in Singapore and China.

Operations: The company's revenue is primarily generated from its Aquariums segment, which accounts for SGD45.96 million, followed by the Giant Observation Wheel (GOW) segment with SGD30.90 million.

Market Cap: SGD367.85M

Straco Corporation Limited, with a market cap of SGD367.85 million, offers a compelling yet cautious case for penny stock investors in Asia. Its financial health is robust, boasting more cash than debt and strong interest coverage. The company’s short-term assets significantly exceed both short and long-term liabilities, enhancing liquidity assurance. Earnings growth has been modest at 6% over the past year but still outpaces the broader hospitality industry. Despite trading below estimated fair value and showing improved profit margins, its return on equity remains low at 10.3%. Recent board changes may influence strategic direction going forward.

- Click to explore a detailed breakdown of our findings in Straco's financial health report.

- Gain insights into Straco's past trends and performance with our report on the company's historical track record.

Yorhe Fluid Intelligent Control (SZSE:002795)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yorhe Fluid Intelligent Control Co., Ltd. operates in the fluid control industry and has a market cap of approximately CN¥2.15 billion.

Operations: Yorhe Fluid Intelligent Control Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.15B

Yorhe Fluid Intelligent Control Co., Ltd., with a market cap of CN¥2.15 billion, presents a mixed opportunity in the penny stock sector. The company reported first-quarter sales of CN¥149.48 million, down from the previous year, and continues to operate at a net loss of CN¥19.61 million. Despite its unprofitability, Yorhe maintains sufficient cash runway for over a year and has reduced its net debt to equity ratio to 8.2%, which is satisfactory. However, short-term liabilities exceed short-term assets by CN¥218.9 million, posing liquidity challenges despite seasoned management and board experience averaging 5.6 years tenure each.

- Click here and access our complete financial health analysis report to understand the dynamics of Yorhe Fluid Intelligent Control.

- Examine Yorhe Fluid Intelligent Control's past performance report to understand how it has performed in prior years.

Taking Advantage

- Dive into all 1,167 of the Asian Penny Stocks we have identified here.

- Ready For A Different Approach? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002795

Yorhe Fluid Intelligent Control

Yorhe Fluid Intelligent Control Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives