- Singapore

- /

- Hospitality

- /

- SGX:M04

Mandarin Oriental Shares Soar 41.7% in a Week—Is Market Optimism Fully Priced In?

Reviewed by Bailey Pemberton

If you have been watching Mandarin Oriental International, you already know it has been on a remarkable run lately. The stock has soared 41.7% in just the past week and is up an impressive 92.5% over the last year. Even zooming further out, holders have seen gains of over 100% across three years, so the momentum is hard to ignore. So what is driving this surge? Recent headlines point to upgraded outlooks for the Asian luxury travel market and renewed interest in high-end hospitality assets, both of which Mandarin Oriental sits firmly at the center of.

With so much optimism baked into the price, investors naturally wonder whether there is still room to grow or if risk perceptions are shifting. That is why valuation matters now more than ever. Our standard toolkit runs Mandarin Oriental through six core valuation checks and here is the attention-grabber: the company scores a zero. That means Mandarin Oriental does not appear undervalued by any major metric we track, even after its rapid ascent.

But does that tell the whole story? In the sections that follow, we will break down how the traditional valuation approaches stack up for Mandarin Oriental right now, and hint at a unique angle that might offer deeper insight into what the market is seeing.

Mandarin Oriental International scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mandarin Oriental International Discounted Cash Flow (DCF) Analysis

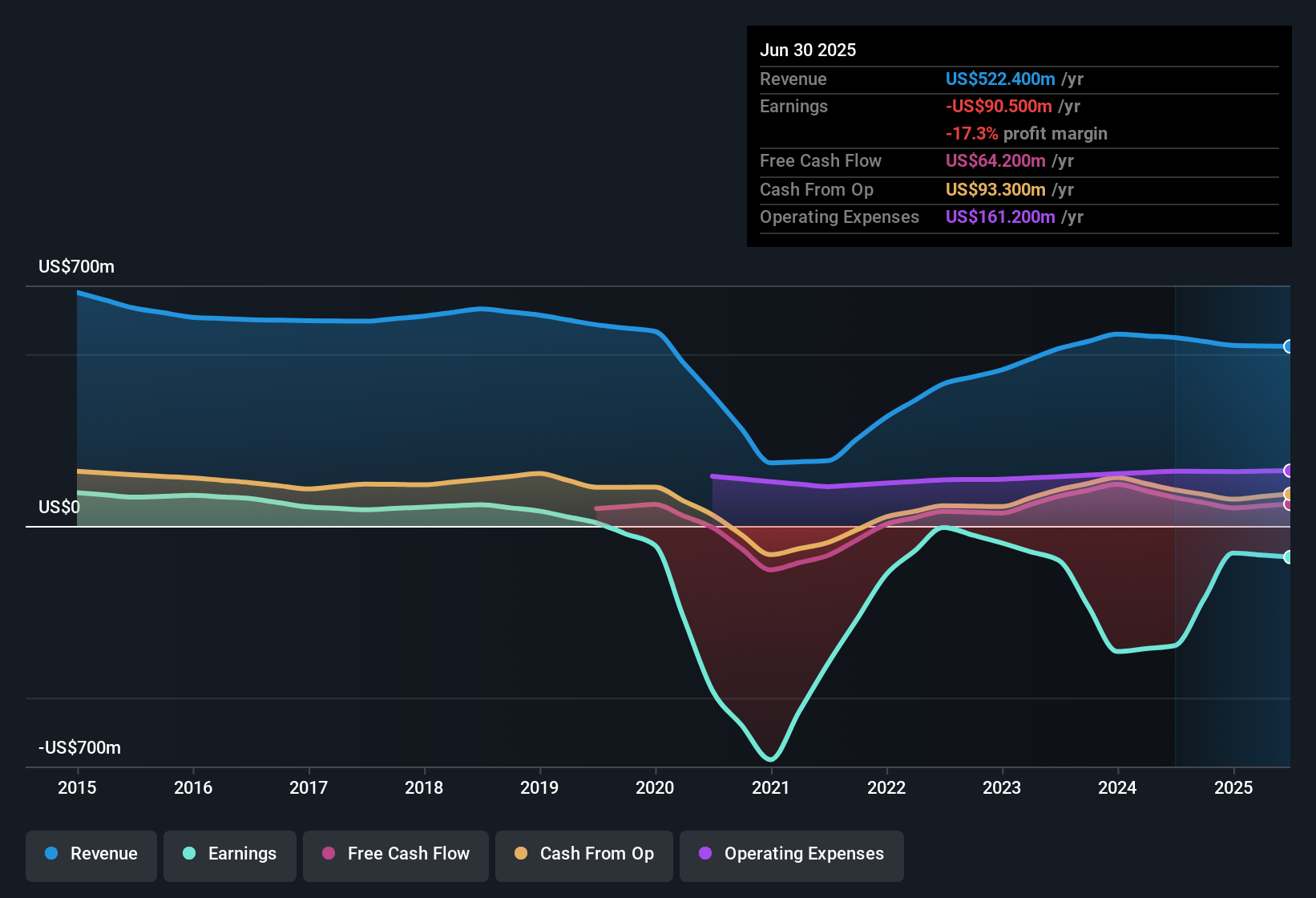

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. For Mandarin Oriental International, this analysis starts with its latest reported Free Cash Flow of $70.2 Million. Over the next five years, analysts expect small declines in cash flow, with projected FCF in 2026 at $66.6 Million. This is followed by modest growth through 2035, reaching around $70 Million once again. Forecasts beyond five years are extrapolated to provide a longer-term picture, though with increased uncertainty.

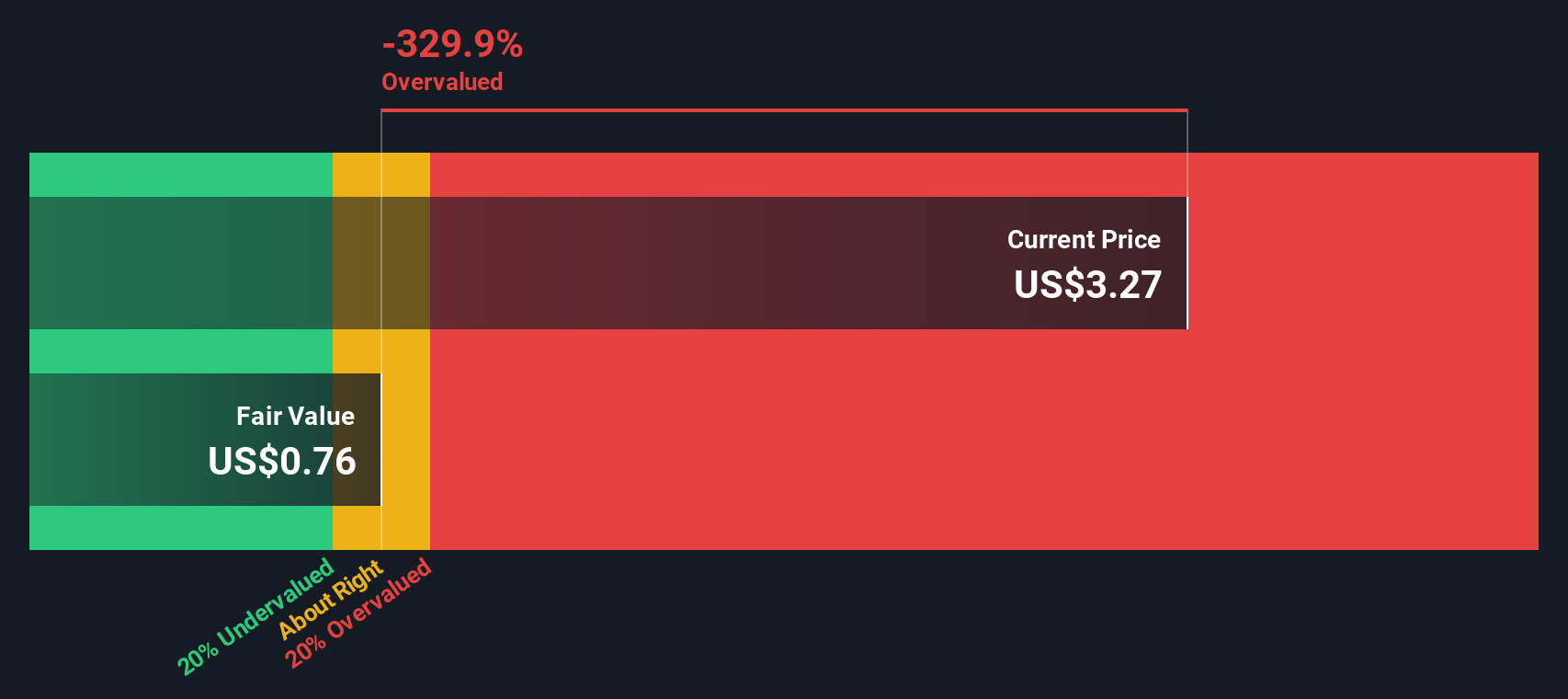

All cash flow projections are presented in US dollars, even though the share price is listed in a different currency. According to the DCF calculation, Mandarin Oriental International's intrinsic fair value is $0.76 per share. However, the market price currently stands at a premium of almost 330% compared to this estimate, which implies the stock is significantly overvalued based on projected cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mandarin Oriental International may be overvalued by 329.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mandarin Oriental International Price vs Sales

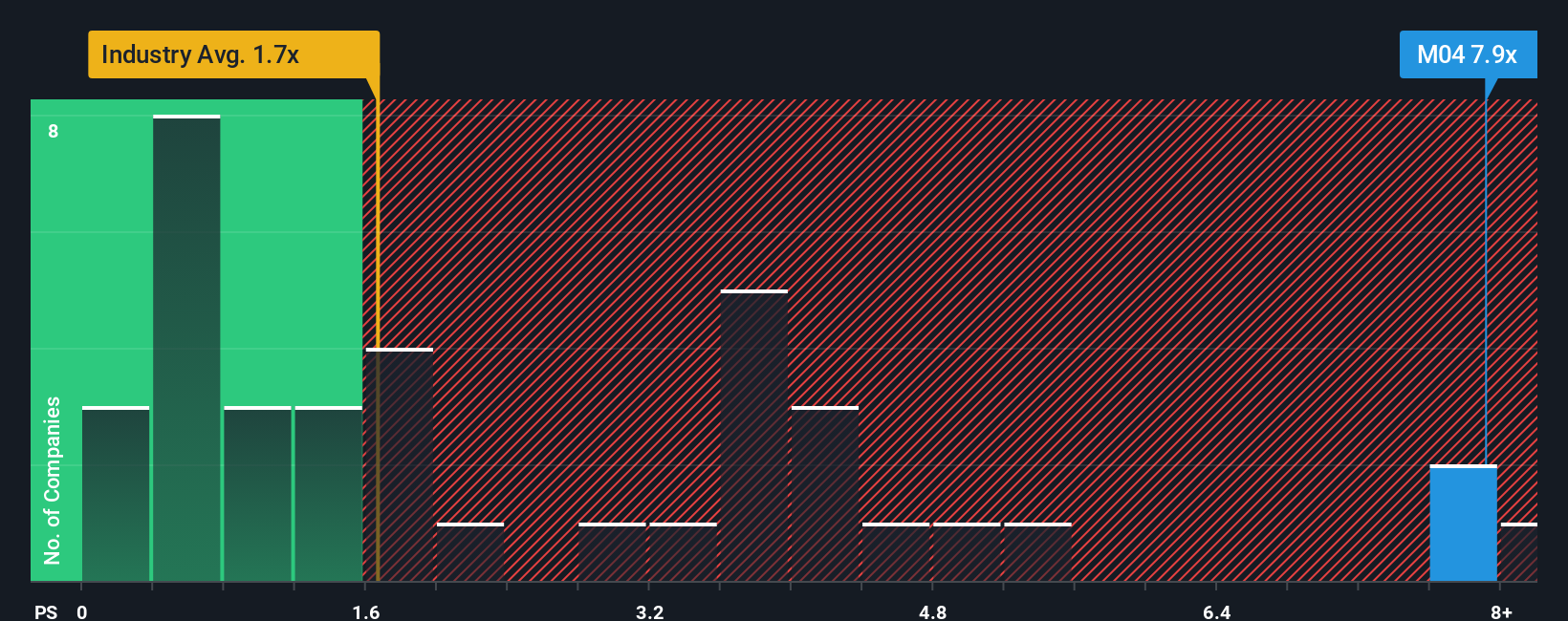

The Price-to-Sales (PS) ratio is often considered a reliable valuation multiple for firms in the hospitality industry, especially when profits are volatile or negative but there is meaningful revenue. It focuses on the value investors place on each dollar of sales, which is particularly relevant for luxury hotel brands like Mandarin Oriental International that can generate steady revenue streams despite earnings fluctuations.

Mandarin Oriental International currently trades at a PS ratio of 7.89x. This stands out against both the broader hospitality industry average of 1.76x and the peer group average of 3.21x. This indicates that the market is assigning a much higher value to each dollar of Mandarin Oriental's sales. Typically, higher ratios can reflect greater growth expectations, stronger profit margins, or a perception of lower business risk. However, these premium valuations warrant closer scrutiny, particularly as growth and risk factors can shift quickly in this sector.

The “Fair Ratio,” calculated by Simply Wall St, goes a step beyond standard peer and industry benchmarks. It integrates a blend of company-specific factors such as earnings growth, margin quality, market risks, underlying industry trends, and the business’s overall size. This tailored approach provides a more balanced and comprehensive perspective on what constitutes a fair valuation multiple for Mandarin Oriental right now.

Comparing the actual PS ratio of 7.89x to the proprietary Fair Ratio (which is not provided here) lets investors judge whether the current price is justified. In this case, since the difference far exceeds 0.10, Mandarin Oriental International appears to be trading at a substantial premium, suggesting the stock is overvalued versus what company fundamentals would support.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mandarin Oriental International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you tell about a company, combining your financial expectations with your view of its future prospects to arrive at your own fair value. Rather than relying solely on historic numbers, Narratives help you connect Mandarin Oriental International’s unique business story to your forecasted revenue, earnings, and margins. This in turn leads to a fair value that reflects your perspective.

This approach is now available to all investors on Simply Wall St, right within the Community page, making it easy to create or compare Narratives no matter your experience level. Narratives are powerful because they do not just calculate a number; they let you compare your fair value estimate to the current price, helping you decide when to buy or sell. Even better, Narratives adjust automatically as new data and news emerge, keeping your thesis up-to-date in real time. For Mandarin Oriental International, one Narrative might reflect high optimism by expecting further luxury travel growth and a higher fair value. Another could signal caution, projecting a more modest outcome.

Do you think there's more to the story for Mandarin Oriental International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:M04

Mandarin Oriental International

Engages in the ownership and operation of hotels, resorts, and residences in Asia, Europe, the Middle East, Africa, and the Americas.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives