- Singapore

- /

- Consumer Services

- /

- SGX:CNE

Should You Be Adding MindChamps PreSchool (SGX:CNE) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MindChamps PreSchool (SGX:CNE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for MindChamps PreSchool

MindChamps PreSchool's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years MindChamps PreSchool grew its EPS by 8.1% per year. That's a pretty good rate, if the company can sustain it.

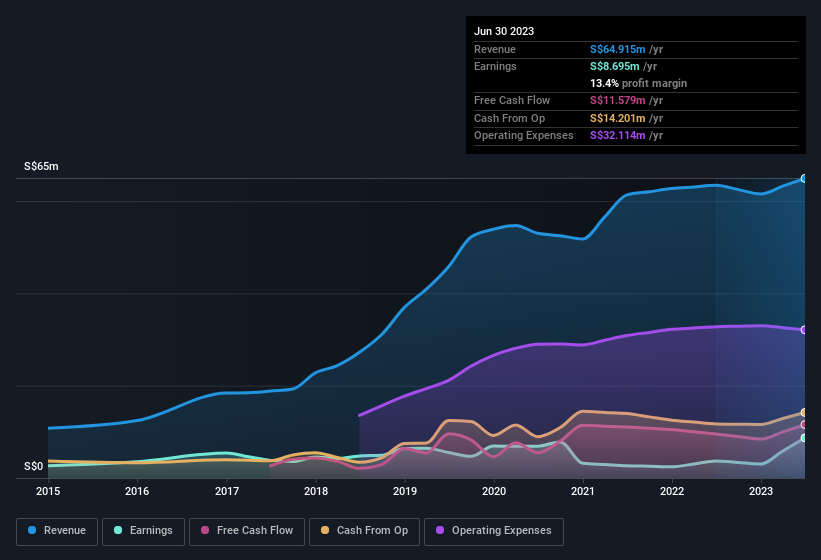

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of MindChamps PreSchool shareholders is that EBIT margins have grown from -2.8% to 0.9% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since MindChamps PreSchool is no giant, with a market capitalisation of S$60m, you should definitely check its cash and debt before getting too excited about its prospects.

Are MindChamps PreSchool Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling MindChamps PreSchool shares, in the last year. With that in mind, it's heartening that Catherine Du, the Non-Independent Non-Executive Director of the company, paid S$11k for shares at around S$0.15 each. It seems that at least one insider is prepared to show the market there is potential within MindChamps PreSchool.

Should You Add MindChamps PreSchool To Your Watchlist?

One important encouraging feature of MindChamps PreSchool is that it is growing profits. While some companies are struggling to grow EPS, MindChamps PreSchool seems free from that morose affliction. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. We should say that we've discovered 3 warning signs for MindChamps PreSchool (1 can't be ignored!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of MindChamps PreSchool, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CNE

MindChamps PreSchool

Provides childcare services in Singapore and Australia.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives