- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

Top SGX Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

As the Singapore market navigates through a period of heightened activity and strategic acquisitions, investors are keenly observing how these developments will influence overall market performance and economic stability. With this backdrop, identifying strong dividend stocks becomes crucial for those looking to secure steady income amidst dynamic market conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.96% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.64% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.23% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.31% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.38% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.72% | ★★★★★☆ |

| Delfi (SGX:P34) | 7.09% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.08% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multi-Chem Limited, with a market cap of SGD254.97 million, is an investment holding company that distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD407.17 million), Greater China, Australia (SGD50.04 million), and India (SGD54.17 million), as well as from its PCB business in Singapore (SGD1.69 million).

Dividend Yield: 9.4%

Multi-Chem Limited announced an interim tax-exempt dividend of 11.10 Singapore cents per share, payable on 13 September 2024. Despite a high cash payout ratio (1054.3%), indicating dividends are not well covered by cash flows, the company reported strong earnings growth for H1 2024 with sales of S$342.53 million and net income of S$16.42 million, up from S$313.15 million and S$11.41 million respectively in H1 2023, suggesting potential for future dividend stability despite past volatility.

- Navigate through the intricacies of Multi-Chem with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Multi-Chem is priced lower than what may be justified by its financials.

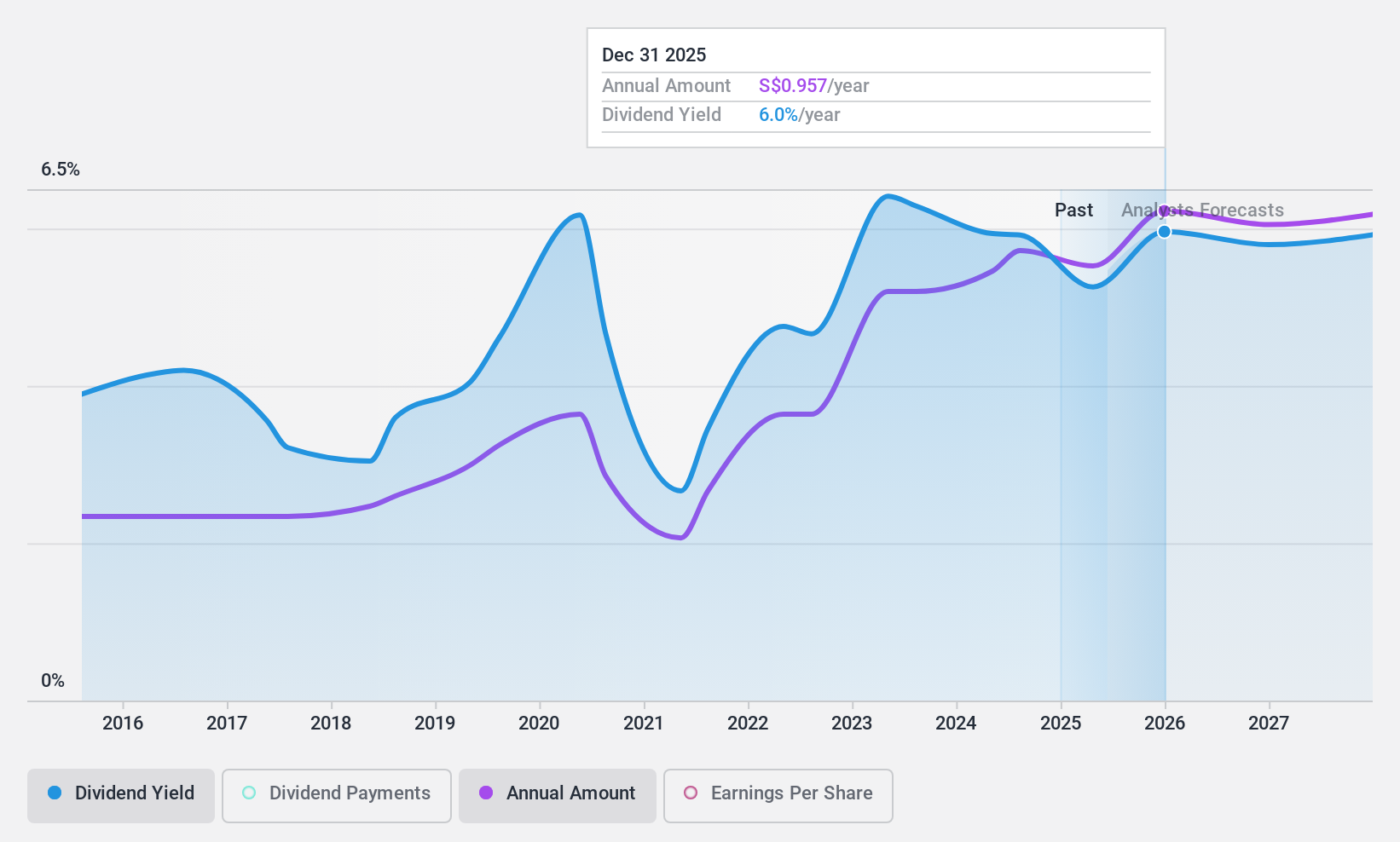

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, with a market cap of SGD65.05 billion, provides financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific, and internationally through its subsidiaries.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue from various segments, including SGD5.23 billion from Global Wholesale Banking, SGD5.19 billion from Global Consumer/Private Banking, SGD1.27 billion from Insurance, and SGD512 million from Global Markets.

Dividend Yield: 6.1%

Oversea-Chinese Banking Corporation Limited announced an interim dividend of S$0.44 per share, payable on 23 August 2024. The bank's earnings for H1 2024 showed net interest income of S$4.87 billion and net income of S$3.93 billion, indicating strong financial performance and a payout ratio of approximately 52.8%, suggesting dividends are well-covered by earnings. However, the dividend track record has been volatile over the past decade, impacting its reliability as a consistent dividend payer.

- Get an in-depth perspective on Oversea-Chinese Banking's performance by reading our dividend report here.

- According our valuation report, there's an indication that Oversea-Chinese Banking's share price might be on the cheaper side.

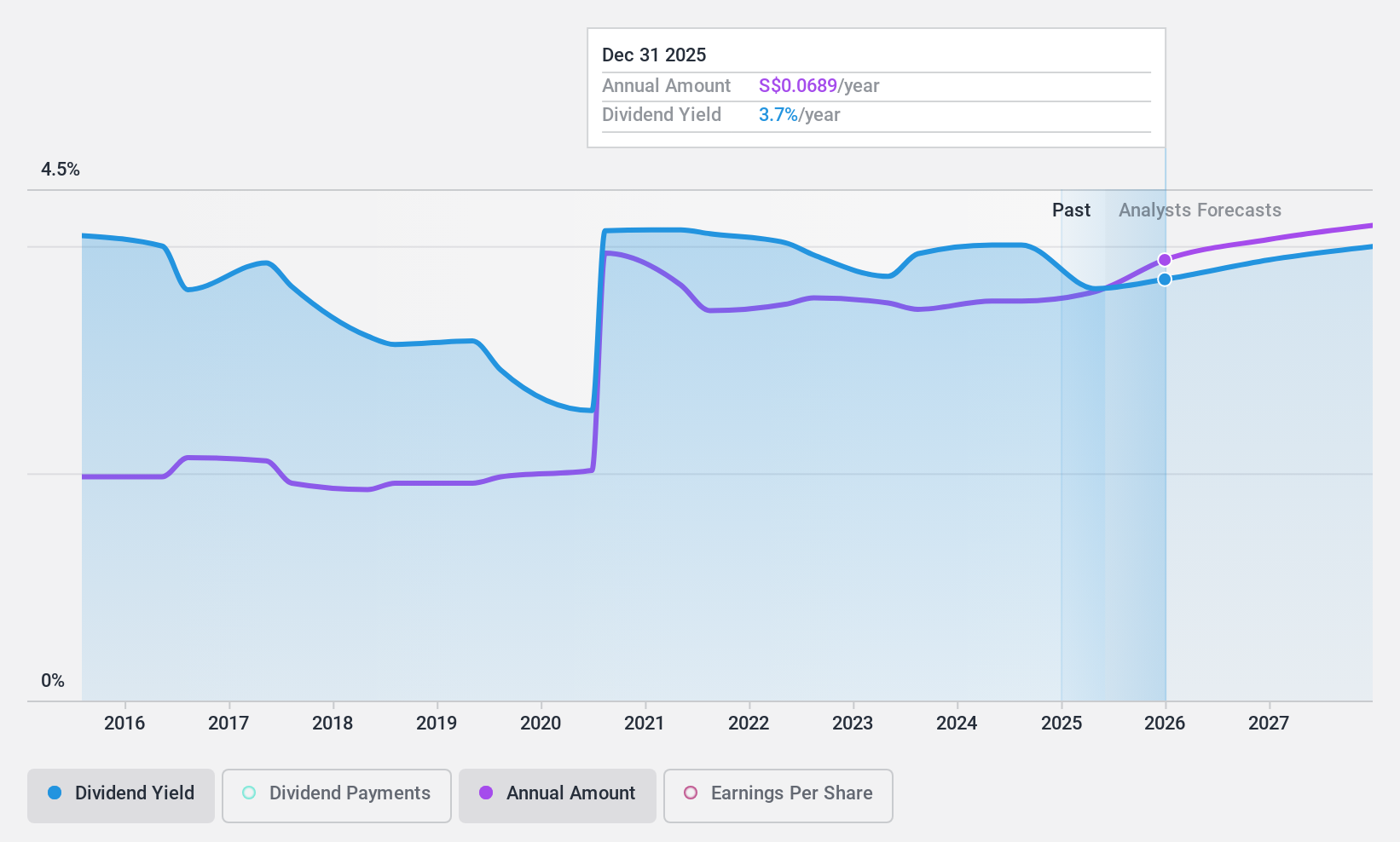

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd, with a market cap of SGD2.26 billion, operates a chain of supermarket retail stores in Singapore.

Operations: Sheng Siong Group Ltd generates SGD1.39 billion in revenue from its supermarket operations selling consumer goods.

Dividend Yield: 4.2%

Sheng Siong Group's dividend payments have been unstable over the past decade, though they are covered by both earnings (69.6% payout ratio) and cash flows (51.8% cash payout ratio). Recent earnings for H1 2024 showed a net income of S$69.91 million on sales of S$714.2 million, reflecting growth from the previous year. However, its dividend yield of 4.17% is low compared to top-tier payers in Singapore's market, making it less attractive for high-yield seekers.

- Unlock comprehensive insights into our analysis of Sheng Siong Group stock in this dividend report.

- The valuation report we've compiled suggests that Sheng Siong Group's current price could be quite moderate.

Key Takeaways

- Explore the 20 names from our Top SGX Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet with proven track record and pays a dividend.