As global markets navigate a complex landscape marked by mixed performances across major indices and geopolitical developments, investors are paying close attention to the strategic decisions of central banks and trade agreements that could influence economic trajectories. In this environment, growth companies with substantial insider ownership stand out as potentially resilient options, as high insider stakes can align management's interests with those of shareholders, fostering long-term value creation even amid market uncertainties.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's review some notable picks from our screened stocks.

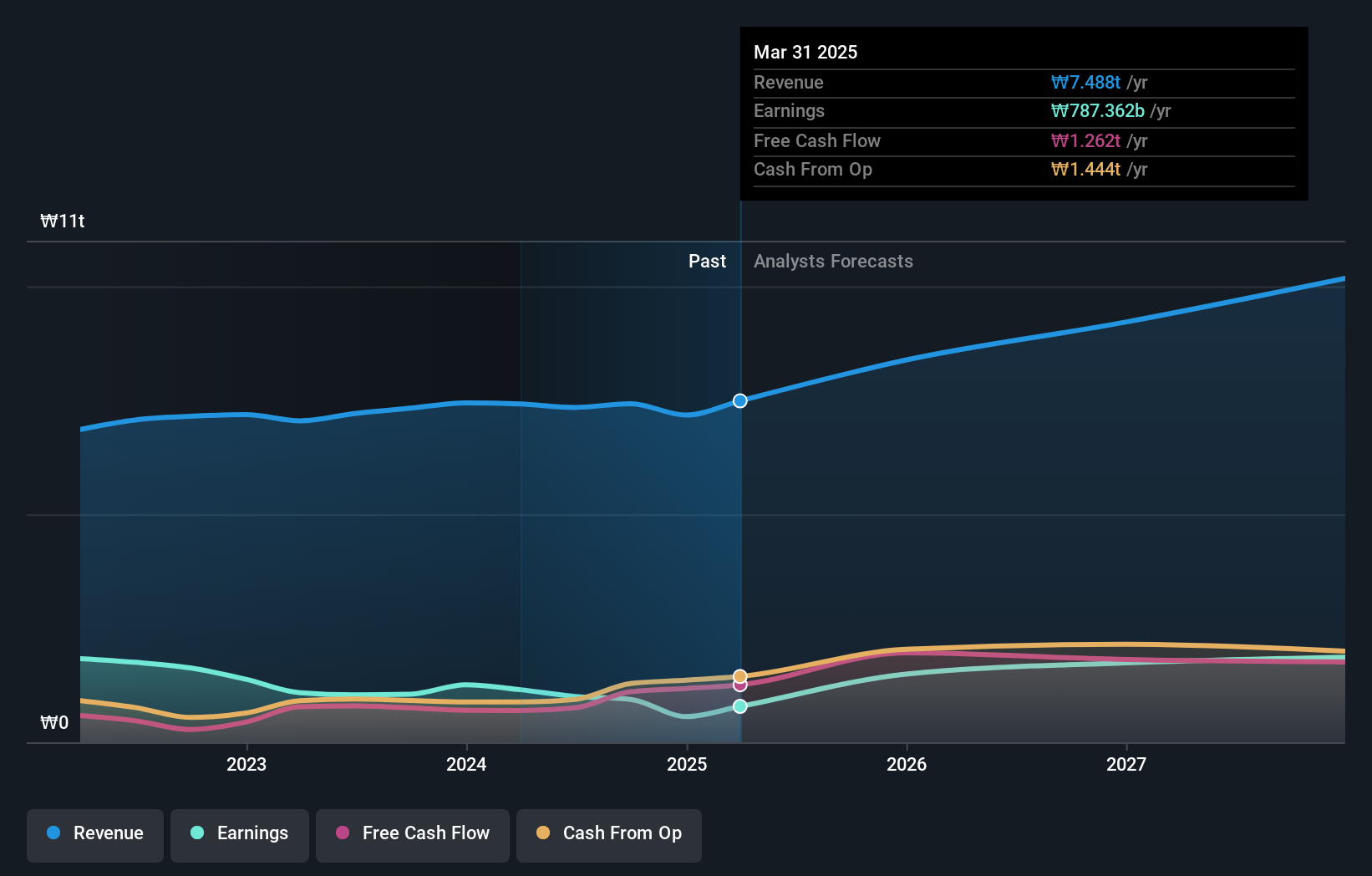

LG (KOSE:A003550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LG Corp., with a market cap of ₩12.25 trillion, operates through its subsidiaries in the electronics, chemicals, and telecommunication and services sectors.

Operations: The company's revenue segments include ₩0.85 billion from LG Corp., and ₩6.93 billion from LG CNS Co., LTD, with additional contributions of ₩0.30 billion from D&O.

Insider Ownership: 38.5%

LG Corp. demonstrates strong growth potential with earnings forecasted to increase significantly at 28.87% annually, surpassing the Korean market's average. Despite a lower revenue growth rate of 11.1%, it still exceeds the market average and is trading well below its estimated fair value, suggesting potential undervaluation. Recent earnings showed mixed results with increased six-month net income but a decline in quarterly net income compared to last year, highlighting both opportunities and challenges for investors.

- Navigate through the intricacies of LG with our comprehensive analyst estimates report here.

- Our valuation report here indicates LG may be undervalued.

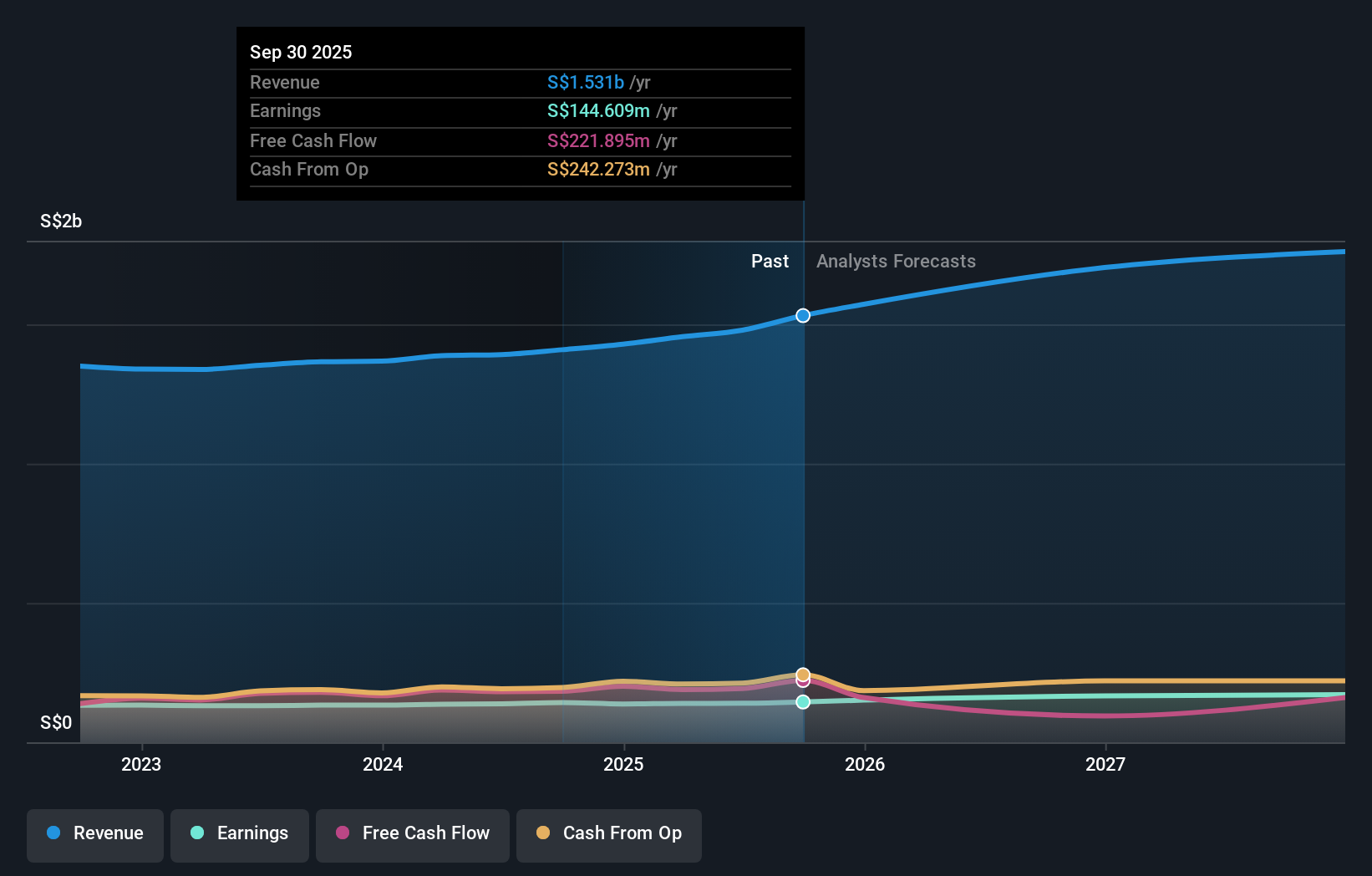

Sheng Siong Group (SGX:OV8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.79 billion.

Operations: The company's revenue primarily comes from its supermarket operations selling consumer goods, amounting to SGD1.53 billion.

Insider Ownership: 26.5%

Sheng Siong Group's earnings are forecast to grow at 7.5% annually, outpacing the Singapore market average of 6.8%. Despite slower revenue growth projections of 6.3%, they still exceed the market's rate of 3.9%. Recent results show robust performance with third-quarter sales reaching S$415.51 million and net income rising to S$43.75 million, reflecting steady growth momentum despite an unstable dividend track record and no significant insider trading activity in recent months.

- Delve into the full analysis future growth report here for a deeper understanding of Sheng Siong Group.

- Insights from our recent valuation report point to the potential overvaluation of Sheng Siong Group shares in the market.

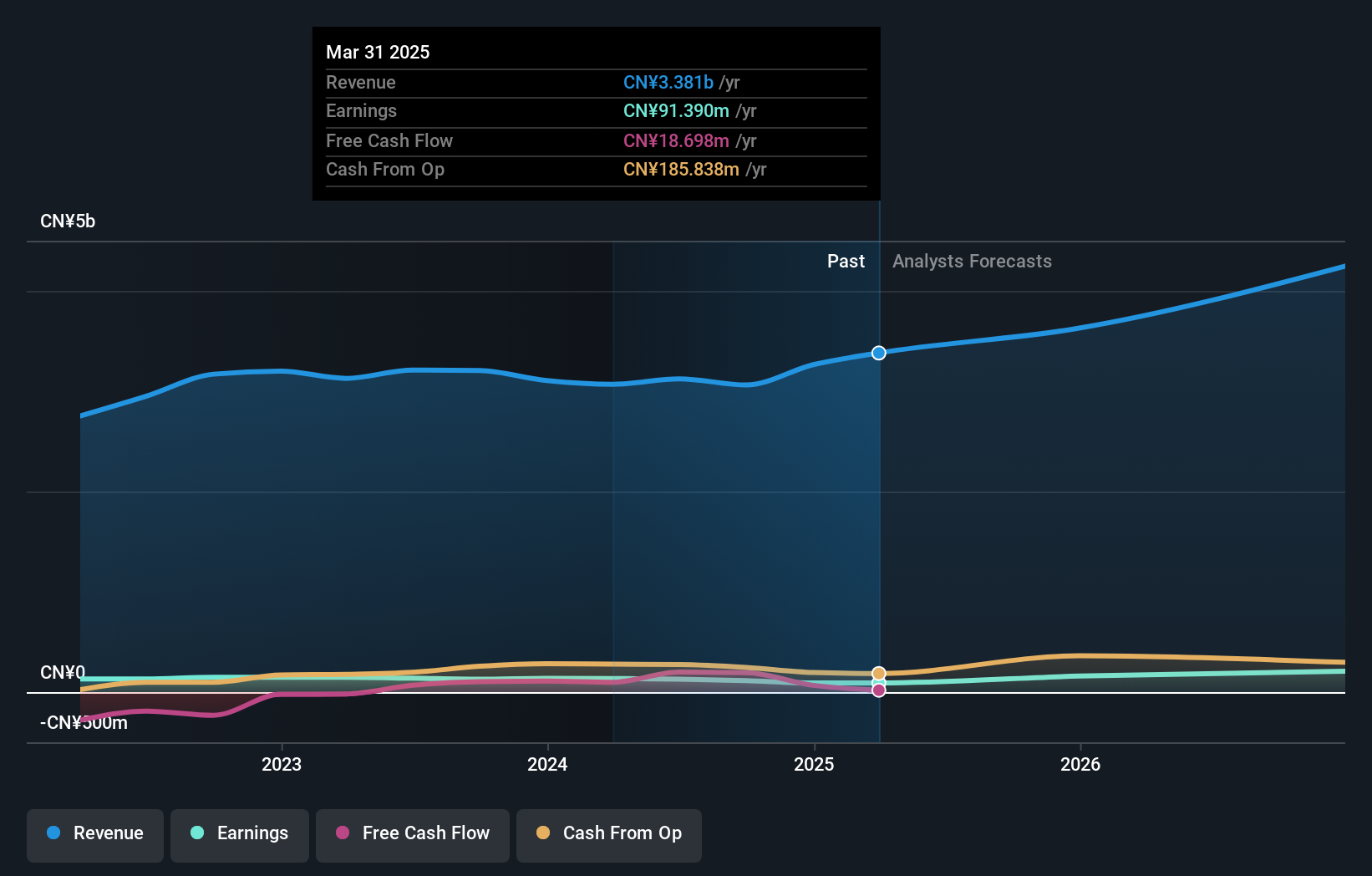

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd specializes in the research, development, manufacture, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil with a market cap of CN¥16.22 billion.

Operations: Zhejiang XCC Group Co., Ltd generates revenue through its research, development, manufacturing, and sales activities in the bearings industry across a diverse range of international markets.

Insider Ownership: 31.7%

Zhejiang XCC Group's earnings are expected to grow significantly at 52.4% annually, surpassing the Chinese market average of 27%. Despite a slower revenue growth forecast of 16.7%, it still exceeds the market's rate of 14.3%. Recent results show sales reaching CNY 2.66 billion for the first nine months of 2025, with net income slightly increasing to CNY 98.48 million, indicating steady performance amidst high share price volatility and no major insider trading activity recently.

- Get an in-depth perspective on Zhejiang XCC GroupLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Zhejiang XCC GroupLtd valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 824 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang XCC GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603667

Zhejiang XCC GroupLtd

Engages in the research, development, manufacture, and sale of bearings in the United States, Japan, Korea, Brazil, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives