- Singapore

- /

- Industrials

- /

- SGX:J36

Jardine Matheson (SGX:J36) Valuation in Focus After $250 Million Share Buyback Announcement

Reviewed by Simply Wall St

Jardine Matheson Holdings (SGX:J36) just kicked off a share buyback program that authorizes up to $250 million in repurchases, aiming to reduce its capital. The plan runs through 2026 and canceled shares are entirely removed from circulation.

See our latest analysis for Jardine Matheson Holdings.

Following the buyback announcement, Jardine Matheson Holdings has seen momentum build in its share price, recording a 61.98% year-to-date return and a strong 68.57% total shareholder return over the past year. Performance has clearly accelerated as investors interpret the capital return move as a sign of confidence in the group’s future potential.

If you’re searching for your next investing opportunity, now is the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

But with shares rallying and trading close to analysts’ price targets, investors may wonder whether Jardine Matheson Holdings is undervalued based on recent fundamentals or if its robust growth is already reflected in the current share price.

Most Popular Narrative: 3.5% Undervalued

With the current share price almost matching the narrative fair value of $70, Jardine Matheson Holdings finds itself in a tight valuation range. While not deeply discounted, there is just enough in the fundamentals to suggest a small upside if the company delivers as projected.

Ongoing portfolio simplification and capital recycling initiatives, exemplified by divestitures at DFI Retail and Hongkong Land, are redirecting resources into higher-margin, faster-growing business areas. This is likely to drive improved group net margins and return on equity over the medium term.

Want to know what key numbers are behind this almost fully priced scenario? The narrative's fair value rests on a set of bold, forward-looking profit, margin, and growth assumptions that could reshape the company's story. Curious which targets the consensus is betting on? Unlock the full narrative and see if this subtle undervaluation stands up to scrutiny.

Result: Fair Value of $70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in the Greater China property market and pressure on Astra's automotive business could present challenges to Jardine Matheson Holdings' growth outlook.

Find out about the key risks to this Jardine Matheson Holdings narrative.

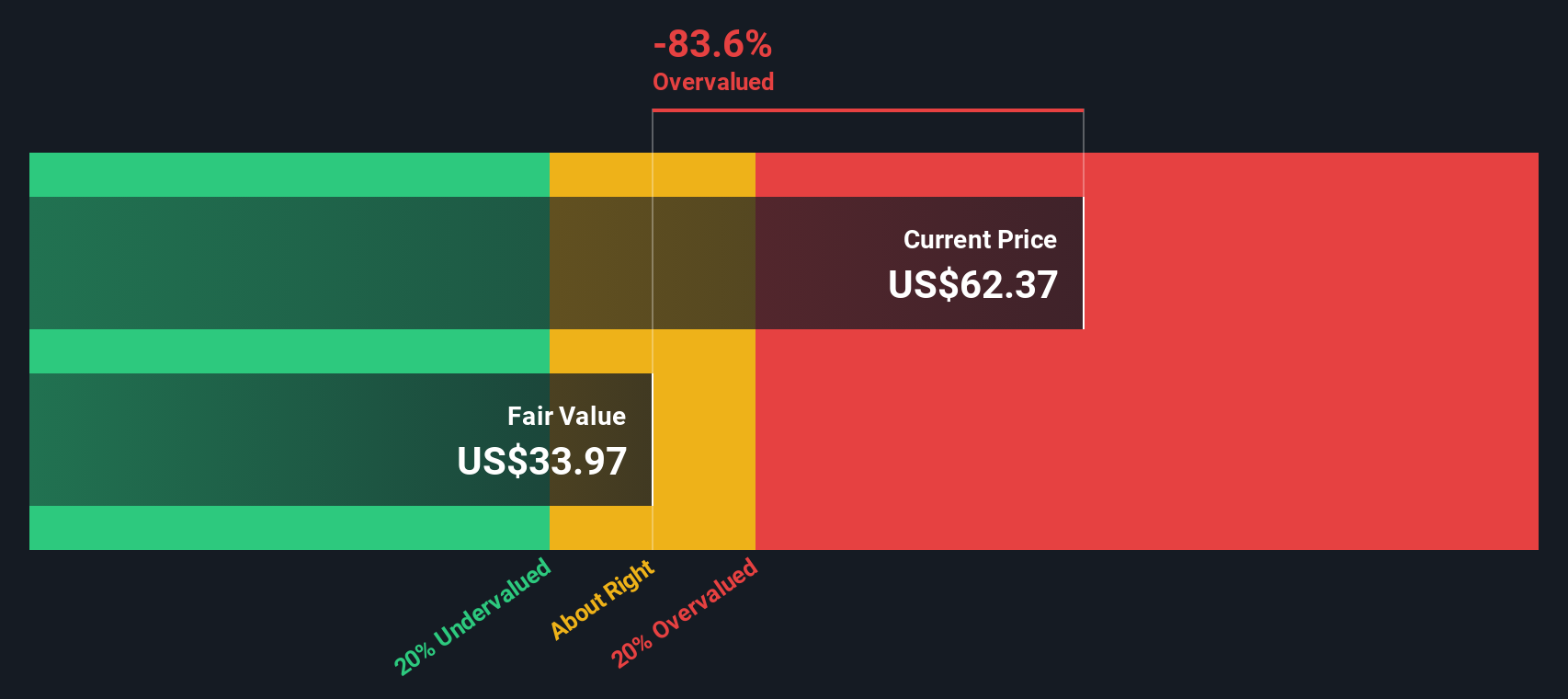

Another View: Our DCF Model Suggests Overvaluation

While the current share price hovers near narrative fair value, our DCF model, which uses future cash flow projections, points to a fair value of $34.47, far below today's price. This contrast suggests that if cash flow assumptions prove too optimistic, downside risk may be higher than it appears. Which approach seems more realistic in this environment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jardine Matheson Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jardine Matheson Holdings Narrative

If you want to dig into the numbers and challenge the consensus view, you can pull together your own narrative based on the latest data in just a few minutes, and Do it your way.

A great starting point for your Jardine Matheson Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to stay ahead with Simply Wall Street's top screeners, which reveal stocks you might be missing. Give your portfolio something extra to talk about.

- Tap into high yields and steady passive income through these 15 dividend stocks with yields > 3%, offering proven returns and real staying power.

- Capitalize on breakthroughs in artificial intelligence by checking out these 26 AI penny stocks, making headlines for innovation and rapid growth.

- Spot hidden gems trading for less than their real worth by reviewing these 876 undervalued stocks based on cash flows, and don’t let the best bargains pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:J36

Jardine Matheson Holdings

Operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives