Asian Market Insights: Tong Ren Tang Technologies And 2 Other Penny Stocks To Consider

Reviewed by Simply Wall St

As Asian markets navigate a complex economic landscape, including factors like global growth concerns and fluctuating trade policies, investors are keenly observing opportunities in various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment area despite the term's somewhat outdated feel. These stocks can offer significant potential for growth when backed by strong financials and sound fundamentals, making them appealing to those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.88 | THB3.83B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.91 | HK$2.37B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.56 | HK$964.89M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.89 | SGD360.71M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.17 | SGD12.48B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.82 | THB9.74B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tong Ren Tang Technologies Co. Ltd., along with its subsidiaries, is engaged in the production and distribution of Chinese medicine products in Mainland China and Hong Kong, with a market cap of HK$6.40 billion.

Operations: The company's revenue is primarily derived from its operations, with CN¥4.16 billion generated by the main entity and CN¥1.57 billion contributed by Tong Ren Tang Chinese Medicine.

Market Cap: HK$6.4B

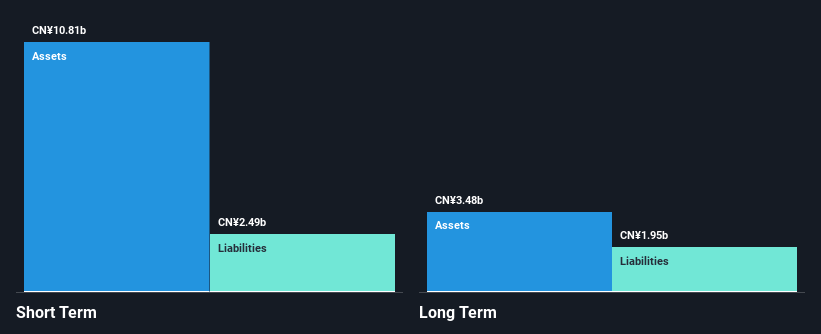

Tong Ren Tang Technologies has faced challenges with a decline in earnings growth, reporting CN¥3.74 billion in sales for the first half of 2025, down from CN¥4.05 billion a year ago. Despite this, its financial stability is supported by having more cash than total debt and strong short-term asset coverage of liabilities. The company trades at a discount to its estimated fair value and offers a stable dividend yield of 3.92%. Recent board changes and amendments to company bylaws may impact governance dynamics as they adapt to evolving business needs in the competitive Chinese medicine sector.

- Click to explore a detailed breakdown of our findings in Tong Ren Tang Technologies' financial health report.

- Examine Tong Ren Tang Technologies' earnings growth report to understand how analysts expect it to perform.

Viva Goods (SEHK:933)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viva Goods Company Limited is an investment holding company that offers apparel and footwear across various regions including the UK, Ireland, the US, China, Asia, Europe, the Middle East, and Africa with a market cap of approximately HK$7.27 billion.

Operations: The company's revenue is primarily derived from its Multi-Brand Apparel and Footwear segment, generating HK$9.58 billion, followed by the Sports Experience segment with HK$558.53 million.

Market Cap: HK$7.27B

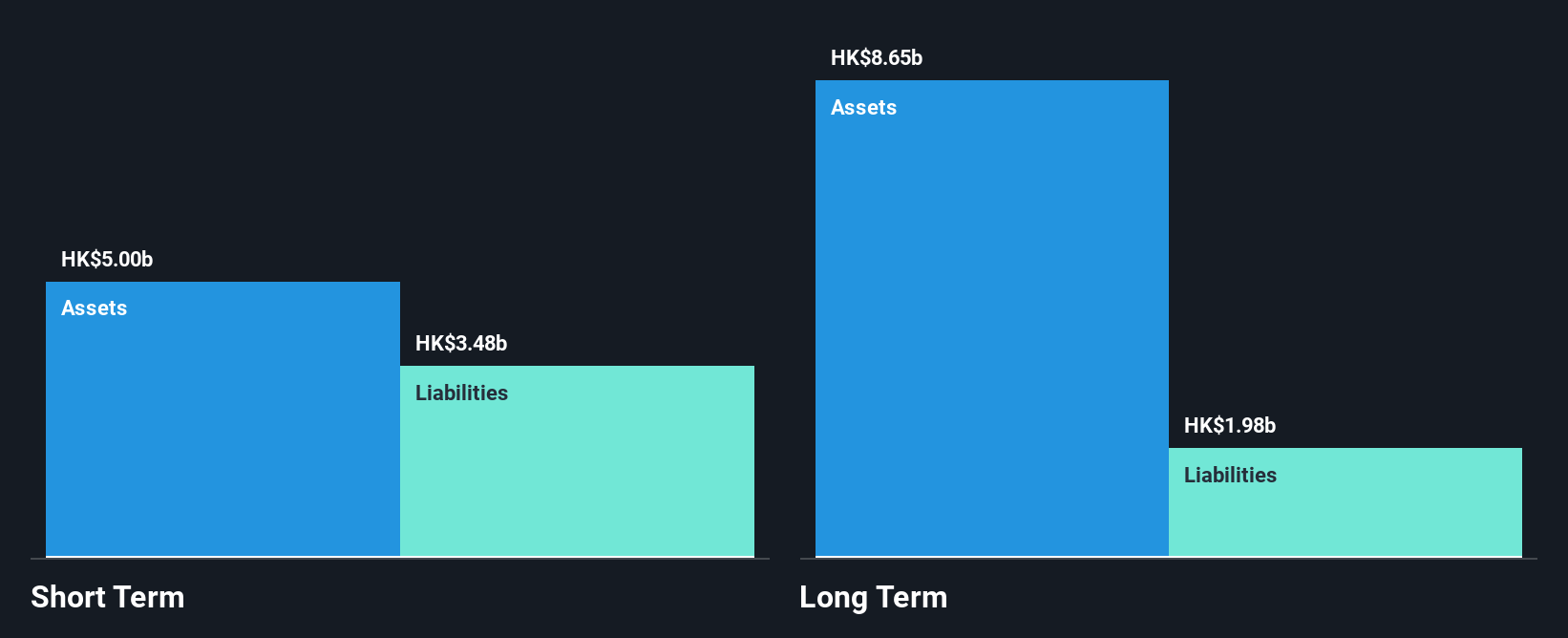

Viva Goods has demonstrated resilience in the volatile penny stock market, with a stable weekly volatility of 11% and a satisfactory net debt to equity ratio of 0.3%. Its seasoned management team, averaging 5.8 years in tenure, navigates complex markets across multiple regions. Despite being unprofitable, recent earnings reports show an improvement in net income to HK$181.5 million for the first half of 2025 from HK$112.81 million a year ago, driven by enhanced cost control measures. The company’s short-term assets exceed both its short and long-term liabilities, indicating solid financial footing amidst ongoing restructuring efforts under new executive leadership.

- Jump into the full analysis health report here for a deeper understanding of Viva Goods.

- Evaluate Viva Goods' historical performance by accessing our past performance report.

Oiltek International (SGX:HQU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oiltek International Limited is an investment holding company involved in the supply and provision of engineering design and commissioning of oil extraction equipment and plants across Asia, the United States, and Africa, with a market cap of SGD454.74 million.

Operations: The company's revenue is primarily derived from its Edible & Non-Edible Oil Refinery segment at MYR177.51 million, followed by Renewable Energy at MYR37.61 million and Product Sales and Trading contributing MYR15.53 million.

Market Cap: SGD454.74M

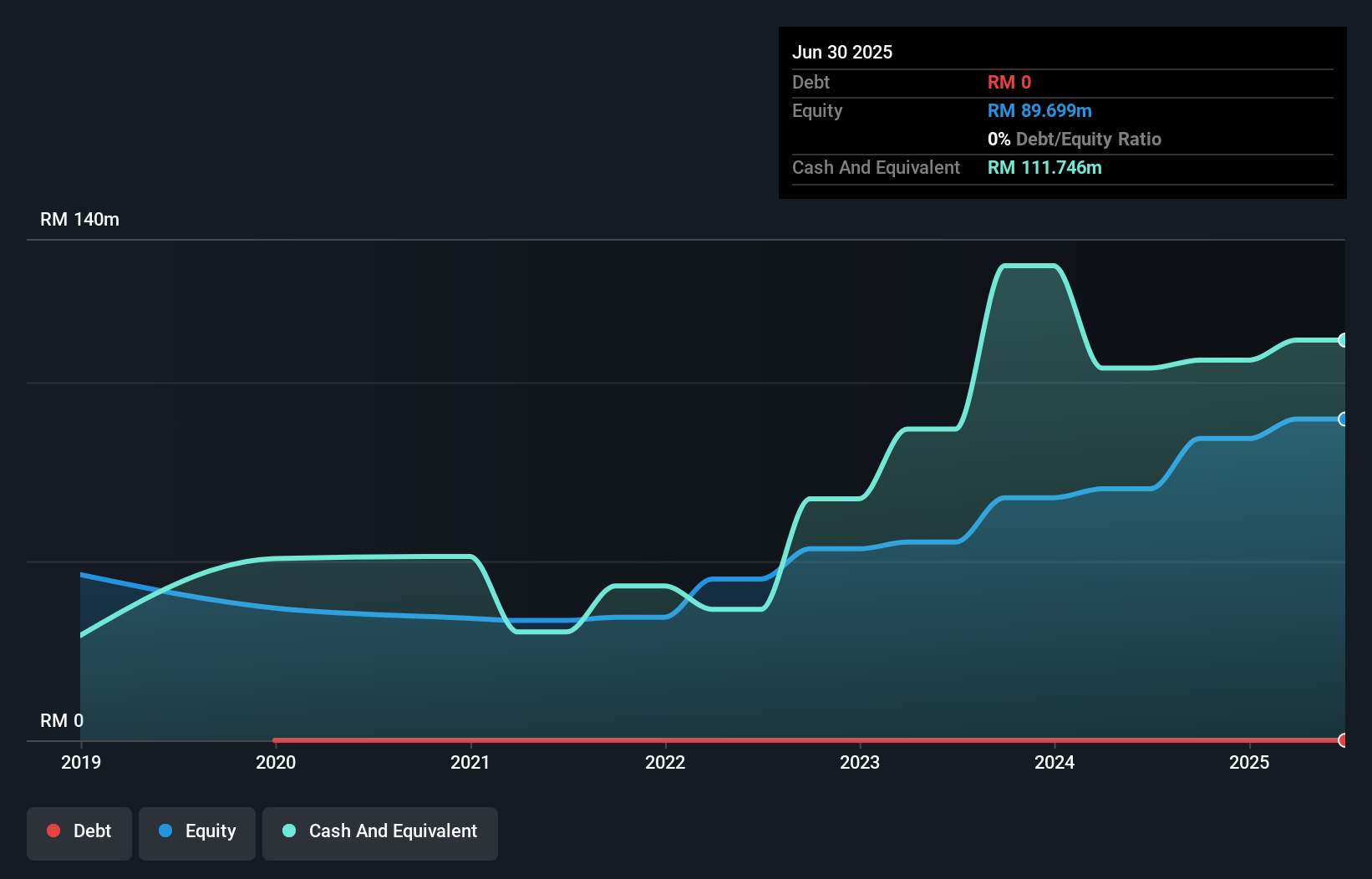

Oiltek International's financial health is robust, with short-term assets of MYR165.3 million surpassing its short-term liabilities of MYR81.0 million, and no debt burden to manage. The company has secured significant new contracts worth MYR74.3 million across Asia, bolstering its order book to approximately MYR398.2 million for FY2025. Recent earnings growth is strong with net income rising to MYR14.13 million for the first half of 2025 from MYR10.28 million a year prior, supported by high-quality earnings and a healthy net profit margin improvement from 10% to 14.5%.

- Click here to discover the nuances of Oiltek International with our detailed analytical financial health report.

- Understand Oiltek International's earnings outlook by examining our growth report.

Key Takeaways

- Gain an insight into the universe of 981 Asian Penny Stocks by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1666

Tong Ren Tang Technologies

Produces and distributes Chinese medicine products in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives