Stock Analysis

As the Singapore market navigates through fluctuating economic indicators and government securities auctions, investors continue to seek stable returns amidst the uncertainty. In this context, dividend stocks remain a compelling option for those looking to generate consistent income from their investments.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.72% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.21% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.02% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.69% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.55% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.63% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.51% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.77% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.43% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tai Sin Electric (SGX:500)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tai Sin Electric Limited, along with its subsidiaries, specializes in the manufacturing and distribution of cable and wire products, with a market capitalization of approximately SGD 174.90 million.

Operations: Tai Sin Electric Limited generates revenue primarily through its Cable & Wire segment at SGD 263.85 million, followed by Electrical Material Distribution at SGD 92.62 million, Test & Inspection services at SGD 28.67 million, and Switchboard production at SGD 4.18 million.

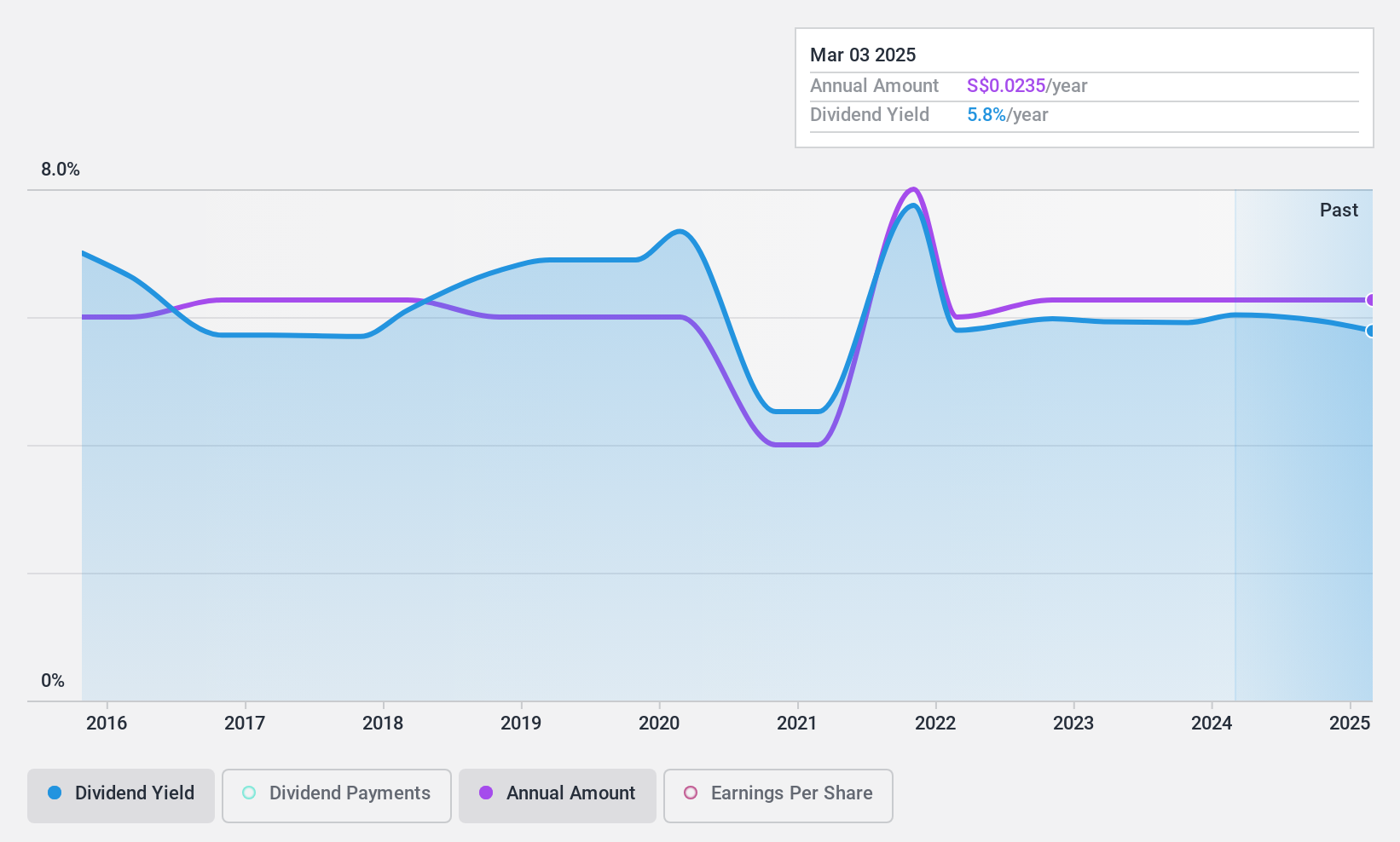

Dividend Yield: 6.2%

Tai Sin Electric offers a dividend yield of 6.18%, placing it in the top 25% of dividend payers in the Singapore market. However, its dividends have shown volatility over the past decade and are not well supported by earnings, with a high payout ratio of 92.8%. Despite this, dividends are reasonably covered by cash flows at a cash payout ratio of 64.6%. The company's profit margins have declined from last year, moving from 5.9% to 3%.

- Take a closer look at Tai Sin Electric's potential here in our dividend report.

- Upon reviewing our latest valuation report, Tai Sin Electric's share price might be too pessimistic.

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited operates as an investment holding company, offering energy engineering, real estate, geospatial, and healthcare technology solutions across diverse global regions with a market capitalization of SGD 496.57 million.

Operations: Boustead Singapore Limited generates revenue through its geospatial, healthcare technology, energy engineering, and real estate solutions segments, with earnings of SGD 212.67 million, SGD 10.58 million, SGD 174.41 million, and SGD 369.46 million respectively.

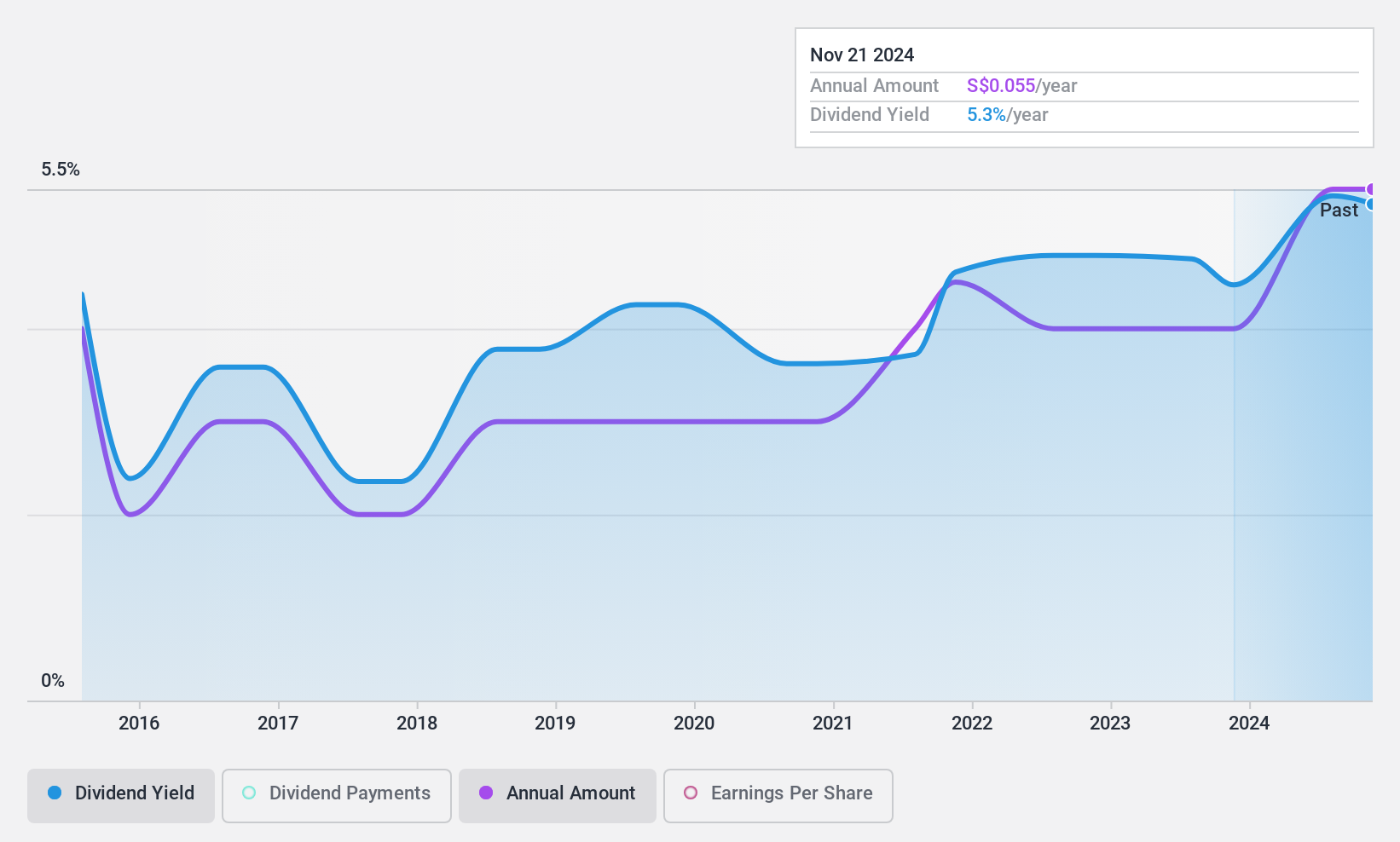

Dividend Yield: 5.3%

Boustead Singapore Limited has displayed a mixed track record with its dividends, showing growth yet volatility over the past decade. Despite this, both earnings and cash flows provide good coverage for dividends, with payout ratios of 40.9% and 28.8%, respectively. Its dividend yield at 5.29% falls below the top quartile in Singapore's market. Recently, Boustead announced a proposed final dividend of 4 cents per share for FY2024, pending shareholder approval at their upcoming AGM.

- Get an in-depth perspective on Boustead Singapore's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Boustead Singapore is priced higher than what may be justified by its financials.

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a range of banking products and services, with a market capitalization of SGD 55.32 billion.

Operations: United Overseas Bank Limited generates its revenue from a variety of banking products and services offered globally.

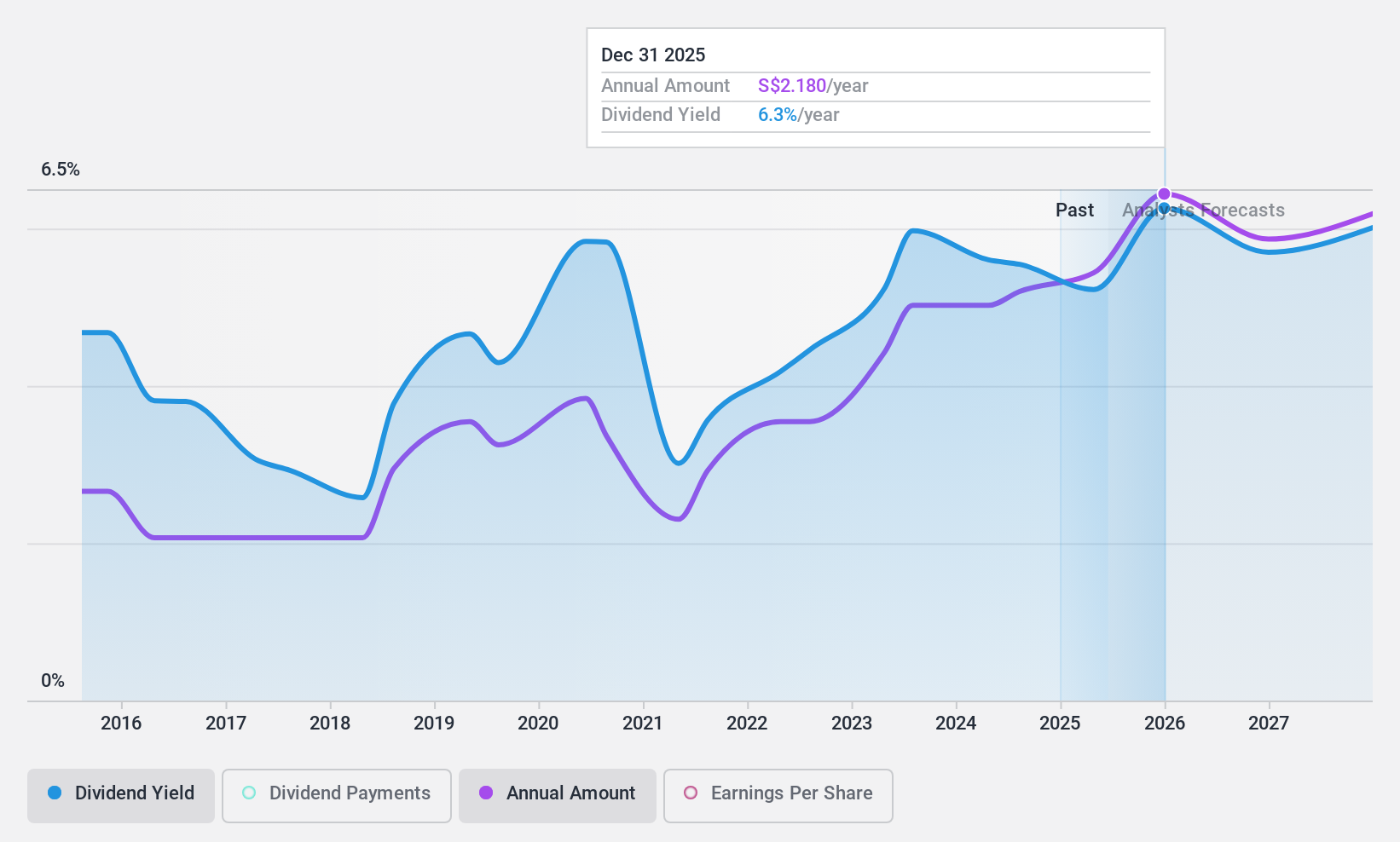

Dividend Yield: 5.1%

United Overseas Bank's dividend sustainability is underpinned by a reasonable payout ratio of 50.8%, with forecasts indicating continued coverage over the next three years at 49.2%. However, its dividend history has been marked by volatility over the past decade. The bank's allowance for bad loans stands at 85%, suggesting potential risk management issues. Recent activities include a share repurchase program initiated on May 8, 2024, and lower earnings reported in Q1 2024 compared to the previous year.

- Click here and access our complete dividend analysis report to understand the dynamics of United Overseas Bank.

- According our valuation report, there's an indication that United Overseas Bank's share price might be on the cheaper side.

Make It Happen

- Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Top SGX Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether United Overseas Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U11

Excellent balance sheet average dividend payer.