Stock Analysis

Exploring Undervalued SGX Stocks With Discounts Ranging From 40.2% To 43.4%

Reviewed by Simply Wall St

Amidst a fluctuating global economic landscape, the Singapore market has shown resilience, with recent government securities auctions reflecting stable investor confidence and interest rates. In such a market environment, identifying undervalued stocks can offer potential opportunities for investors looking for value in a steady yet cautious trading climate.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.37 | SGD7.39 | 40.9% |

| Winking Studios (Catalist:WKS) | SGD0.295 | SGD0.51 | 41.9% |

| Hongkong Land Holdings (SGX:H78) | US$3.39 | US$5.79 | 41.4% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.00 | SGD1.67 | 40.2% |

| Seatrium (SGX:5E2) | SGD1.49 | SGD2.63 | 43.4% |

| Digital Core REIT (SGX:DCRU) | US$0.615 | US$1.11 | 44.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.965 | SGD1.48 | 34.8% |

Let's uncover some gems from our specialized screener.

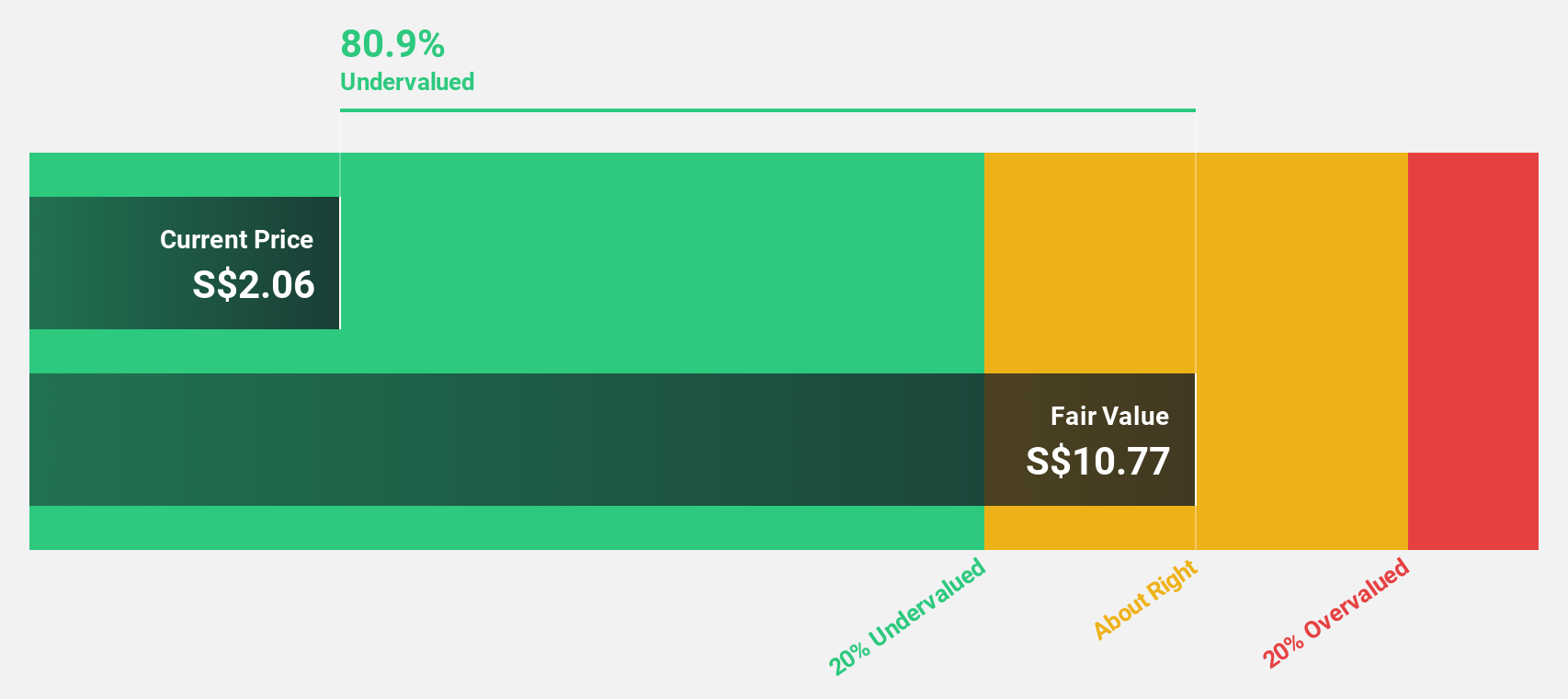

Seatrium (SGX:5E2)

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors with a market capitalization of SGD 5.08 billion.

Operations: Seatrium Limited generates revenue primarily through its segments in rigs & floaters, repairs & upgrades, offshore platforms, and specialized shipbuilding which collectively contribute SGD 7.26 billion, alongside a smaller segment in ship chartering amounting to SGD 31.63 million.

Estimated Discount To Fair Value: 43.4%

Seatrium Limited, trading at SGD1.49, is significantly below the estimated fair value of SGD2.63, indicating a potential undervaluation based on discounted cash flows. Despite a highly volatile share price recently and ongoing investigations by Singaporean authorities which could pose risks, analysts project an 82.1% price increase. Expected to turn profitable within three years with revenue growth forecasted at 8.7% per year—above Singapore's market average of 3.6%. However, its projected return on equity in three years is relatively low at 8.2%.

- In light of our recent growth report, it seems possible that Seatrium's financial performance will exceed current levels.

- Take a closer look at Seatrium's balance sheet health here in our report.

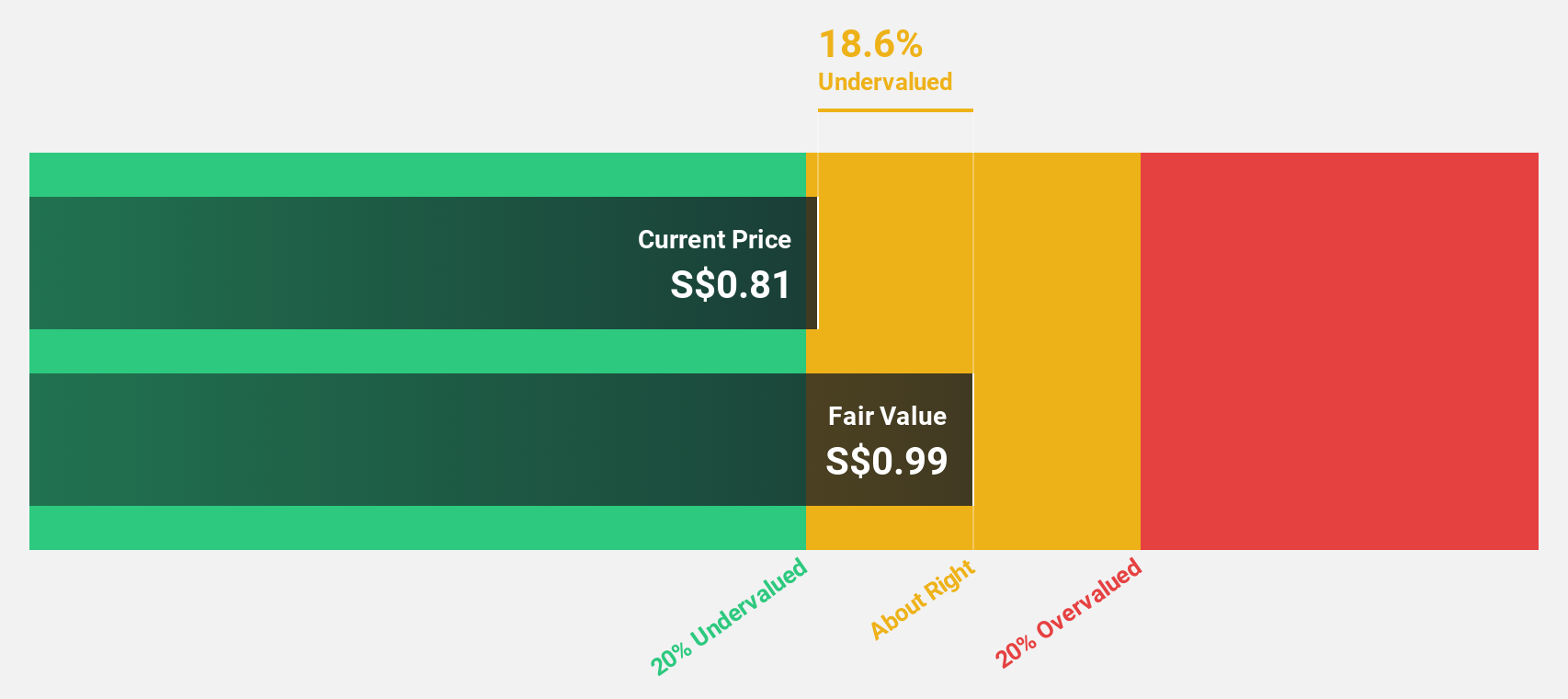

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages 107 industrial and commercial properties valued at approximately S$6.4 billion, spread across five developed markets including Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market capitalization of about S$3.76 billion.

Operations: The trust generates revenue from industrial and commercial properties spread across Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

Estimated Discount To Fair Value: 40.2%

Frasers Logistics & Commercial Trust, priced at SGD1, is valued below its estimated fair value of SGD1.67, suggesting potential undervaluation based on cash flows. Despite a decrease in net income from SGD 118.07 million to SGD 93.59 million year-over-year and an unstable dividend track record, the trust is expected to become profitable with projected earnings growth of 40.96% annually. However, its debt coverage by operating cash flow is weak, posing financial risk concerns amidst recent dividend reductions and mixed earnings results.

- The growth report we've compiled suggests that Frasers Logistics & Commercial Trust's future prospects could be on the up.

- Get an in-depth perspective on Frasers Logistics & Commercial Trust's balance sheet by reading our health report here.

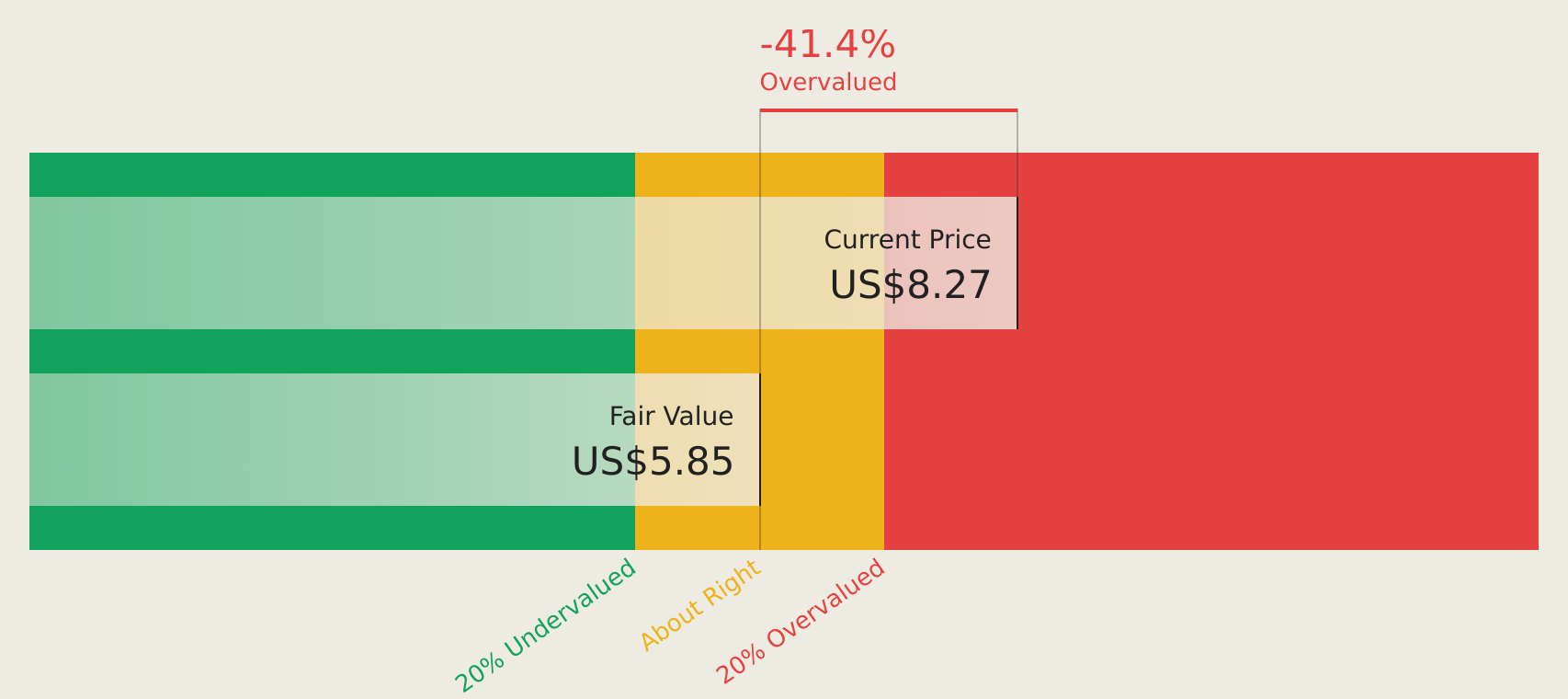

Hongkong Land Holdings (SGX:H78)

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia, and other international locations with a market capitalization of $7.48 billion.

Operations: The company generates revenue through two primary segments: Investment Properties, which brought in $1.08 billion, and Development Properties, contributing $0.76 billion.

Estimated Discount To Fair Value: 41.4%

Hongkong Land Holdings, trading at US$3.39, is significantly undervalued with an estimated fair value of US$5.79, reflecting a 41.4% discount based on cash flows. The company's revenue growth at 4.6% annually is poised to outpace the Singapore market average of 3.6%. Despite this, its expected return on equity remains low at 2.4%, and its dividend coverage by earnings is weak, indicating potential financial stress despite stable interim profits as reported in May 2024.

- Our growth report here indicates Hongkong Land Holdings may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Hongkong Land Holdings.

Where To Now?

- Embark on your investment journey to our 7 Undervalued SGX Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Seatrium is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5E2

Seatrium

Provides engineering solutions to the offshore, marine, and energy industries.

Flawless balance sheet and good value.