Stock Analysis

SGX Dividend Stocks Spotlight Featuring Multi-Chem And Two Others

Reviewed by Simply Wall St

As the global travel sector shows signs of robust recovery, reflected by companies like Currensea rapidly expanding their market presence, investors are keenly watching market trends and opportunities. In Singapore, the focus on dividend stocks remains strong as they offer potential for steady income in a fluctuating economic landscape. A good stock in this context is one that not only provides reliable dividends but also demonstrates stability and growth potential amid current market conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.34% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.34% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.00% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.62% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.80% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.82% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.77% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.98% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and other international markets, with a market capitalization of SGD 248.66 million.

Operations: Multi-Chem Limited generates revenue primarily through its IT business in Singapore (SGD 372.78 million), followed by other international markets (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million).

Dividend Yield: 8.8%

Multi-Chem Limited, a player in Singapore's dividend stock arena, is trading at 42.9% below its estimated fair value, making it an attractive option for value-focused investors. Despite a volatile dividend history over the past decade, the company maintains a payout ratio of 80.7%, with dividends well-covered by both earnings and cash flows (cash payout ratio at 88.1%). Recent board changes, including the appointment of Chong Teck Sin as Chairman and ARMC head on April 30, 2024, could signal strategic shifts enhancing governance and potentially stabilizing future dividends.

- Click here to discover the nuances of Multi-Chem with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Multi-Chem is trading behind its estimated value.

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited operates as an investment holding company, offering energy engineering, real estate, geospatial, and healthcare technology solutions across various global regions including Singapore, Australia, Malaysia, the US, Europe, and more. The company has a market capitalization of approximately SGD 491.80 million.

Operations: Boustead Singapore Limited generates revenue through its geospatial, healthcare technology, energy engineering, and real estate solutions segments, with earnings of SGD 212.67 million, SGD 10.58 million, SGD 174.41 million, and SGD 369.46 million respectively.

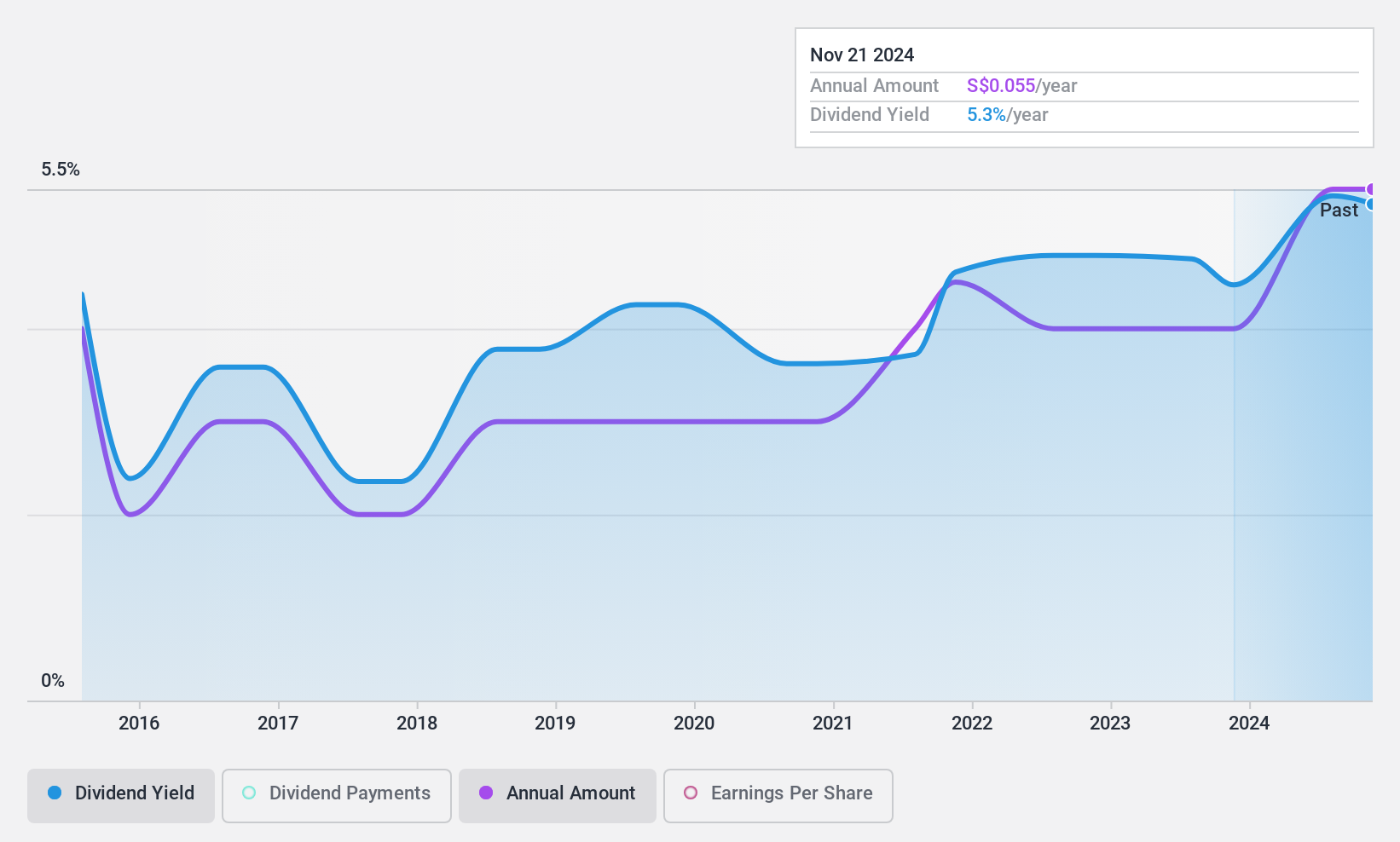

Dividend Yield: 5.3%

Boustead Singapore Limited, despite a projected average earnings decline of 9.9% over the next three years, maintains a solid dividend profile with a low cash payout ratio of 28.6% and an earnings coverage ratio of 40.9%. However, its dividend yield of 5.34% falls short compared to Singapore's top dividend payers at 6.25%. The company recently reported substantial growth in sales and net income for the year ending March 31, 2024, with sales reaching SGD 767.57 million and net income at SGD 64.19 million.

- Navigate through the intricacies of Boustead Singapore with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Boustead Singapore's share price might be too optimistic.

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a broad range of banking products and services, with a market capitalization of approximately SGD 52.39 billion.

Operations: United Overseas Bank Limited generates its revenue from a diverse array of banking products and services offered worldwide.

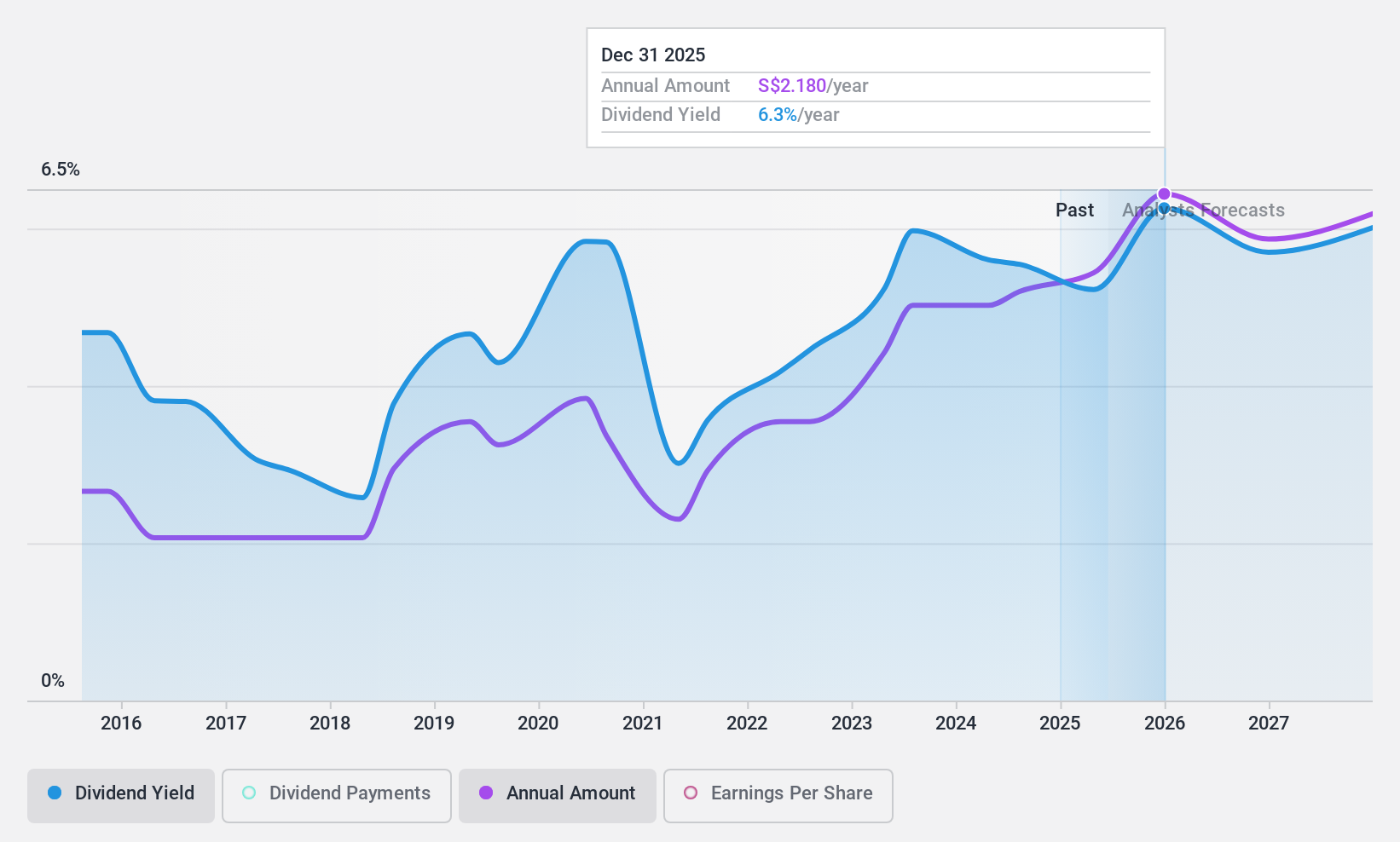

Dividend Yield: 5.4%

United Overseas Bank has a history of volatile dividends over the past decade, reflecting an unstable dividend track record. Despite this, the bank's recent financial performance shows a slight dip in net interest income and net income for Q1 2024. It recently initiated a share repurchase program, aiming to buy back up to 5.01% of its issued share capital using internal funds or borrowings. The bank's dividends are currently well-covered by earnings with a payout ratio of 50.8%, though its dividend yield at 5.43% is below the market's top quartile at 6.25%.

- Unlock comprehensive insights into our analysis of United Overseas Bank stock in this dividend report.

- Our valuation report here indicates United Overseas Bank may be undervalued.

Next Steps

- Take a closer look at our Top SGX Dividend Stocks list of 21 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether United Overseas Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U11

Excellent balance sheet average dividend payer.