- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A068930

Asian Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As global markets continue to navigate a mix of economic signals, Asian indices have shown resilience amid ongoing trade discussions and economic adjustments. In this context, dividend stocks in Asia offer a compelling opportunity for investors seeking stable income streams, particularly as they look for companies with strong fundamentals and consistent payout histories.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.47% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.34% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

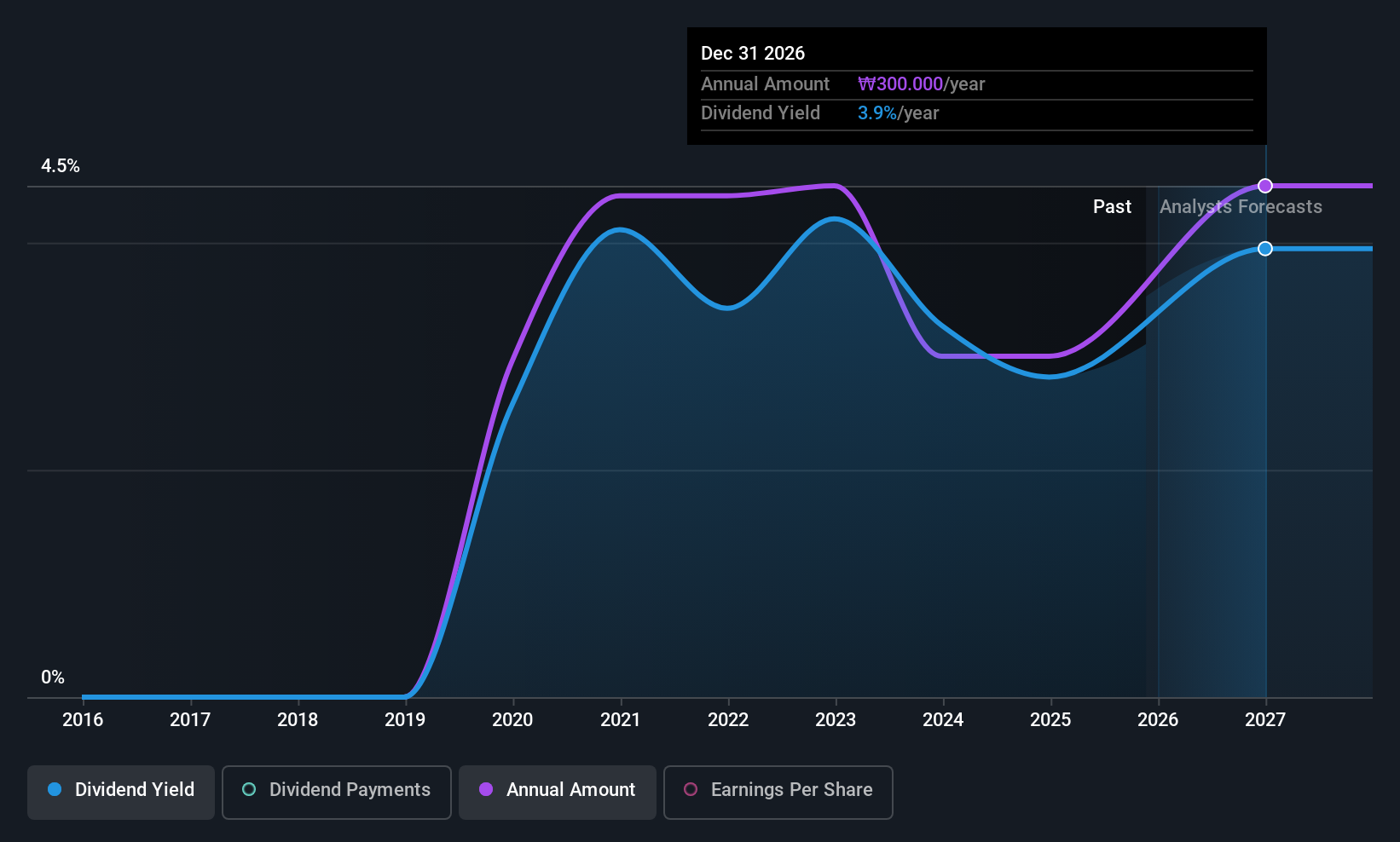

Digital Daesung (KOSDAQ:A068930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Digital Daesung Co., Ltd. offers online and offline educational services both in South Korea and internationally, with a market cap of ₩216.64 billion.

Operations: Digital Daesung Co., Ltd. generates revenue from higher education services amounting to ₩188.35 billion and elementary and secondary education services totaling ₩41.04 billion.

Dividend Yield: 6%

Digital Daesung reported a strong Q1 2025 with sales of KRW 30.17 billion and net income of KRW 1.44 billion, reflecting significant year-over-year growth. Its dividend yield ranks in the top 25% of the Korean market, supported by an earnings payout ratio of 81.1% and a cash payout ratio of 38%. However, dividends have been volatile over its short six-year history, raising concerns about long-term reliability despite recent growth in earnings and dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Digital Daesung.

- Our expertly prepared valuation report Digital Daesung implies its share price may be lower than expected.

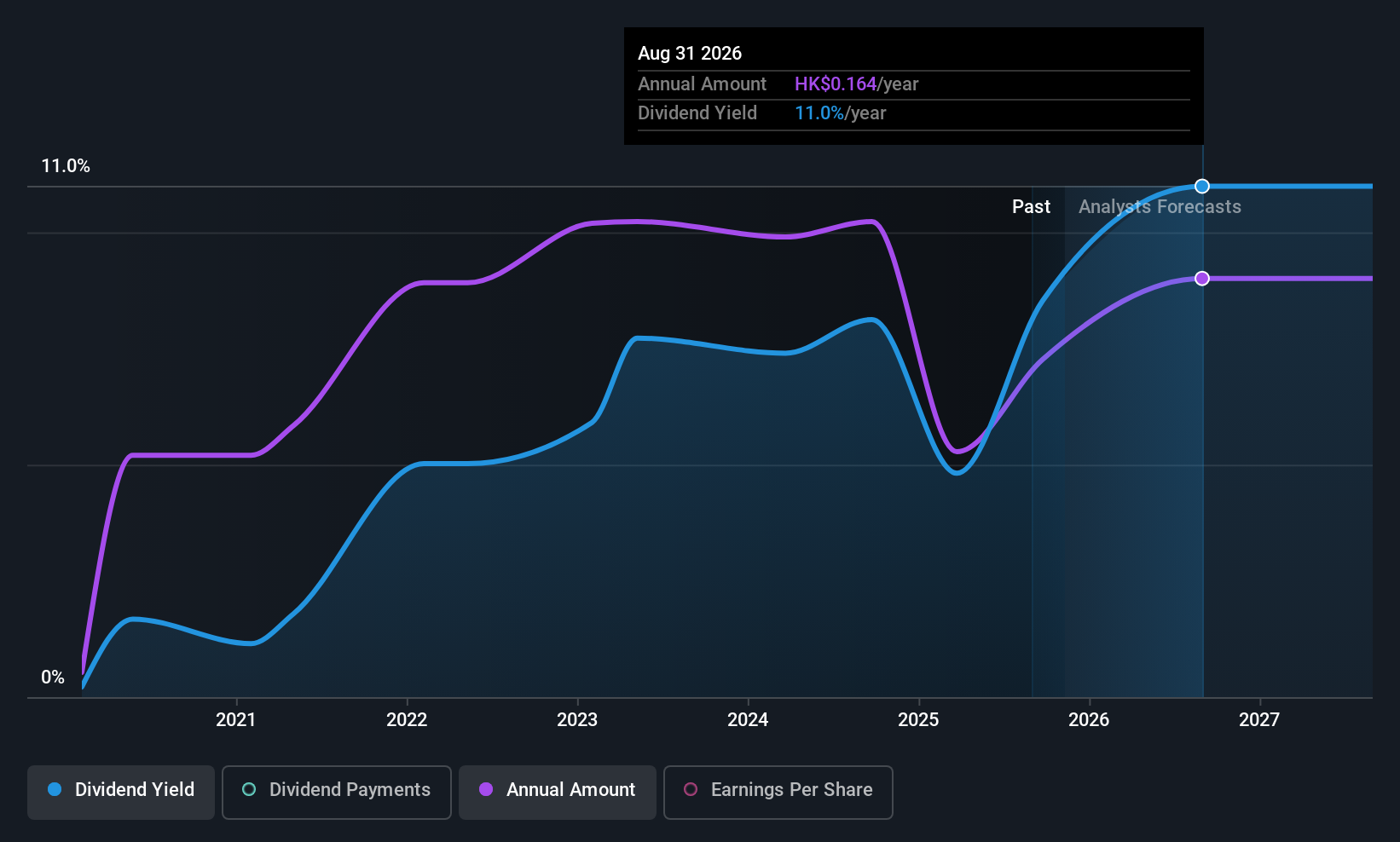

Edvantage Group Holdings (SEHK:382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Edvantage Group Holdings Limited is an investment holding company that operates private higher and vocational education institutions in the People's Republic of China, Australia, and Singapore, with a market cap of HK$1.98 billion.

Operations: Edvantage Group Holdings Limited generates revenue from its private higher and vocational education institutions, with CN¥2.36 billion coming from operations in the People's Republic of China and CN¥39.90 million from its overseas educational activities.

Dividend Yield: 7.9%

Edvantage Group Holdings' dividend yield is among the top 25% in Hong Kong, supported by low payout ratios of 11.3% for earnings and 23.1% for cash flows, indicating strong coverage. However, its six-year dividend history has been marked by volatility and a recent decrease in interim dividends to HKD 77.76 million from HKD 109.61 million last year reflects this instability. Additionally, the company's earnings declined despite increased sales, impacting future dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Edvantage Group Holdings.

- Our comprehensive valuation report raises the possibility that Edvantage Group Holdings is priced lower than what may be justified by its financials.

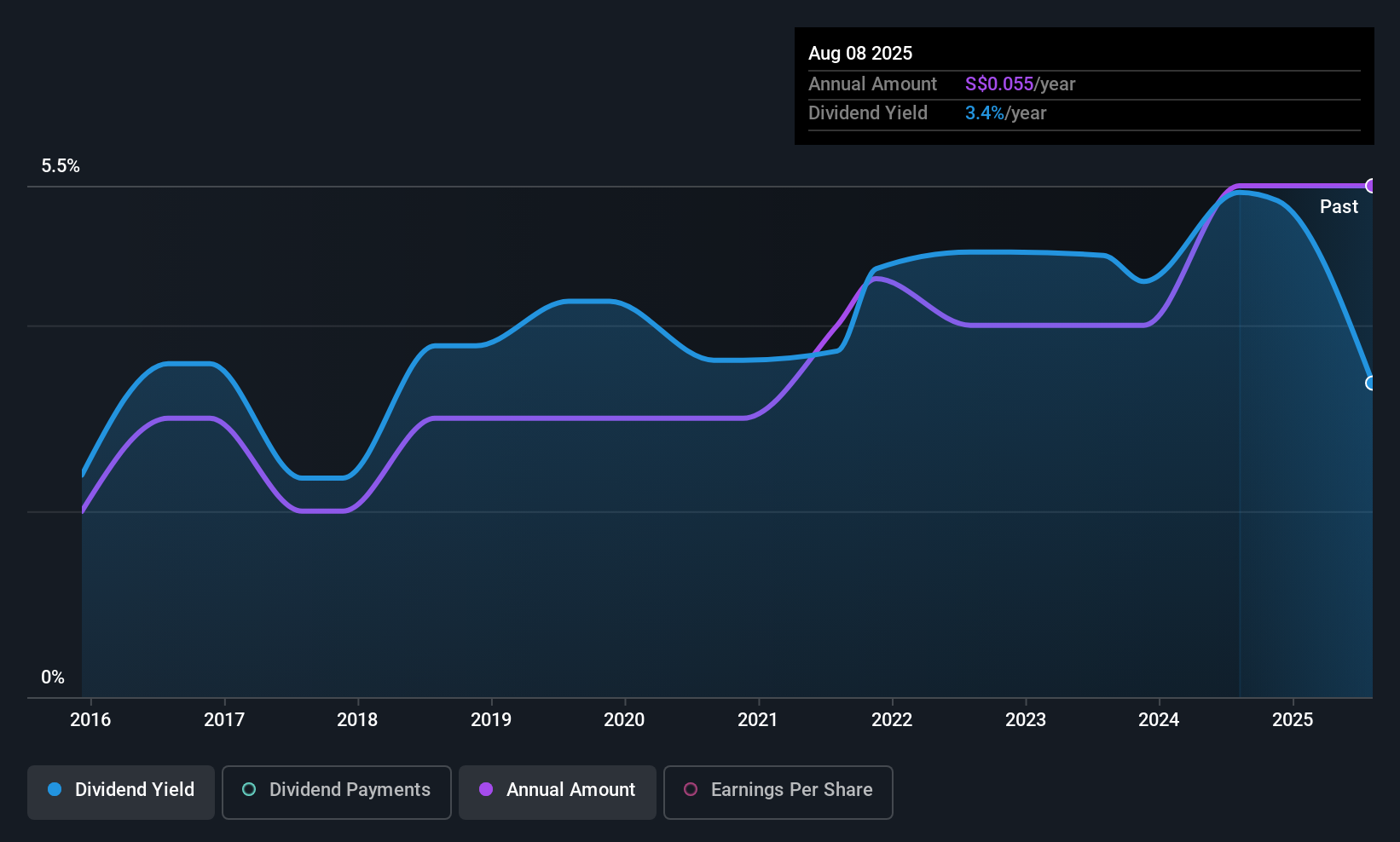

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, and the United States; it has a market cap of SGD776.76 million.

Operations: Boustead Singapore Limited's revenue is primarily derived from its Geospatial segment at SGD221.35 million, followed by Energy Engineering at SGD158.89 million, Real Estate Solutions at SGD134.35 million, and Healthcare at SGD12.14 million.

Dividend Yield: 3.5%

Boustead Singapore's dividend payments are well-supported by a low payout ratio of 28.1% and cash payout ratio of 38.8%, indicating strong coverage from earnings and cash flows. Despite a volatile dividend history, the company announced a special dividend, raising total dividends for 2025 to S$0.075 per share, up from S$0.055 in 2024. Earnings increased significantly to S$95.05 million despite lower sales, suggesting improved profitability that could enhance future dividend stability if sustained.

- Take a closer look at Boustead Singapore's potential here in our dividend report.

- The analysis detailed in our Boustead Singapore valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 1202 Top Asian Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A068930

Digital Daesung

Provides online and offline educational services in South Korea and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives