David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies CSC Holdings Limited (SGX:C06) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CSC Holdings

What Is CSC Holdings's Net Debt?

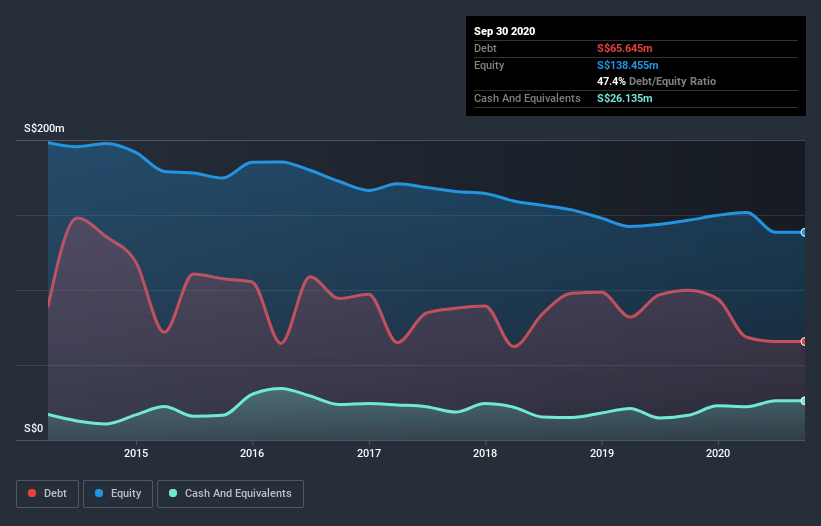

You can click the graphic below for the historical numbers, but it shows that CSC Holdings had S$65.6m of debt in September 2020, down from S$99.9m, one year before. However, because it has a cash reserve of S$26.1m, its net debt is less, at about S$39.5m.

How Healthy Is CSC Holdings' Balance Sheet?

The latest balance sheet data shows that CSC Holdings had liabilities of S$155.7m due within a year, and liabilities of S$18.7m falling due after that. On the other hand, it had cash of S$26.1m and S$100.2m worth of receivables due within a year. So its liabilities total S$48.2m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of S$49.9m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since CSC Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, CSC Holdings made a loss at the EBIT level, and saw its revenue drop to S$225m, which is a fall of 29%. That makes us nervous, to say the least.

Caveat Emptor

Not only did CSC Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping S$9.6m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of S$9.9m into a profit. In the meantime, we consider the stock very risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with CSC Holdings , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade CSC Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:C06

CSC Holdings

An investment holding company, provides foundation and geotechnical, and ground engineering solutions in Singapore, Malaysia, India, Thailand, the Philippines, Vietnam, and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives