Asian Market Insights: FIT Hon Teng And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate complex economic landscapes, Asia remains a focal point for investors seeking opportunities amid fluctuating trade dynamics and evolving monetary policies. Penny stocks, often seen as smaller or newer companies, continue to capture attention due to their potential for growth at accessible price points. Despite the term's seemingly outdated connotations, these stocks can offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.099 | SGD42.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 3 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.24 | HK$2.07B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.64 | THB792M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.15 | SGD864.2M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.58 | HK$52.47B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,147 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$17.30 billion.

Operations: The company's revenue is primarily derived from Intermediate Products at $3.90 billion and Consumer Products at $685.67 million.

Market Cap: HK$17.3B

FIT Hon Teng Limited, with a market cap of HK$17.30 billion, has shown a promising earnings growth of 19.2% over the past year, outpacing its five-year average and the broader electronic industry. The company's short-term assets significantly exceed both its short-term and long-term liabilities, indicating strong liquidity positions. While interest payments are well covered by EBIT at 4.2 times, the net debt to equity ratio is satisfactory at 14.5%. However, recent financial results were impacted by a large one-off gain of $95.2 million, which may affect perceived earnings quality despite stable profit margins improvement to 3.5%.

- Navigate through the intricacies of FIT Hon Teng with our comprehensive balance sheet health report here.

- Explore FIT Hon Teng's analyst forecasts in our growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD8.97 billion.

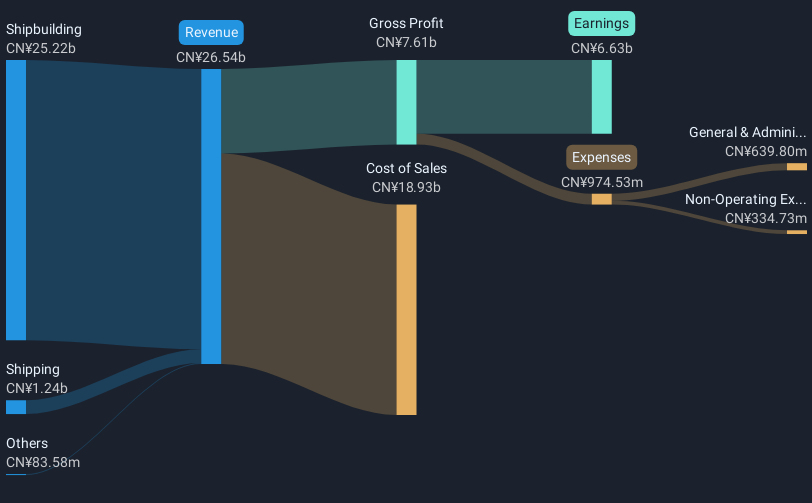

Operations: The company generates revenue from two primary segments: Shipbuilding, which accounts for CN¥25.22 billion, and Shipping, contributing CN¥1.24 billion.

Market Cap: SGD8.97B

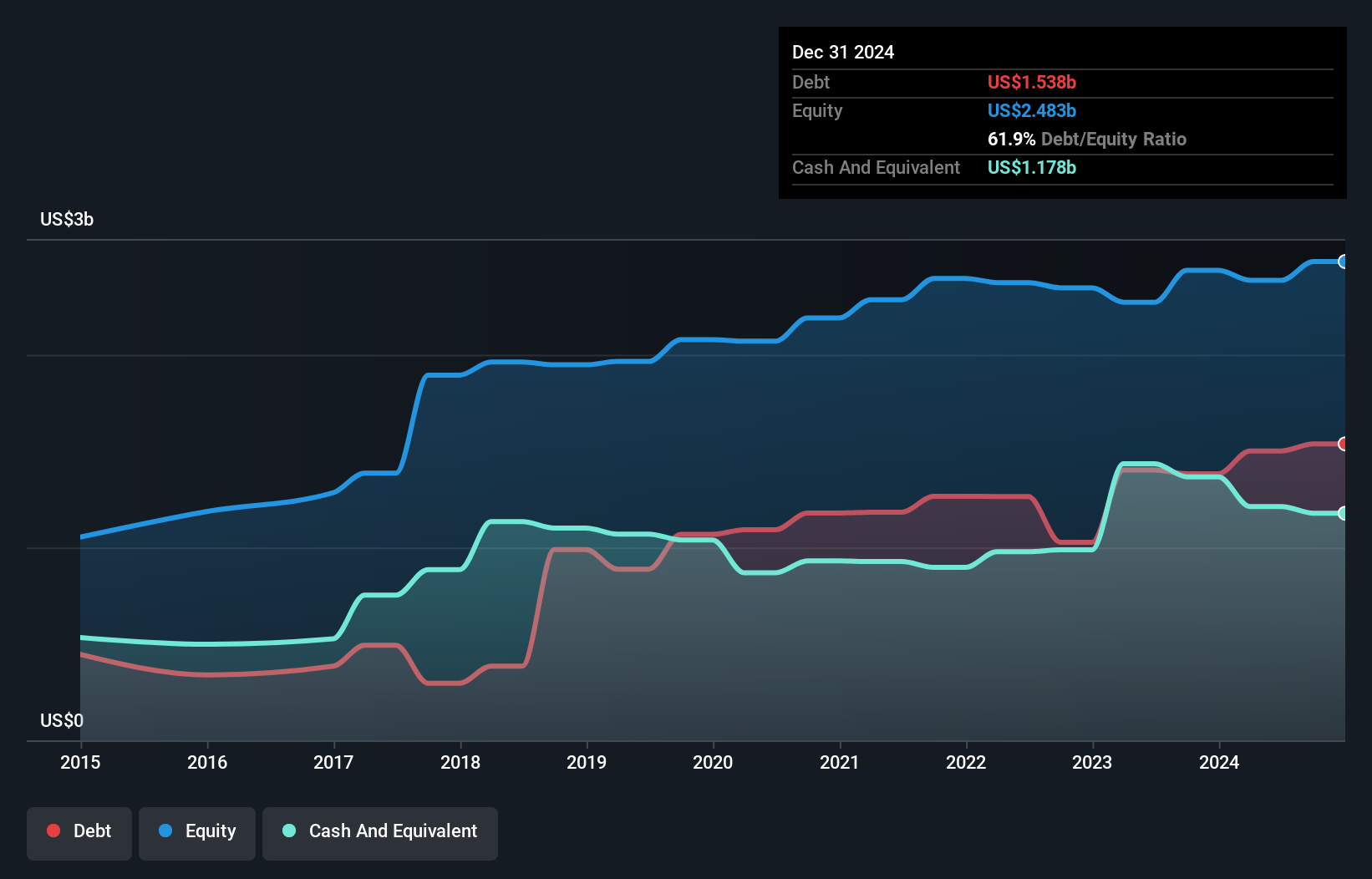

Yangzijiang Shipbuilding (Holdings) Ltd., with a market cap of SGD8.97 billion, is trading at a significant discount to its estimated fair value, offering potential relative value. The company has demonstrated robust earnings growth of 61.7% over the past year, surpassing both its historical average and industry benchmarks. It maintains a strong financial position with short-term assets covering both short and long-term liabilities comfortably, and its debt is well-covered by operating cash flow. Despite an inexperienced board, the management team is seasoned with an average tenure of 3.9 years, supporting operational stability amidst recent dividend increases and share buyback activities.

- Unlock comprehensive insights into our analysis of Yangzijiang Shipbuilding (Holdings) stock in this financial health report.

- Assess Yangzijiang Shipbuilding (Holdings)'s future earnings estimates with our detailed growth reports.

ZJBC Information Technology (SZSE:000889)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZJBC Information Technology Co., Ltd, operating through its subsidiaries, primarily offers information intelligent transmission services in China and has a market cap of CN¥3.52 billion.

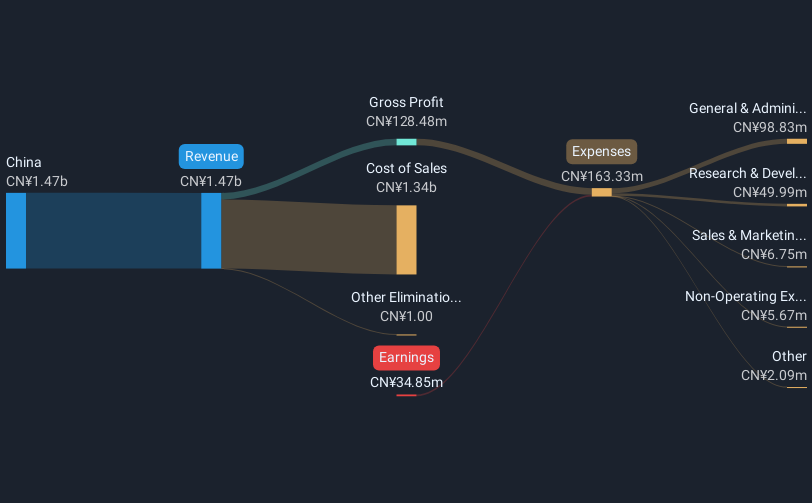

Operations: The company generates CN¥1.47 billion in revenue from its operations within China.

Market Cap: CN¥3.52B

ZJBC Information Technology Co., Ltd, with a market cap of CN¥3.52 billion, offers a mixed picture for penny stock investors. Despite a stable weekly volatility and reducing losses by 35.9% annually over the past five years, the company remains unprofitable with negative return on equity and insufficient short-term assets to cover liabilities. Recent earnings reports show slight revenue growth to CN¥1.47 billion and reduced net losses from CN¥125.3 million to CN¥35.43 million year-over-year, indicating gradual financial improvement amidst high share price volatility. The board is experienced with an average tenure of 3.6 years, although management tenure data is lacking.

- Click here and access our complete financial health analysis report to understand the dynamics of ZJBC Information Technology.

- Gain insights into ZJBC Information Technology's historical outcomes by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 1,147 Asian Penny Stocks.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZJBC Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000889

ZJBC Information Technology

Through its subsidiaries, offers information intelligent transmission services in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives