Amidst a backdrop of fluctuating trade policies and economic uncertainty, Asian markets have been navigating a complex landscape. With inflationary pressures and trade tensions influencing investor sentiment, dividend stocks in Asia offer a potential avenue for income-seeking investors to explore. A good dividend stock typically combines stable earnings with consistent payout histories, making them appealing during periods of market volatility as they can provide regular income streams despite broader economic challenges.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.49% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.24% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.16% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

Click here to see the full list of 1247 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Puregold Price Club (PSE:PGOLD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Puregold Price Club, Inc. operates in the Philippines as a retailer and wholesaler of dry goods, food, and other merchandise, with a market cap of ₱97.14 billion.

Operations: Puregold Price Club, Inc.'s revenue from its retailing business amounts to ₱224.27 billion.

Dividend Yield: 3.2%

Puregold Price Club has recently announced a regular cash dividend of PHP 1.09 per share and a special dividend of PHP 0.72 per share, reflecting its commitment to returning value to shareholders despite a historically volatile dividend track record. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 29.5% and 24.7%, respectively, indicating sustainability in the near term despite past fluctuations in payments.

- Navigate through the intricacies of Puregold Price Club with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Puregold Price Club shares in the market.

PAX Global Technology (SEHK:327)

Simply Wall St Dividend Rating: ★★★★★★

Overview: PAX Global Technology Limited is an investment holding company that develops and sells electronic funds transfer point-of-sale products across Hong Kong, the People’s Republic of China, the United States, and Italy, with a market cap of HK$5.70 billion.

Operations: PAX Global Technology Limited generates revenue primarily from its e-Payment Terminal Solutions Business, which amounted to HK$6.04 billion.

Dividend Yield: 9.3%

PAX Global Technology approved a final dividend of HKD 0.25 per share for 2024, maintaining a stable dividend history over the past decade. Despite a decline in profit margins from 17.2% to 11.8%, its dividends remain sustainable with a payout ratio of 73.2% and cash flow coverage at 51.1%. Trading at an attractive value with a P/E ratio of 8x, PAX's dividend yield is among the top quartile in Hong Kong, offering reliable returns to investors.

- Get an in-depth perspective on PAX Global Technology's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that PAX Global Technology is trading behind its estimated value.

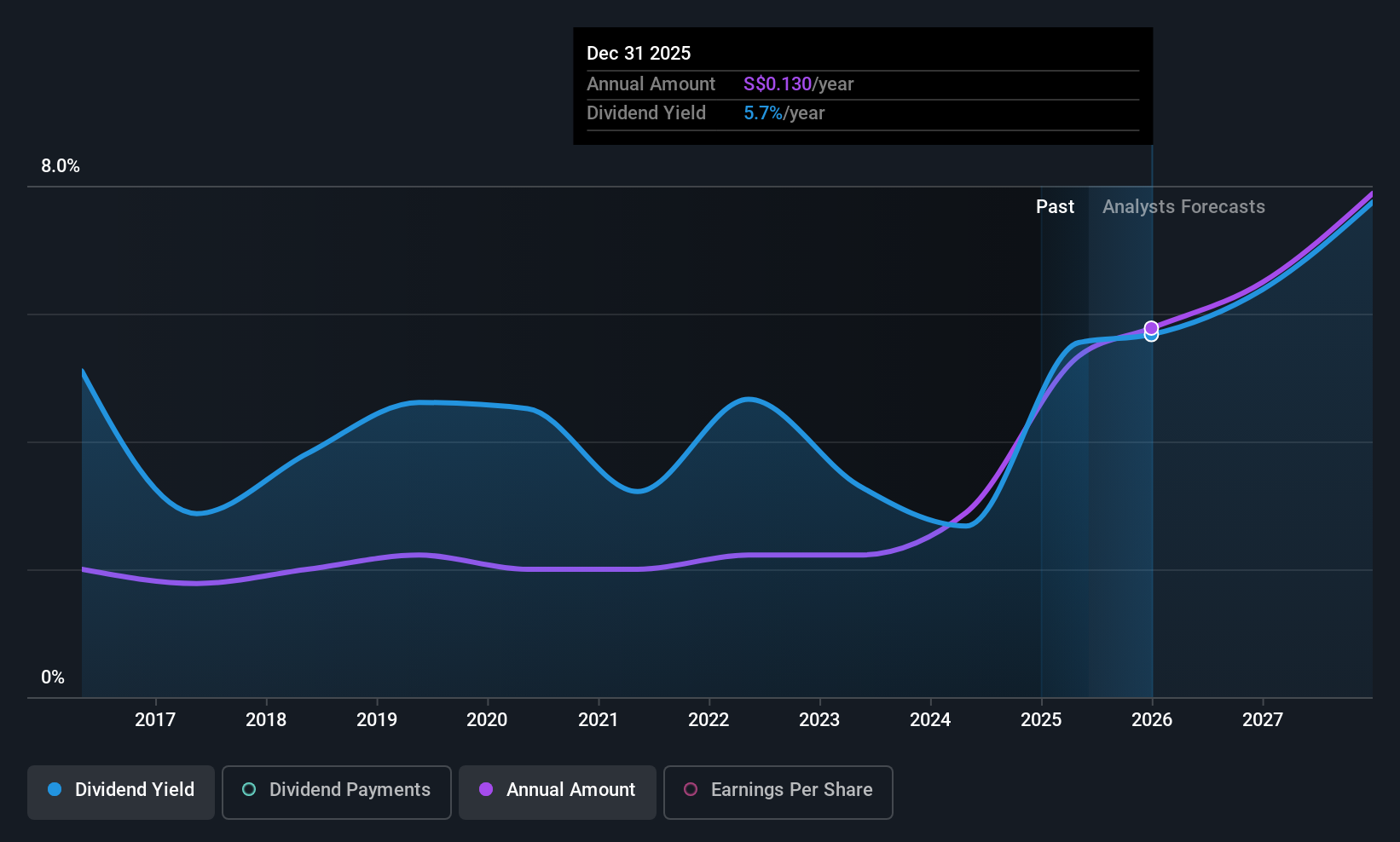

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD9.09 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates its revenue primarily from the shipbuilding segment, which accounts for CN¥25.22 billion, followed by the shipping segment at CN¥1.24 billion.

Dividend Yield: 5.1%

Yangzijiang Shipbuilding (Holdings) declared a final dividend of S$0.12 per share for 2024, reflecting its consistent dividend growth over the past decade. With a payout ratio of 38.2% and cash payout at 22%, dividends are well covered by earnings and cash flows. Although its yield is below the top quartile in Singapore, trading at a significant discount to fair value enhances its appeal as a reliable dividend payer within the industry.

- Take a closer look at Yangzijiang Shipbuilding (Holdings)'s potential here in our dividend report.

- The valuation report we've compiled suggests that Yangzijiang Shipbuilding (Holdings)'s current price could be quite moderate.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1247 Top Asian Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, Germany, Bulgaria, United Kingdom, Singapore, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion