As global markets experience a mix of optimism from strong U.S. labor reports and geopolitical uncertainties, major indices like the S&P 500 and Nasdaq Composite are approaching record highs, reflecting broad-based gains despite some economic unpredictability. In this context, dividend stocks can offer investors potential stability and income, as they often represent companies with strong fundamentals that may weather market volatility effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD699.59 million, operates in the prefabrication of steel reinforcement for concrete across Singapore and other international markets.

Operations: BRC Asia Limited generates revenue primarily from its operations in the prefabrication of steel reinforcement for concrete across various regions, including Singapore, Australia, Brunei, Indonesia, Malaysia, Thailand, and India.

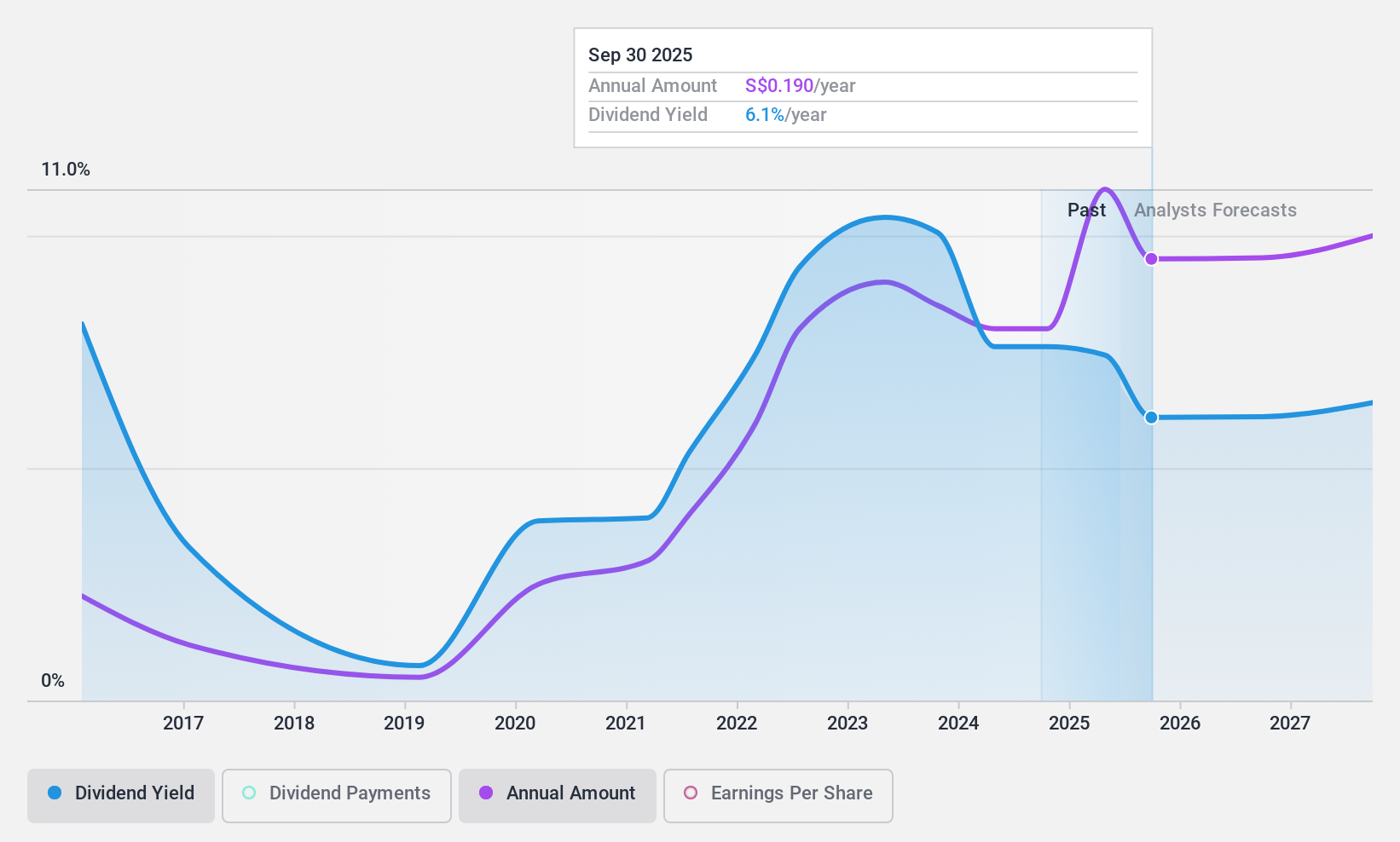

Dividend Yield: 6.3%

BRC Asia's dividend yield is attractive, ranking in the top 25% of Singapore's market. Despite this, its dividend history has been volatile over the past decade. However, dividends are well-covered by both earnings and cash flows with payout ratios of 26.5% and 23.3%, respectively. Recent earnings growth of SGD 93.54 million indicates improved profitability, yet future earnings are expected to decline by an average of 4.9% annually over three years.

- Navigate through the intricacies of BRC Asia with our comprehensive dividend report here.

- According our valuation report, there's an indication that BRC Asia's share price might be on the cheaper side.

Oriental Shiraishi (TSE:1786)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oriental Shiraishi Corporation operates in Japan, focusing on the production, construction, and sale of prestressed concrete products and structures, with a market cap of ¥51.27 billion.

Operations: Oriental Shiraishi Corporation's revenue is primarily derived from its Construction Business at ¥57.30 billion and Steel Structure Business at ¥9.27 billion, with additional income from its Port Business amounting to ¥3.31 billion.

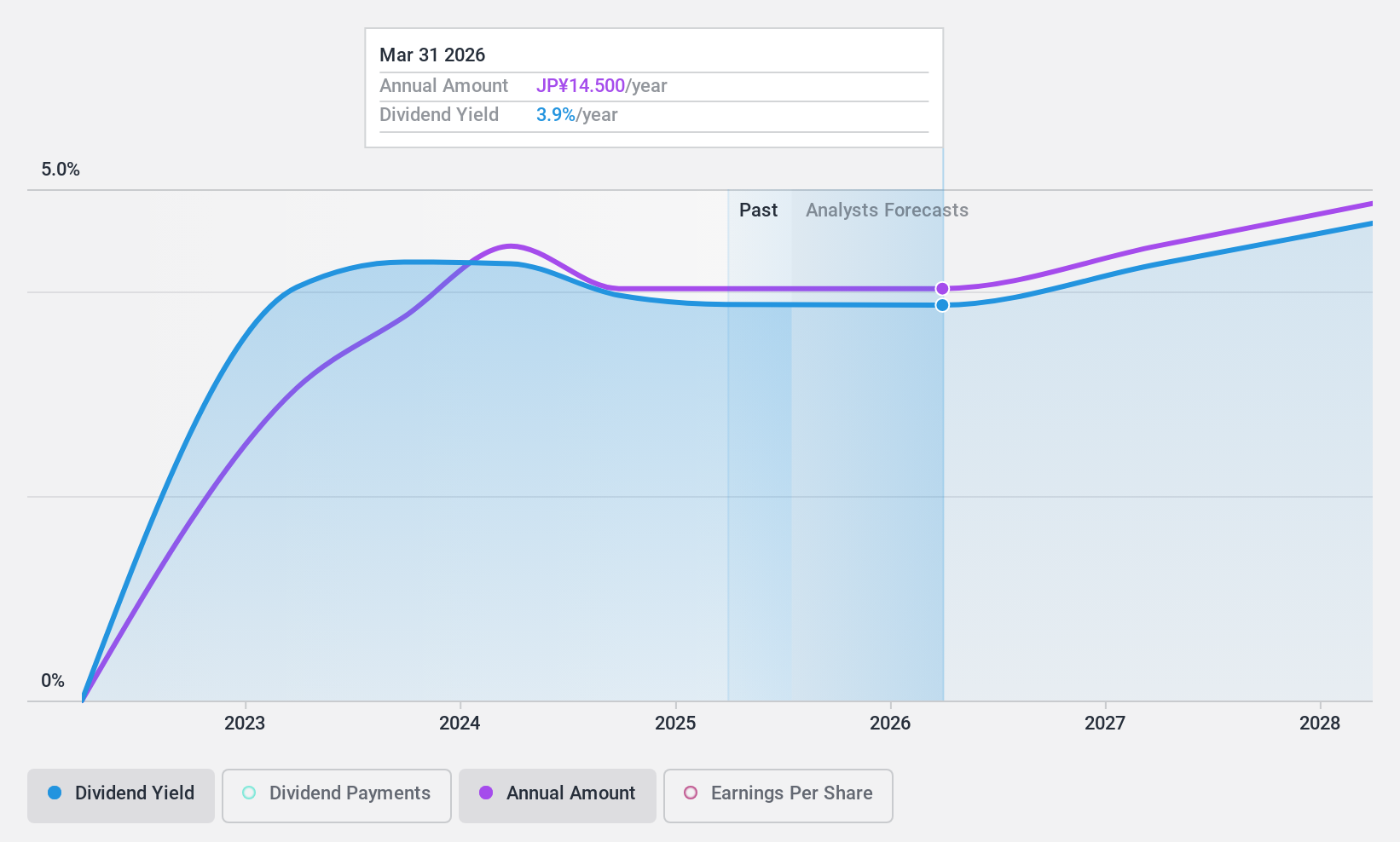

Dividend Yield: 3.9%

Oriental Shiraishi's dividend yield ranks in the top 25% of Japan's market, offering a JPY 7.00 per share dividend for Q2 of FY2025. Despite only three years of payments and some volatility, dividends are well-covered by earnings and cash flows with payout ratios of 18.6% and 36.2%, respectively. While trading below estimated fair value, revenue is expected to grow annually by 4.24%, though earnings may decline slightly over the next few years.

- Click to explore a detailed breakdown of our findings in Oriental Shiraishi's dividend report.

- In light of our recent valuation report, it seems possible that Oriental Shiraishi is trading behind its estimated value.

QuickLtd (TSE:4318)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quick Co., Ltd. operates in recruiting, human resources services, information publishing, and Internet-related businesses both in Japan and internationally, with a market cap of ¥38.65 billion.

Operations: Quick Co., Ltd.'s revenue is derived from its operations in recruiting, human resources services, information publishing, and Internet-related businesses.

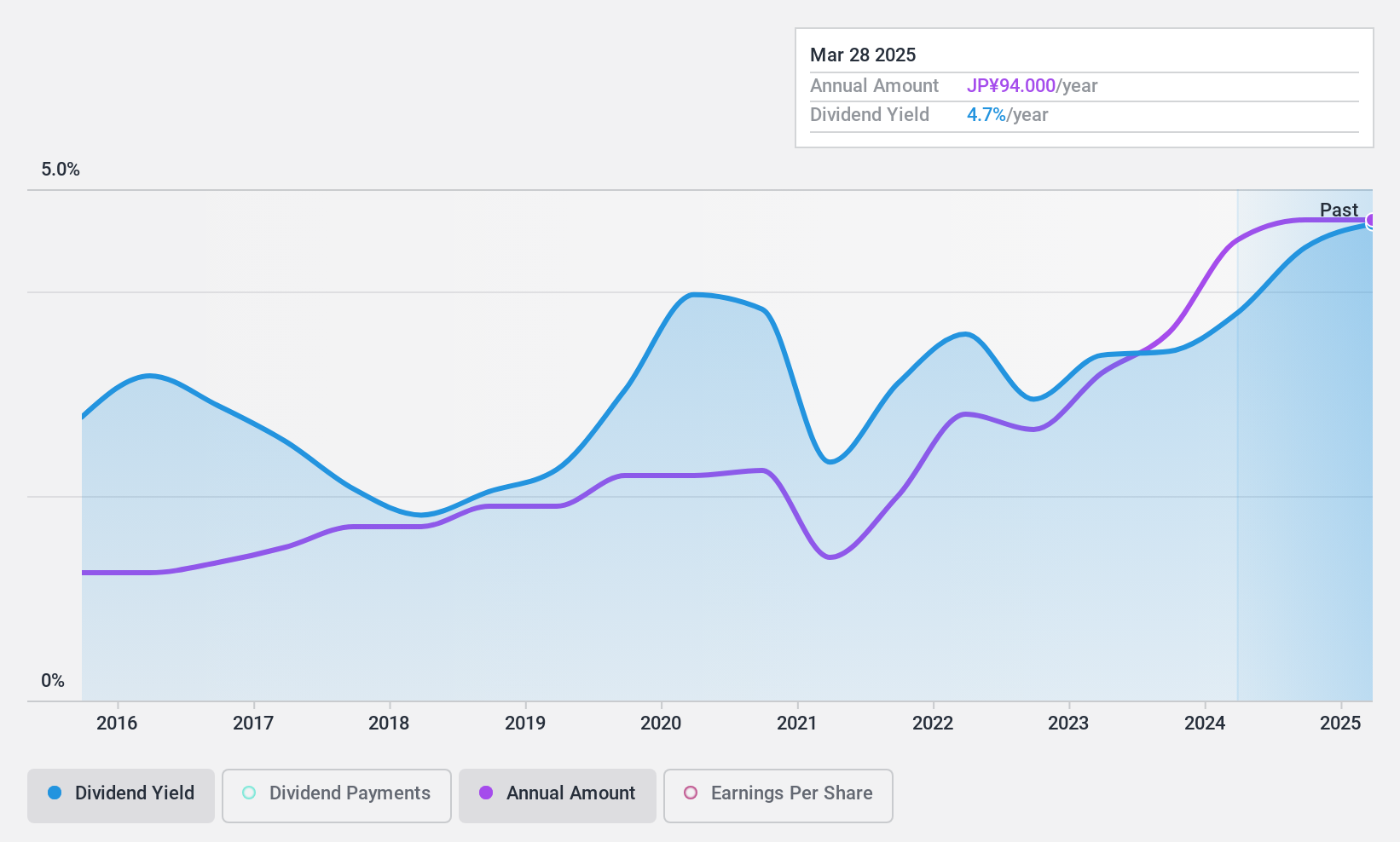

Dividend Yield: 4.5%

Quick Ltd. recently increased its dividend to JPY 47.00 per share, up from JPY 36.00 a year ago, reflecting strong earnings growth of 7.7%. The dividend yield is among the top 25% in Japan, supported by a sustainable payout ratio of 28.5% and cash flow coverage at 58.9%. Despite historical volatility in dividends, the company offers value trading below estimated fair value by nearly half, suggesting potential for capital appreciation alongside income returns.

- Unlock comprehensive insights into our analysis of QuickLtd stock in this dividend report.

- Our valuation report unveils the possibility QuickLtd's shares may be trading at a discount.

Seize The Opportunity

- Click here to access our complete index of 1954 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEC

BRC Asia

Engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives