- Singapore

- /

- Water Utilities

- /

- SGX:5GD

Sunpower Group (SGX:5GD) stock falls 11% in past week as three-year earnings and shareholder returns continue downward trend

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Sunpower Group Ltd. (SGX:5GD) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 74% drop in the share price over that period. And more recent buyers are having a tough time too, with a drop of 43% in the last year. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Sunpower Group

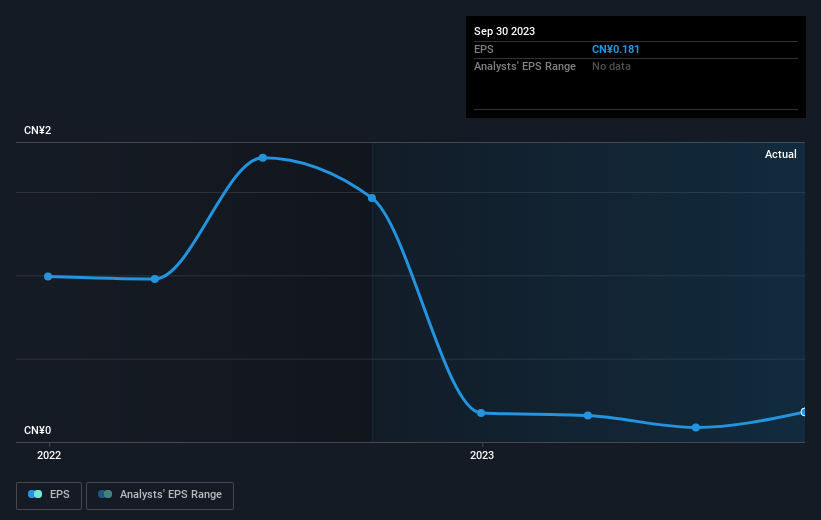

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Sunpower Group saw its EPS decline at a compound rate of 4.8% per year, over the last three years. The share price decline of 36% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 6.22.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Sunpower Group's key metrics by checking this interactive graph of Sunpower Group's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Sunpower Group's TSR for the last 3 years was -65%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Sunpower Group shareholders are down 43% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sunpower Group is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5GD

Sunpower Group

An investment holding company, engages in the investment, development, and operation of centralized heat, steam, and electricity generation plants in the People’s Republic of China.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives