- Singapore

- /

- Real Estate

- /

- SGX:OU8

3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In a week marked by the end of the longest U.S. government shutdown in history, small-cap stocks faced challenges, with the Russell 2000 Index dropping 1.83% amid concerns over elevated valuations and cautious Federal Reserve commentary on interest rates. As economic uncertainties persist, investors are increasingly looking for opportunities in sectors that can withstand market fluctuations; small-cap stocks with strong fundamentals and strategic insider buying may offer such potential amidst these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 22.93% | ★★★★★★ |

| Centurion | 3.8x | 3.2x | 39.07% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 20.13% | ★★★★★☆ |

| Senior | 24.0x | 0.8x | 28.32% | ★★★★★☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.58% | ★★★★☆☆ |

| Nickel Asia | 12.0x | 1.8x | 16.98% | ★★★☆☆☆ |

| Amaero | NA | 55.0x | 21.55% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.7x | 0.4x | -437.84% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 19.39% | ★★★☆☆☆ |

| Chinasoft International | 23.3x | 0.7x | -1270.46% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Nam Cheong (SGX:1MZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nam Cheong is a Malaysia-based company primarily engaged in the construction and engineering of offshore support vessels, with a market cap of approximately SGD 1.09 million.

Operations: Nam Cheong's revenue model shows a focus on managing costs, with cost of goods sold (COGS) being a significant component impacting gross profit. The company experienced fluctuations in its gross profit margin, reaching 65.03% in September 2024 before decreasing to 52.23% by March 2025. Operating expenses and non-operating expenses also play a role in determining net income outcomes, with notable reductions in non-operating expenses contributing to positive net income margins during certain periods.

PE: 4.5x

Nam Cheong's recent financials reveal a decline in sales and net income for both the third quarter and nine months ending September 2025, with MYR 449 million in sales compared to MYR 512 million a year ago. Despite this, insider confidence is evident as Seng Keat Leong purchased 277,000 shares valued at approximately S$199,301 between September and November. The company faces challenges like high debt levels and non-cash earnings but remains proactive in mitigating risks from terminated contracts by seeking new opportunities.

- Click here and access our complete valuation analysis report to understand the dynamics of Nam Cheong.

Review our historical performance report to gain insights into Nam Cheong's's past performance.

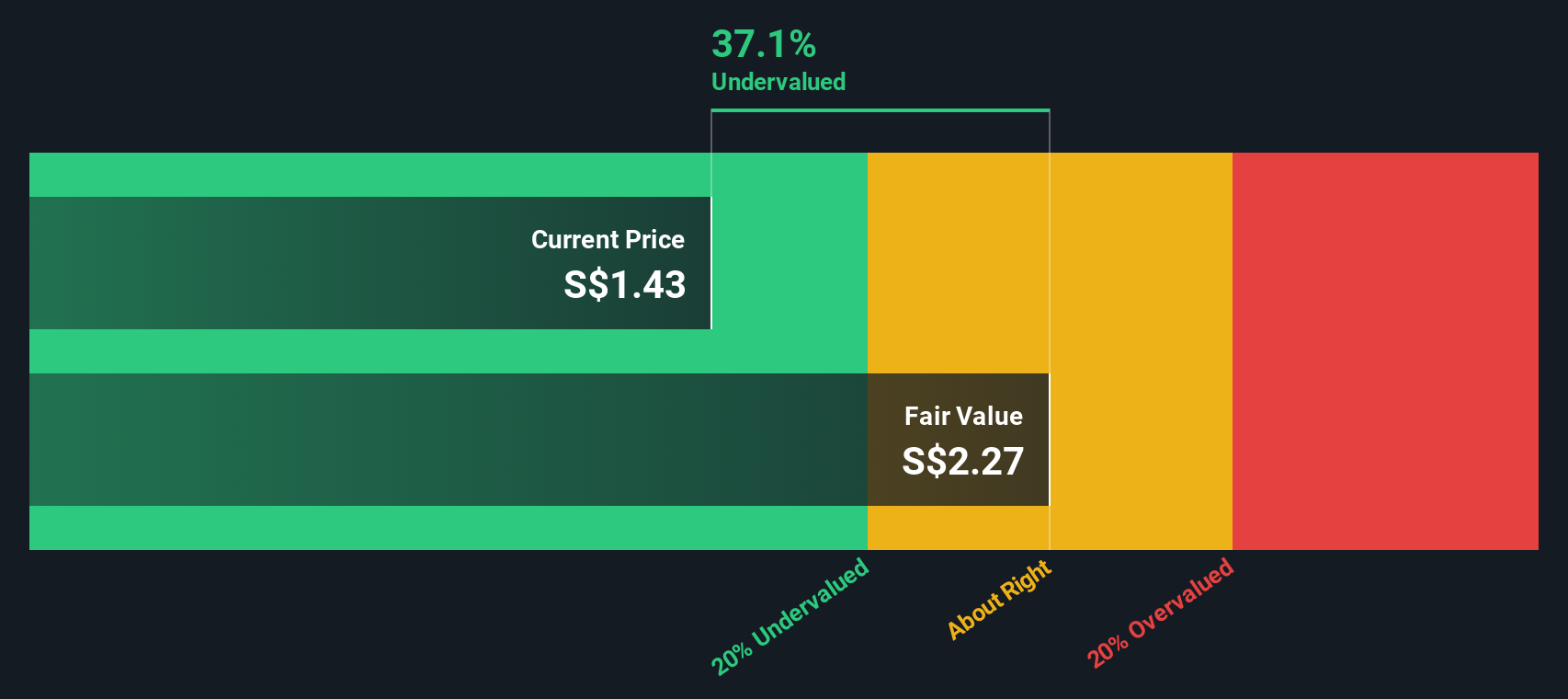

Centurion (SGX:OU8)

Simply Wall St Value Rating: ★★★★★★

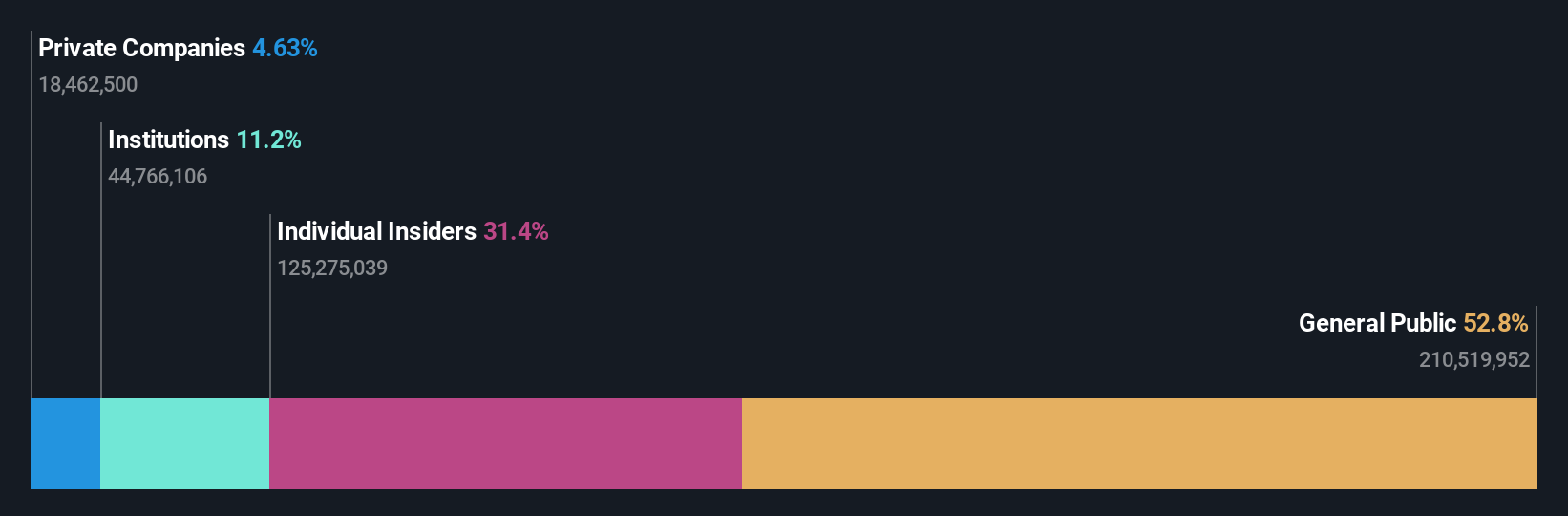

Overview: Centurion is a company that specializes in providing accommodation solutions, primarily focusing on workers and student housing, with a market capitalization of SGD 0.46 billion.

Operations: Centurion's revenue primarily stems from its Workers Accommodation segment, contributing significantly more than its Student Accommodation segment. The company's net income margin has shown a notable increase, reaching 101.51% by the end of 2024, while gross profit margin was at 83.31% in mid-2025. Operating expenses have been increasing alongside revenue growth, with general and administrative expenses being a significant component of these costs.

PE: 3.8x

Centurion's recent acquisition of a London property for approximately S$71 million highlights their strategic expansion into the UK student accommodation market. This move leverages strong demand fundamentals and positions Centurion to capitalize on limited supply in key educational hubs. Insider confidence is evident as Seng Juan Han purchased 600,000 shares, totaling around S$586,320 in value. Despite high debt levels and reliance on external borrowing, Centurion's inclusion in the S&P Global BMI Index signals market recognition of its growth potential.

- Click here to discover the nuances of Centurion with our detailed analytical valuation report.

Gain insights into Centurion's historical performance by reviewing our past performance report.

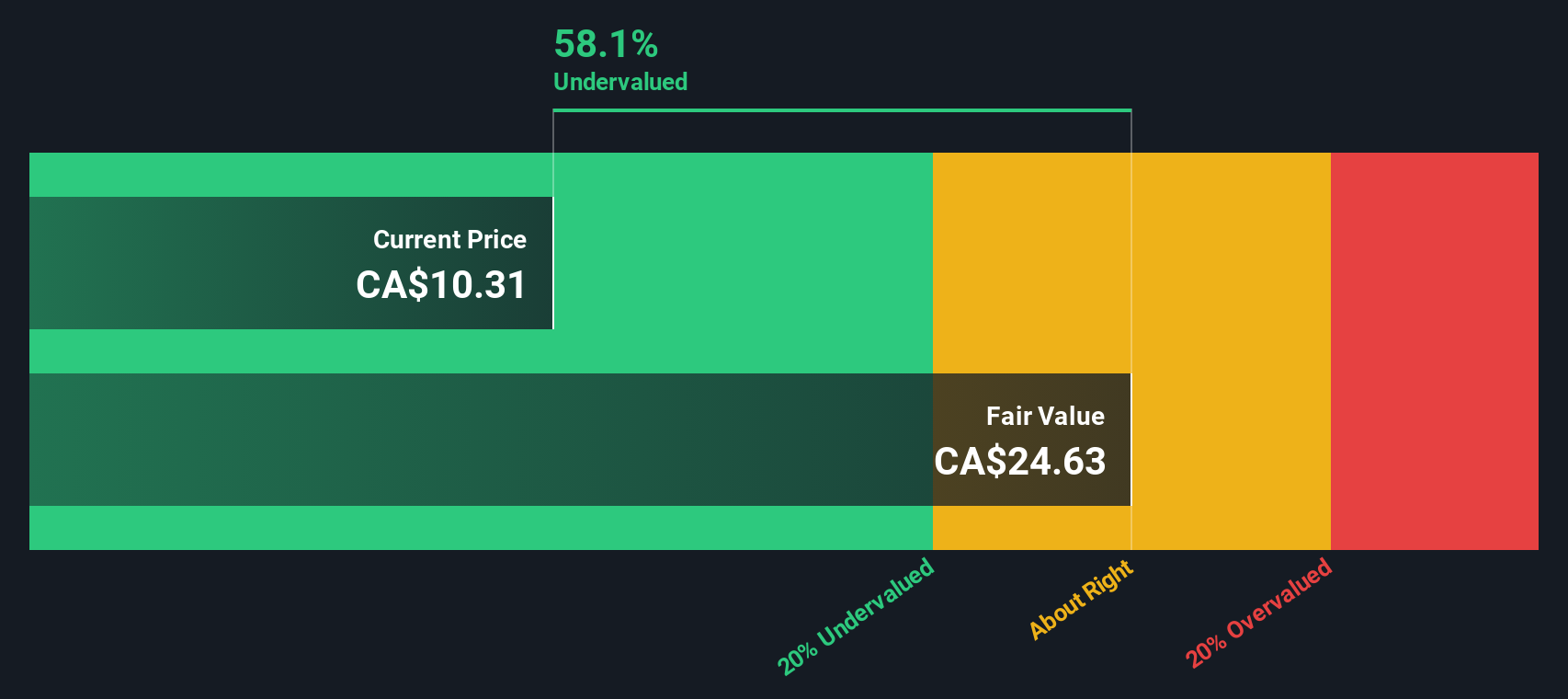

Versamet Royalties (TSXV:VMET)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Versamet Royalties focuses on acquiring and managing royalty interests in the mining sector, with a market capitalization of approximately $1.25 billion.

Operations: Versamet Royalties generates revenue primarily through its operations, with a notable increase in revenue from $3.14 million to $19.65 million over the observed periods. The company experienced fluctuations in its gross profit margin, reaching 55.52% initially and later adjusting to 33.73%. Despite rising revenues, net income remained negative across all periods, indicating ongoing challenges with profitability driven by substantial non-operating expenses and general & administrative costs.

PE: -399.2x

Versamet Royalties, a smaller company in its sector, recently announced significant growth in sales and revenue for the third quarter of 2025, with sales reaching US$5.07 million from US$2.59 million the previous year. Despite this growth, net income dipped slightly to US$3.32 million from US$3.86 million. The firm has a limited cash runway under one year and relies heavily on external borrowing for funding, which carries higher risk than customer deposits. However, insider confidence is evident as insiders have been purchasing shares consistently over recent months, signaling potential optimism about future performance despite current financial constraints and funding risks.

- Unlock comprehensive insights into our analysis of Versamet Royalties stock in this valuation report.

Examine Versamet Royalties' past performance report to understand how it has performed in the past.

Taking Advantage

- Click here to access our complete index of 128 Undervalued Global Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OU8

Centurion

Owns, develops, and manages workers and student accommodation assets in Singapore, Malaysia, Australia, the United Kingdom, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives