Here's Why I Think Oversea-Chinese Banking (SGX:O39) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Oversea-Chinese Banking (SGX:O39). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Oversea-Chinese Banking

How Fast Is Oversea-Chinese Banking Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Oversea-Chinese Banking's EPS soared from S$0.80 to S$1.08, in just one year. That's a impressive gain of 35%.

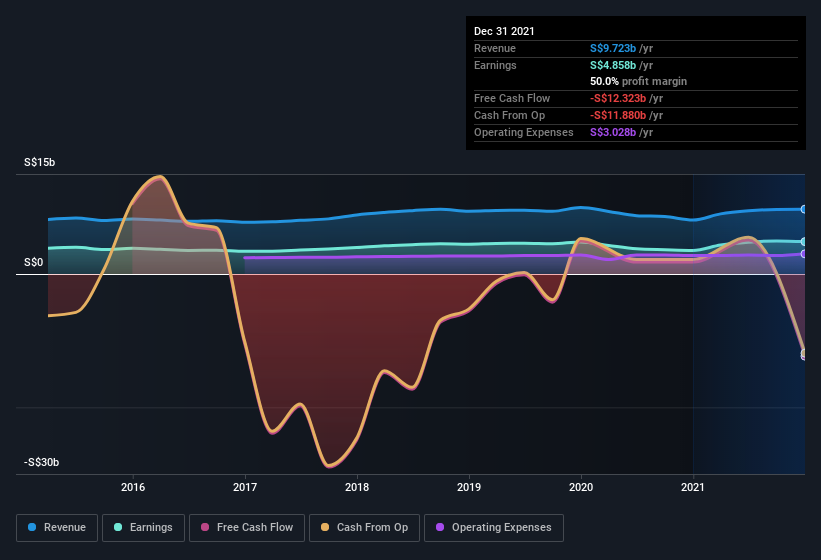

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Oversea-Chinese Banking's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Oversea-Chinese Banking maintained stable EBIT margins over the last year, all while growing revenue 20% to S$9.7b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Oversea-Chinese Banking.

Are Oversea-Chinese Banking Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Oversea-Chinese Banking, is that company insiders paid S$18k for shares in the last year. While this isn't much, we also note an absence of sales.

Along with the insider buying, another encouraging sign for Oversea-Chinese Banking is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth S$260m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Oversea-Chinese Banking Worth Keeping An Eye On?

You can't deny that Oversea-Chinese Banking has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Still, you should learn about the 2 warning signs we've spotted with Oversea-Chinese Banking (including 1 which shouldn't be ignored) .

The good news is that Oversea-Chinese Banking is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.