- Sweden

- /

- Renewable Energy

- /

- OM:ORRON

Orrön Energy (OM:ORRON): Losses Mount at 57% Annual Rate as 19% Revenue Growth Confronts Market Doubts

Reviewed by Simply Wall St

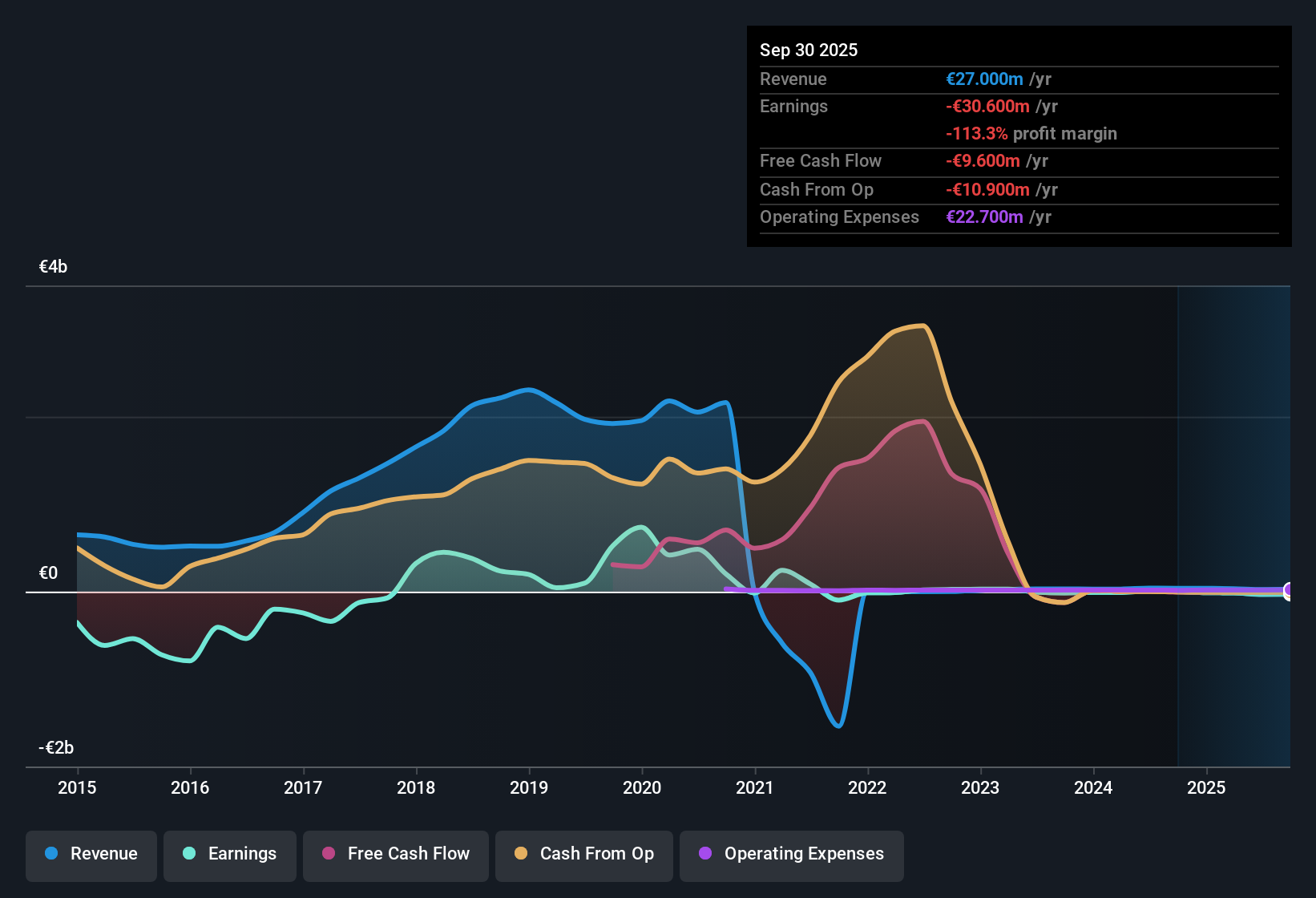

Orrön Energy (OM:ORRON) remains in the red, with losses compounding at an average annual rate of 57.4% over the last five years and profit margins still under pressure. While profitability is not expected in the next three years, revenue is forecast to surge at 19.15% per year, outpacing the Swedish market’s 3.7% average. Investors are left weighing Orrön’s premium valuation and strong revenue growth outlook in comparison to a track record of persistent losses and little evidence that a turnaround is near.

See our full analysis for Orrön Energy.The next section will put these headline numbers to the test against widely followed market narratives, examining how investor sentiment may align or diverge from the latest financial trends.

See what the community is saying about Orrön Energy

Profit Margin Stuck Deep in Negative Territory

- Orrön’s most recent profit margin is -145.0%, echoing years of persistent losses and emphasizing just how far the company remains from breaking even.

- According to the analysts' consensus view, long-term bulls believe the path to profits lies in project monetization and rising ancillary service revenue.

- Profit margin improvement to the industry average (30.2%) by 2028 is a significant stretch from today's deep losses, requiring not only operational fixes but also a dramatic shift in underlying Nordic market conditions.

- The expected boost from balance sheet strength and ongoing capacity investment is promising, but risks from low regional power prices and rising grid costs leave little margin for error.

- The consensus narrative points out that if project sales and regulatory reforms proceed faster than expected, the cash flow picture could shift meaningfully. However, the current -145% margin leaves no buffer for setbacks.

See how analysts and investors are weighing these contradictions in the full consensus narrative. 📊 Read the full Orrön Energy Consensus Narrative.

Premium Valuation Relative to Industry, Discount to Peers

- The current Price-to-Sales Ratio stands at 3.9x, which is above the European Renewable Energy industry average of 2.5x, but more attractive than immediate peers at 8.5x.

- Consensus analysts call this a classic valuation straddle.

- Orrön’s future top-line is forecast at 19.15% annual growth, yet the company is priced higher than the wider industry, showing that the market is paying up for growth while remaining cautious compared to higher-priced peers.

- Investors need to reconcile the gap between persistent unprofitability and a stock trading at a premium to most of its sector. This tension will only ease if project execution delivers on expectations.

Share Price Lags Analyst Target Despite Bold Growth Assumptions

- With Orrön’s share price at SEK4.04, it sits 63% below the analyst price target of SEK10.99, even as consensus forecasts revenue to reach €50.7 million and profit margins to swing positive by 2028.

- Consensus commentary highlights the disconnect.

- For the price target to be realized, the company must close a wide profitability gap, achieve and sustain major project sales, and avoid further market or policy headwinds.

- Bears see the steep discount as justified given balance sheet risk and uncertainty around monetization, while bulls see an opportunity if Orrön can hit its ambitious growth path.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Orrön Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on these numbers? Take a few minutes to share your perspective and shape your narrative. Do it your way

A great starting point for your Orrön Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Orrön Energy continues to struggle with steep negative profit margins, challenges in project monetization, and a persistent disconnect between ambitious growth assumptions and actual financial health.

If you want steadier prospects, check out solid balance sheet and fundamentals stocks screener (1977 results) to focus on companies displaying stronger balance sheets and more resilient financial foundations than Orrön’s current position allows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ORRON

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives