Elanders (OM:ELAN B) Trades at 0.2x Sales Despite 98% Annual Earnings Growth Forecast

Reviewed by Simply Wall St

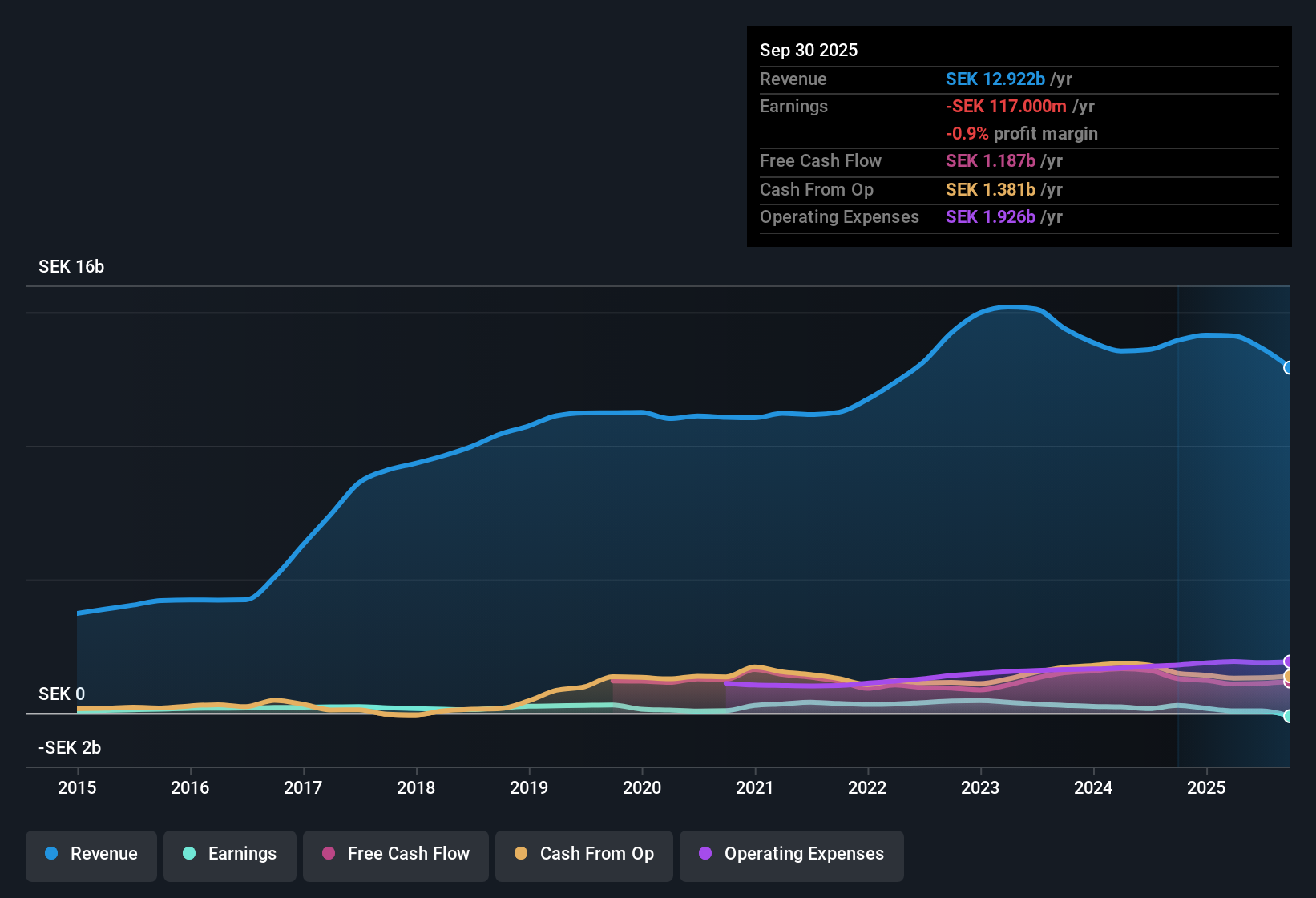

Elanders (OM:ELAN B) is currently unprofitable, with net losses having accelerated at an annual rate of 18.7% over the past five years. Looking ahead, earnings are forecast to grow at 98.2% per year, and the company is expected to reach profitability within three years, which is notably faster than the market average. Investors may see the recent profile as an intriguing value opportunity with significant recovery potential, though caution is warranted due to ongoing profitability and financial stability concerns.

See our full analysis for Elanders.The next section examines how these headline numbers compare with the key narratives that investors and analysts are following, highlighting where expectations and reality may align or differ.

See what the community is saying about Elanders

Cost Cuts Aim for SEK 145 Million in Savings

- Elanders has introduced structural cost-saving measures targeting a SEK 145 million reduction in its annual expense base. The goal is to improve net profit margins, which have not seen meaningful gains despite top-line growth forecasts.

- According to the analysts' consensus view, these cost reductions are expected to lift margins from the current 0.6% up to 4.0% in three years.

- Consensus narrative notes that ongoing strong cash conversion and net debt reduction should support earnings improvement as these savings take effect.

- However, adjustments in personnel costs, driven by system changes and operational restructuring—particularly in major European warehouses—could continue to squeeze margins in the near term.

- To see how much further operational changes can stretch profitability, explore the range of perspectives from analysts and investors in the full consensus narrative. 📊 Read the full Elanders Consensus Narrative.

Peer Valuation Points to Deep Discount

- ELAN B trades at a price-to-sales ratio of just 0.2x, well below the European logistics sector average of 0.7x and the peer average of 4x. This signals that the stock is priced significantly beneath both competitors and the industry as a whole.

- The analysts' consensus view interprets this relative undervaluation as an opportunity for value-oriented investors.

- Given the current share price of SEK 61.1 and the most optimistic analyst price target of SEK 110.0, there is a substantial 80% price gap that some believe could narrow as profitability recovers.

- Bears counter that slow revenue growth, forecasted at just 1.6% per year versus a 3.6% market average, may justify this persistent discount and any upside is conditioned on delivering margin improvements and sustained top-line gains.

Dividend Sustainability in Question Despite Debt Reduction

- The company’s efforts to reduce net debt and improve cash conversion have bolstered the balance sheet. However, analysts flag the dividend as unsustainable due to ongoing profitability concerns and weak net margins.

- The analysts' consensus view highlights this as a key risk for income-focused investors.

- With Elanders not yet achieving steady positive earnings and facing cost headwinds, the ability to fund dividends without straining cash flow remains questionable even as structural improvements unfold.

- Market watchers suggest monitoring both margin and earnings trends closely, as any stumbles on either front may force a rethinking of short-term dividend policy.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Elanders on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Jump in now to shape your perspective and craft a narrative in just a few minutes. Do it your way

A great starting point for your Elanders research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Elanders continues to struggle with unstable earnings and pressure on its ability to sustain dividends and margins. This is occurring despite attempts to cut costs and reduce debt.

If reliable income matters most, target companies with consistent yields and less payout risk by using our these 1982 dividend stocks with yields > 3% to spot stronger dividend plays now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ELAN B

Elanders

A logistics company, provides supply chain, and print and packaging solutions in Sweden, Germany, the United States, Singapore, the United Kingdom, the Netherlands, India, China, Switzerland, Poland, Hungary, and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives