- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Telia (OM:TELIA) Profit Margin Surges to 6%, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

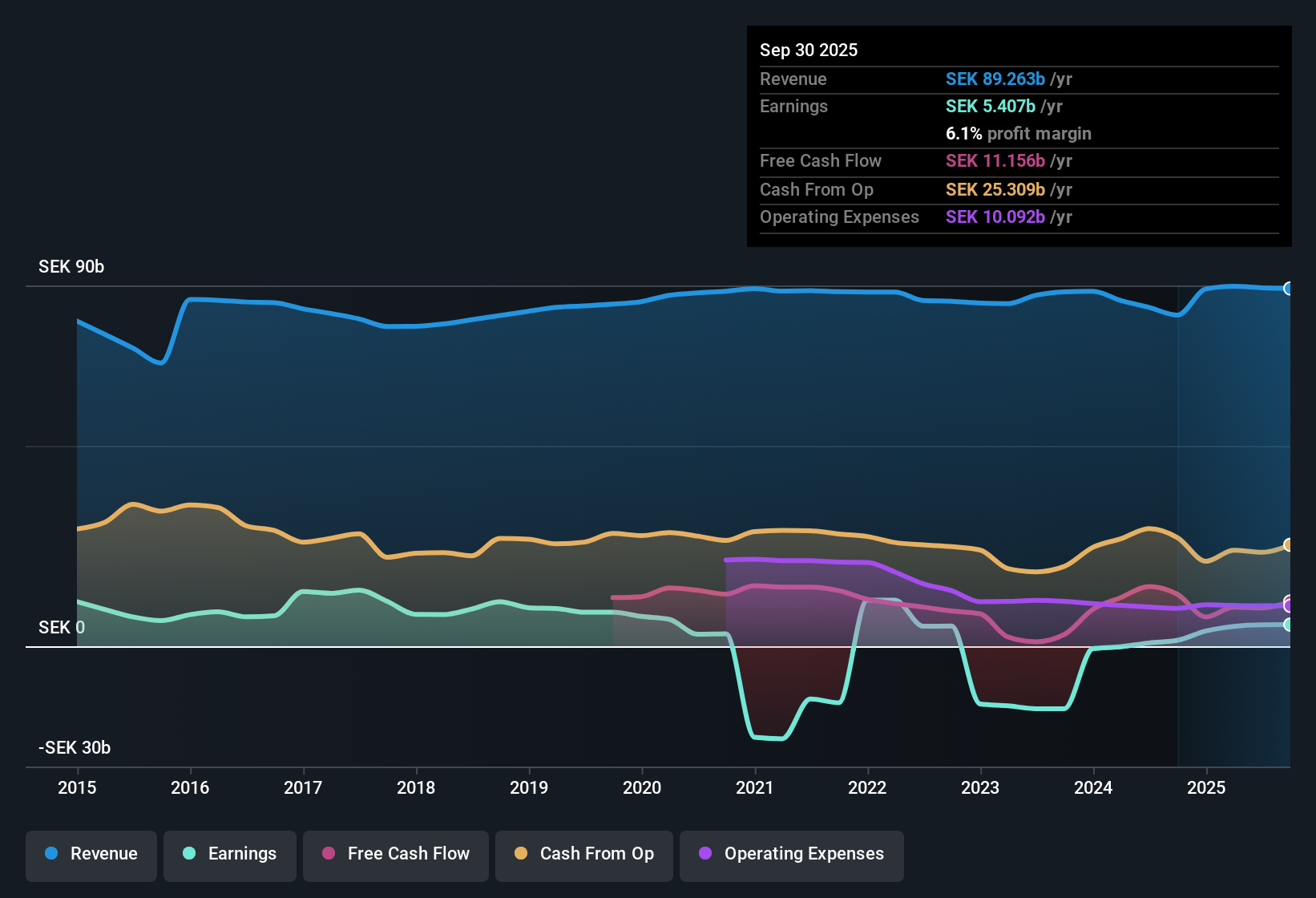

Telia Company (OM:TELIA) posted a striking jump in net profit margins to 6% for the year, a sharp improvement from last year’s 1%. Earnings growth soared 548.1%, far outpacing the company’s 29.6% five-year annualized rate. Looking ahead, earnings are forecast to rise 8.83% per year, lagging the Swedish market’s anticipated 12.3% annual rate, while revenue is expected to grow just 1.2% per year. Telia’s strong profit expansion stands out, though investors remain mindful of flagged risks around financial stability and dividend sustainability.

See our full analysis for Telia Company.With the headline results on the table, the next step is to measure them against the narratives that shape market sentiment. This helps reveal where perceptions align with reality and where surprises could emerge.

See what the community is saying about Telia Company

Profit Margin Recovery Puts Upward Pressure on Long-Term Forecasts

- Analysts see margin expansion from 6.0% today to 10.4% in three years, suggesting rising profitability and improved cost efficiency based on current projections rather than lofty revenue growth hopes.

- Consensus narrative highlights that focus on broadband, bundled services, and digitalization is deepening customer loyalty and allowing higher ARPU, driving recurring revenue and margin gains.

- Recent EBITDA margin trends and network upgrades are expected to support these forecasts, underlining the company's operational pivot to higher-value, stickier services.

- Even with revenue growth projected at only 1.2% per year, the focus on margins signals that Telia is squeezing more profit out of each krona of sales, which fits well with the analysts' balanced view.

See what the full spectrum of analysts expects from Telia's growth roadmap and margin trajectory. 📊 Read the full Telia Company Consensus Narrative.

Premium Price-To-Earnings Raises Eyebrows Despite Low DCF Fair Value

- Telia trades at a 27.5x Price-To-Earnings ratio, considerably above the telecom industry average of 18.1x. Its current share price (SEK37.58) sits well below the DCF fair value estimate (SEK85.05).

- Consensus narrative notes that while the low share price may attract value-oriented investors, the premium P/E reflects investor willingness to pay more for perceived earnings quality and stability.

- This valuation tension is reinforced by the current share price being roughly 56% below the DCF fair value, implying that the market is skeptical about the company's ability to deliver on margin and growth promises.

- Analysts expect Telia to trade at an 18.7x P/E on 2028 earnings, a significant contraction from today, suggesting that future performance must accelerate to justify current multiples.

Risks Signal Pressure on Dividend and Financial Position

- Financial stability and dividend sustainability remain flagged risks, tempering optimism about recent margin and profit expansion.

- Consensus narrative points out that significant ongoing capital expenditures for 5G, fiber rollouts, and regulation costs could compress free cash flow and constrain future dividends.

- Persistent competition and limited differentiation in digital services may also put additional pressure on ARPU and long-term profitability.

- These industry challenges show that while Telia’s profit margins are climbing, investors must continuously monitor the balance between returns and emerging financial strains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Telia Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the figures tell a different story? Share your perspective and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Telia Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite Telia's impressive profit margin recovery, ongoing pressure on its dividend and financial stability signals underlying vulnerability in its balance sheet.

If you want to put your money in companies with stronger fundamentals and lower risk, check out solid balance sheet and fundamentals stocks screener (1984 results) as a smarter starting point for your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives