- Sweden

- /

- Wireless Telecom

- /

- OM:TEL2 B

Tele2 (OM:TEL2 B) Valuation in Focus Following Executive Leadership Change and New Strategic Direction

Reviewed by Simply Wall St

Tele2 (OM:TEL2 B) has announced Nicholas Högberg will join as Executive Vice President, Chief Commercial Officer, and Deputy CEO Sweden. He will take on the role starting December 1, 2025. This executive move follows the departure of Petr Cermak and marks a notable shift in leadership direction.

See our latest analysis for Tele2.

Tele2’s announcement comes on the back of notable one-year momentum, with a 29.96% year-to-date share price return and a total shareholder return of 34.17% over the past year. That performance stands out even after some recent turbulence, hinting at confidence in the company’s prospects and reflecting renewed optimism following this executive appointment.

If leadership shake-ups have you curious about what else is trending, consider broadening your search and explore fast growing stocks with high insider ownership.

But after such a strong rally and a wave of positive sentiment, investors are left to consider whether Tele2 remains undervalued or if the market is already pricing in all of its potential for future growth.

Most Popular Narrative: 10% Undervalued

Tele2's fair value, as estimated by the most popular narrative, sits notably higher than the last close price, highlighting significant headroom if consensus forecasts are realized. This divergence suggests analysts see more runway for the stock, despite the recent rally and lingering questions over sector consolidation.

"High cash generation, reduced leverage, and disciplined CapEx spending, through targeted network upgrades and operational prioritization, strengthen financial flexibility. This may enable further M&A/consolidation or accelerate capital returns, supporting long-term earnings growth and returns to shareholders."

Want to know which strategic moves could unlock lasting value for Tele2? The future fair value here is built on key profit upgrades, operational efficiency, and higher earnings power. Could a pivotal industry shift be behind these projections? Unlock the full story and see the bold projections analysts are betting on for the years ahead.

Result: Fair Value of $161.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressure and potential regulatory delays remain key risks. These factors could quickly challenge this otherwise optimistic outlook for Tele2.

Find out about the key risks to this Tele2 narrative.

Another View: Market Multiples Tell a Different Story

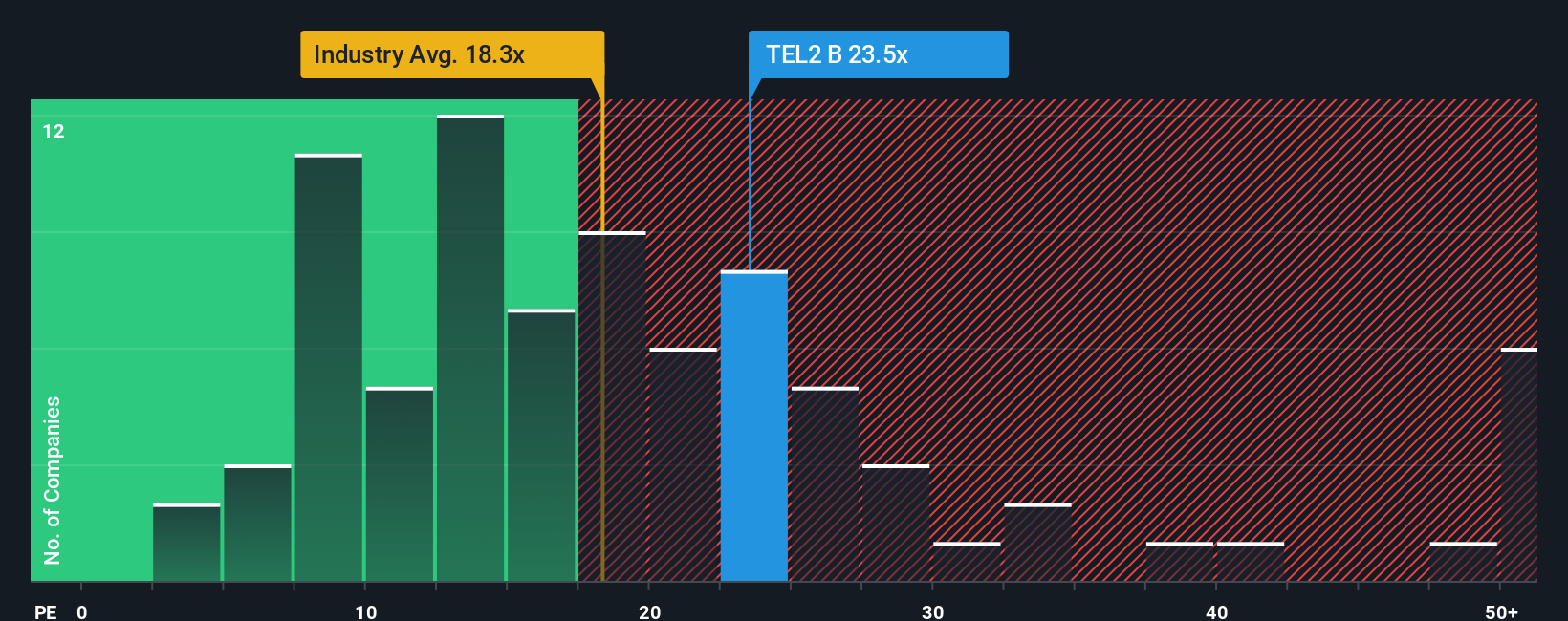

Looking at valuation through the lens of the company's price-to-earnings ratio, Tele2 appears expensive compared to both its industry peers and the global sector average. At 23.2x, its multiple stands above the peer average of 22.2x and the global industry average of 18.1x. However, compared to its fair ratio of 25.3x, there may still be upside potential if market sentiment adjusts. Does this gap signal hidden risk, or could investors find overlooked value here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tele2 Narrative

If you have your own perspective or want to dig deeper into the numbers, you can quickly create a personalized narrative to test your view. Do it your way.

A great starting point for your Tele2 research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never stand still. Make your next move by uncovering unique opportunities across new markets and sectors before others spot them.

- Capitalize on rising demand by checking out these 30 healthcare AI stocks, which are redefining the future of medicine and patient care with artificial intelligence.

- Boost your income strategy by finding these 15 dividend stocks with yields > 3% that are poised to deliver steady returns from high-yield payouts and resilient cash flows.

- Seize the momentum in cutting-edge industries by tapping into these 26 quantum computing stocks, which are at the forefront of breakthrough computing and transformative technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tele2 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives