With global markets responding to the recent rate cut by the U.S. Federal Reserve, European indices have shown mixed results, reflecting cautious investor sentiment. In this environment, Swedish dividend stocks present a compelling opportunity for those seeking stable income and potential growth. When evaluating dividend stocks, it's essential to consider factors such as consistent payout history, robust financial health, and resilience in varying market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.42% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.83% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.65% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.81% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.55% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.05% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.83% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.45% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.64% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.65% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

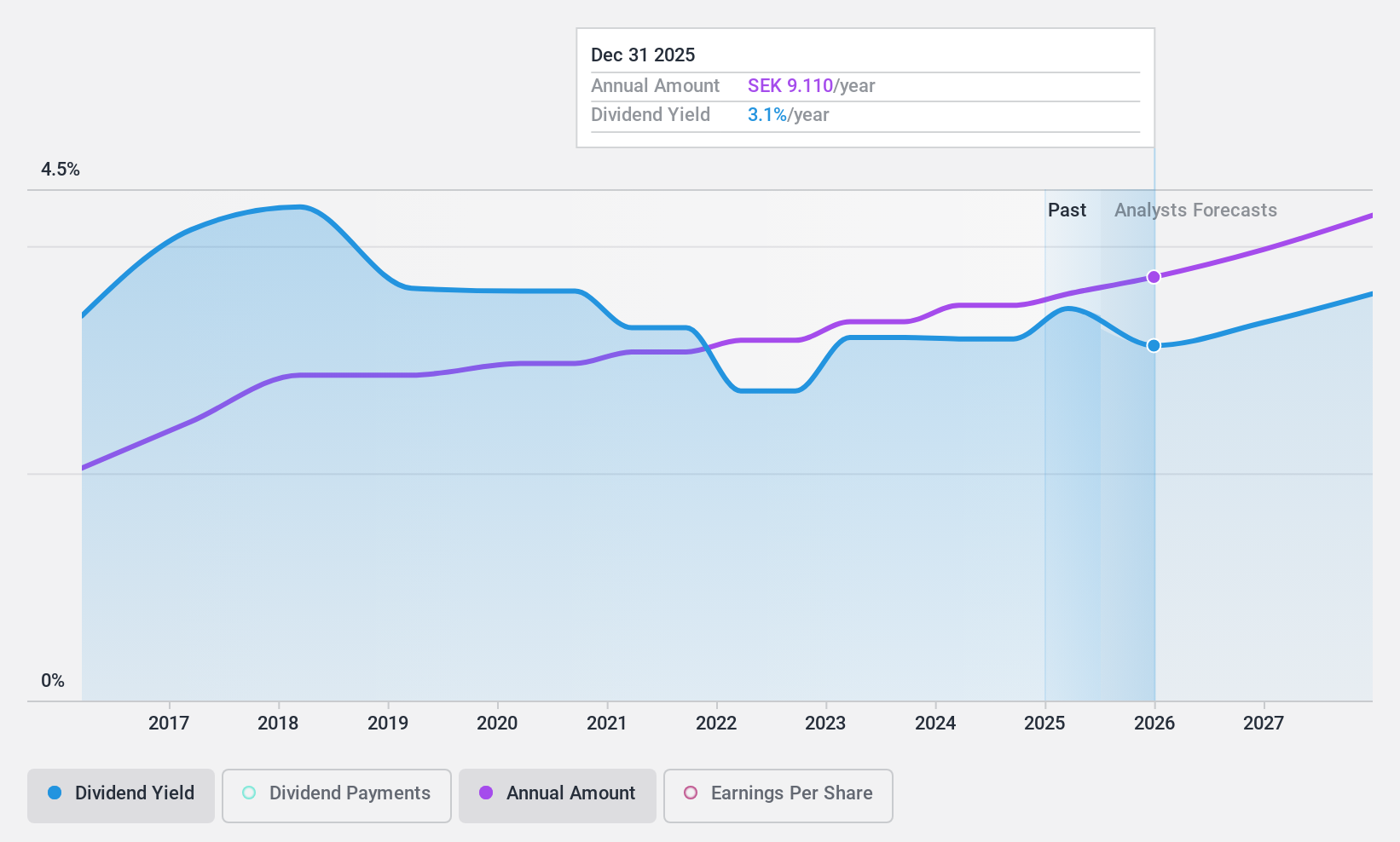

Axfood (OM:AXFO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB (publ) operates in the food retail and wholesale sectors primarily in Sweden, with a market cap of SEK60.23 billion.

Operations: Axfood AB (publ) generates revenue from several segments, including Dagab (SEK75.09 billion), Willys (SEK44.82 billion), Snabbgross (SEK5.38 billion), Joint-Group (SEK1.45 billion), and Home Purchase (SEK7.67 billion).

Dividend Yield: 3%

Axfood's dividend payments have been stable and growing over the past decade, supported by a payout ratio of 76.8% and a cash payout ratio of 39.3%, indicating strong coverage by both earnings and cash flows. Despite recent challenges, including the closure of Middagsfrid due to market conditions, Axfood continues to maintain reliable dividends with a yield of 3.05%. Recent executive changes bring experienced leadership which may influence future performance positively.

- Dive into the specifics of Axfood here with our thorough dividend report.

- The analysis detailed in our Axfood valuation report hints at an deflated share price compared to its estimated value.

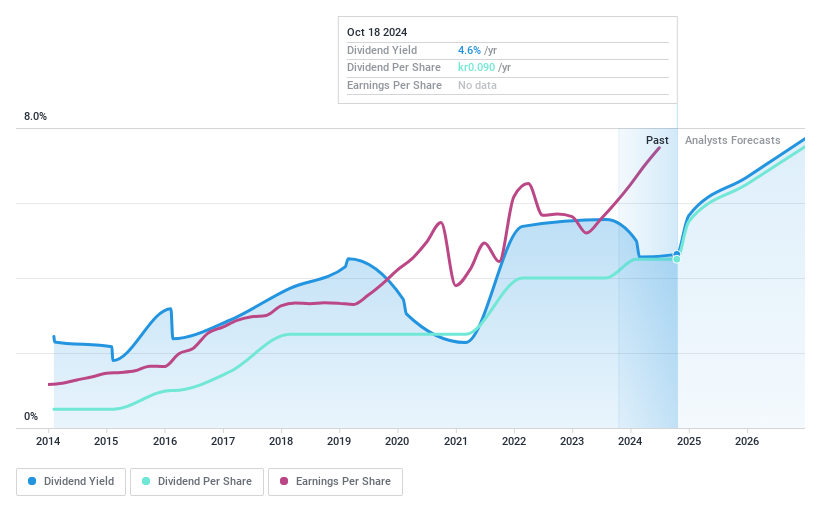

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.95 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue primarily from its National Broadband Service, amounting to SEK1.65 billion.

Dividend Yield: 4.4%

Bredband2 i Skandinavien offers a high and reliable dividend yield of 4.42%, placing it in the top 25% of Swedish dividend payers. The company's dividends are well-covered by earnings (87.6% payout ratio) and cash flows (39.1% cash payout ratio). Over the past decade, dividends have been stable and growing with minimal volatility. Recent earnings reports show strong performance, with Q2 sales at SEK 429.55 million and net income at SEK 24.35 million, indicating robust financial health supporting sustainable dividends.

- Take a closer look at Bredband2 i Skandinavien's potential here in our dividend report.

- The analysis detailed in our Bredband2 i Skandinavien valuation report hints at an inflated share price compared to its estimated value.

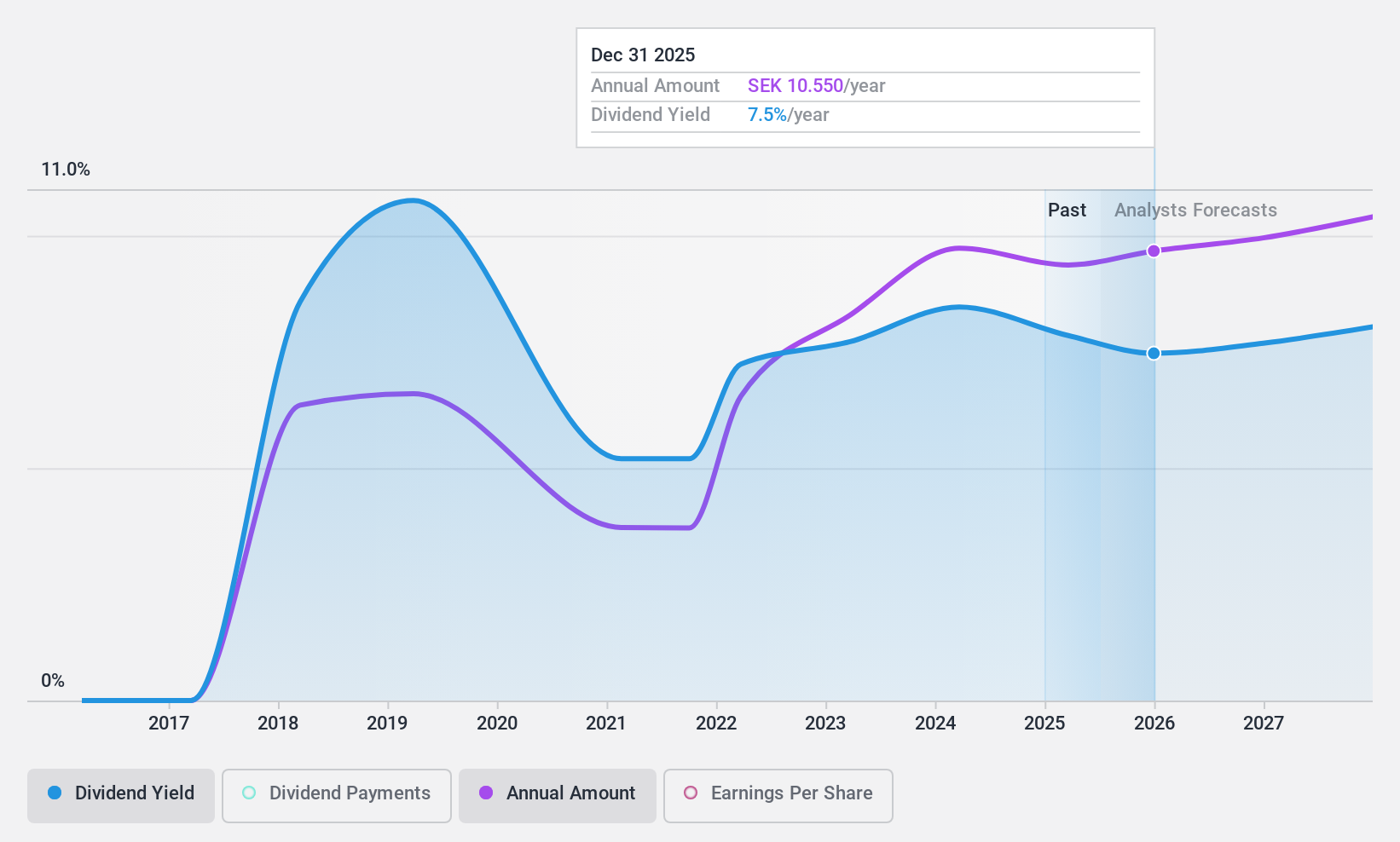

Nordea Bank Abp (OM:NDA SE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nordea Bank Abp provides a range of banking products and services across Sweden, Finland, Norway, Denmark, and internationally with a market cap of SEK421.28 billion.

Operations: Nordea Bank Abp generates revenue from several segments, including Business Banking (€3.59 billion), Personal Banking (€4.78 billion), Asset and Wealth Management (€1.44 billion), and Large Corporates & Institutions (€2.48 billion).

Dividend Yield: 8.7%

Nordea Bank Abp's dividend payments have been volatile over the past 10 years, but they are currently covered by earnings with a payout ratio of 63.8%, and are forecast to remain covered in three years at 68.6%. The stock offers a high dividend yield, placing it in the top 25% of Swedish dividend payers. Recent earnings show stable performance with net interest income for H1 2024 at EUR 3.86 billion and net income at EUR 2.66 billion.

- Unlock comprehensive insights into our analysis of Nordea Bank Abp stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Nordea Bank Abp shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 17 Top Swedish Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordea Bank Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NDA SE

Nordea Bank Abp

Offers banking products and services in Sweden, Finland, Norway, Denmark, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.