- Sweden

- /

- Paper and Forestry Products

- /

- OM:NPAPER

Swedish Exchange Showcases 3 Dividend Stocks With Yields Up To 7.8%

Reviewed by Simply Wall St

Amidst a backdrop of global economic fluctuations and varying market performances, the Swedish stock market presents unique opportunities for investors interested in stable income streams. Dividend stocks, particularly those offering high yields up to 7.8%, stand out as attractive options in the current environment where discerning investment choices are paramount.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.29% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.55% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.64% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.44% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.39% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.37% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.86% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.32% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.85% | ★★★★☆☆ |

| AB Traction (OM:TRAC B) | 3.99% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector primarily in Sweden and across Europe, with a market capitalization of approximately SEK 5.59 billion.

Operations: Bahnhof AB generates revenue primarily through two segments: the Retail Market, which contributes SEK 1.30 billion, and the Corporate Market (excluding Typhoon) with SEK 0.61 billion in sales.

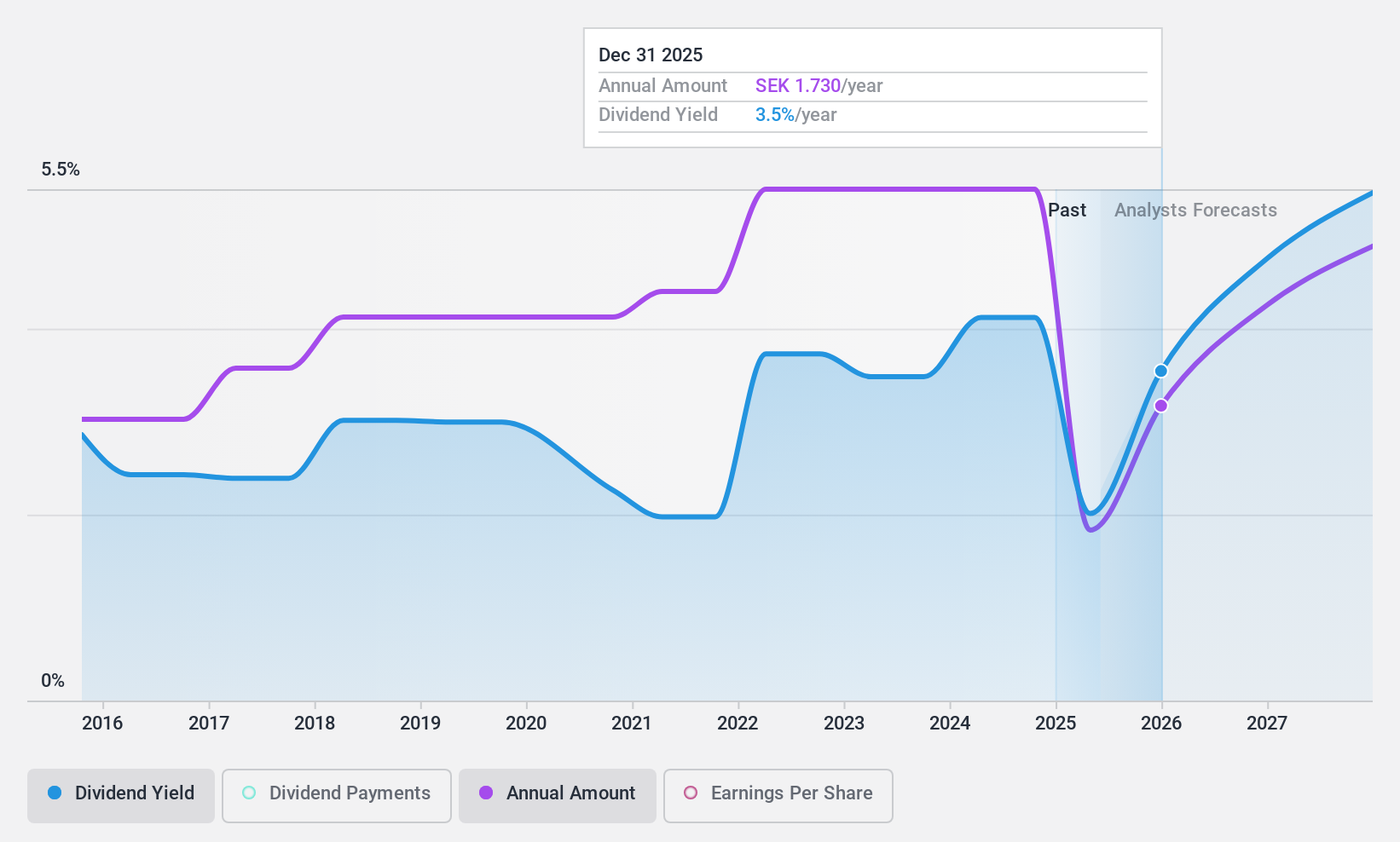

Dividend Yield: 3.8%

Bahnhof AB, trading at a 23.5% discount to its estimated fair value, offers a dividend yield of 3.85%, which is below the top quartile of Swedish dividend payers at 4.28%. Despite a track record of reliable and increasing dividends over the past decade, the sustainability is questionable with a high payout ratio of 97.5% and only 76.9% coverage by cash flows, indicating potential pressure on future payouts unless profitability improves significantly from current levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Bahnhof.

- According our valuation report, there's an indication that Bahnhof's share price might be on the expensive side.

Husqvarna (OM:HUSQ B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB, headquartered in Sweden, specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment with a market capitalization of approximately SEK 51.71 billion.

Operations: Husqvarna AB generates revenue through three primary segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

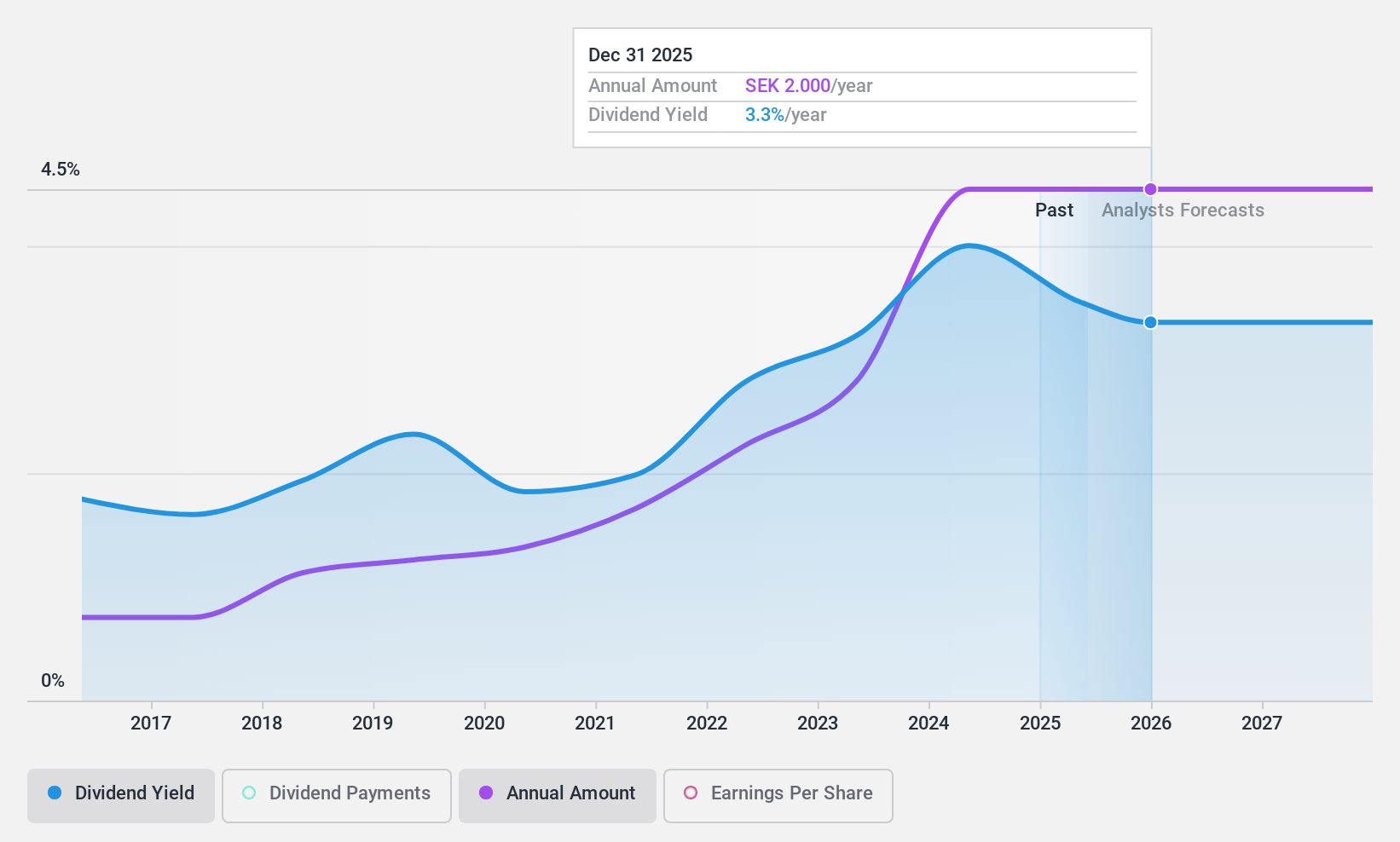

Dividend Yield: 3.3%

Husqvarna maintains a 10-year history of stable and growing dividends, currently at a 3.3% yield, below the Swedish market's top quartile. Despite its consistent dividend history, coverage issues persist with a high payout ratio of 92.8%, though cash flows cover 58.6% of distributions. Recent partnership with Liverpool FC could enhance global brand visibility, potentially impacting future financial stability positively. However, recent quarterly reports show declining earnings and sales, signaling potential challenges ahead in maintaining dividend growth.

- Delve into the full analysis dividend report here for a deeper understanding of Husqvarna.

- According our valuation report, there's an indication that Husqvarna's share price might be on the cheaper side.

Nordic Paper Holding (OM:NPAPER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates in the production and sale of natural greaseproof and kraft paper across Sweden, Italy, Germany, other parts of Europe, the United States, and internationally, with a market capitalization of approximately SEK 3.39 billion.

Operations: Nordic Paper Holding AB generates revenue primarily through two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper, contributing SEK 2.19 billion.

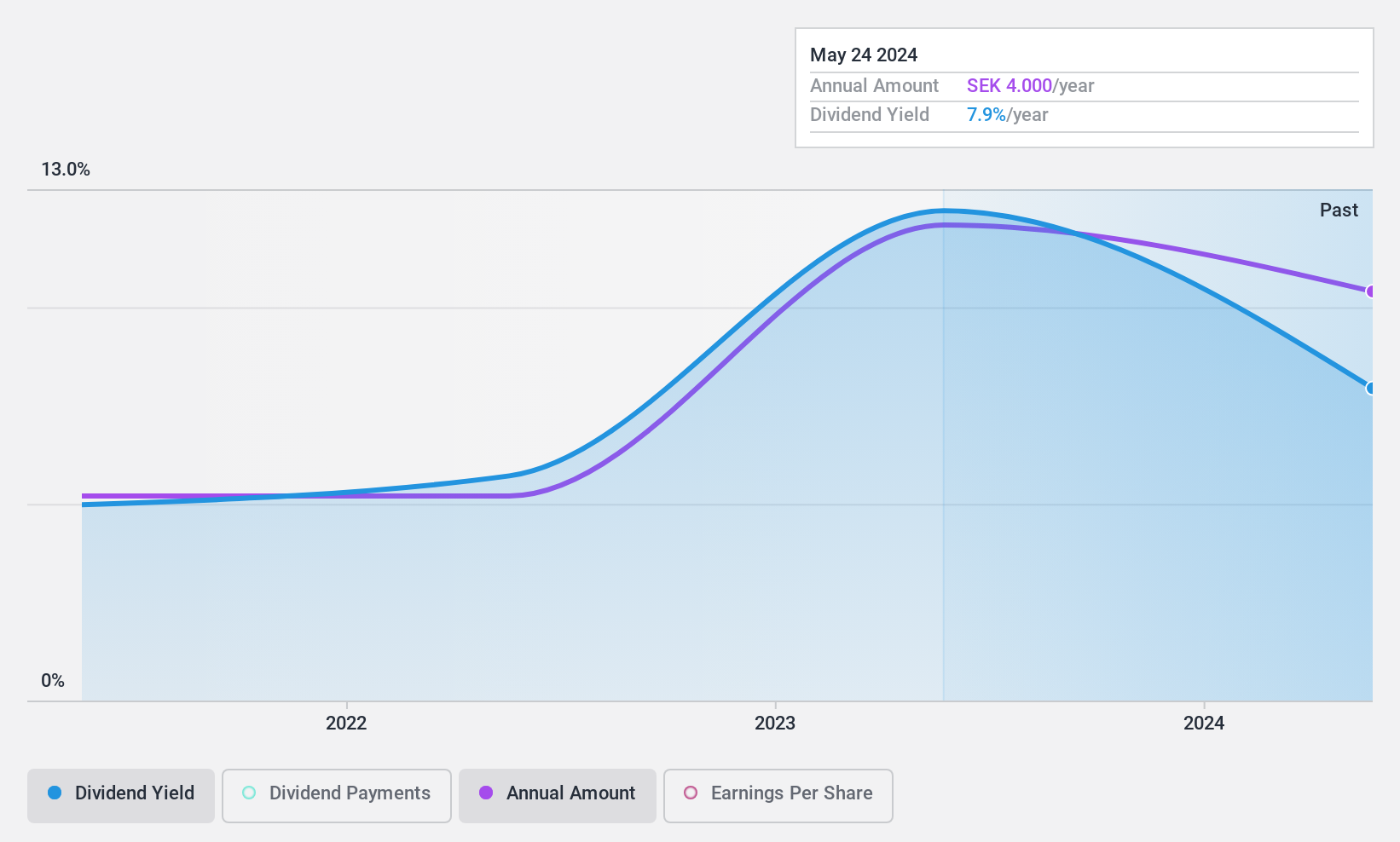

Dividend Yield: 7.9%

Nordic Paper Holding's recent dividend announcement of SEK 4 per share reflects a cautious approach amid a slight decline in Q1 2024 earnings and sales, with net income dropping to SEK 149 million from SEK 173 million year-over-year. Despite trading at significant undervaluation and maintaining dividends covered by both earnings (68.3% payout ratio) and cash flows (78% cash payout ratio), the company's short, unstable dividend history and high debt levels present risks. The appointment of KPMG as auditor may signal a strengthening of financial oversight.

- Click to explore a detailed breakdown of our findings in Nordic Paper Holding's dividend report.

- Upon reviewing our latest valuation report, Nordic Paper Holding's share price might be too pessimistic.

Key Takeaways

- Click here to access our complete index of 20 Top Swedish Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Paper Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NPAPER

Nordic Paper Holding

Engages in the production and sale of natural greaseproof and kraft paper in Sweden, Italy, Germany, the United Kingdom, rest of Europe, the United States, and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives