- Norway

- /

- Specialty Stores

- /

- OB:KID

Exploring Undiscovered European Gems This July 2025

Reviewed by Simply Wall St

As European markets experience a modest upswing, buoyed by German economic stimulus and easing trade tensions, the pan-European STOXX Europe 600 Index has risen by 1.32%, signaling a positive shift in investor sentiment. Amidst this backdrop of cautious optimism, identifying promising small-cap stocks in the region becomes increasingly relevant for investors seeking opportunities beyond the mainstream indices. In such an environment, a good stock is often characterized by strong fundamentals and growth potential that align with broader economic trends and regional developments.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Kid (OB:KID)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kid ASA, along with its subsidiaries, is a home textile retailer operating in Norway, Sweden, Finland, and Estonia with a market capitalization of NOK6.32 billion.

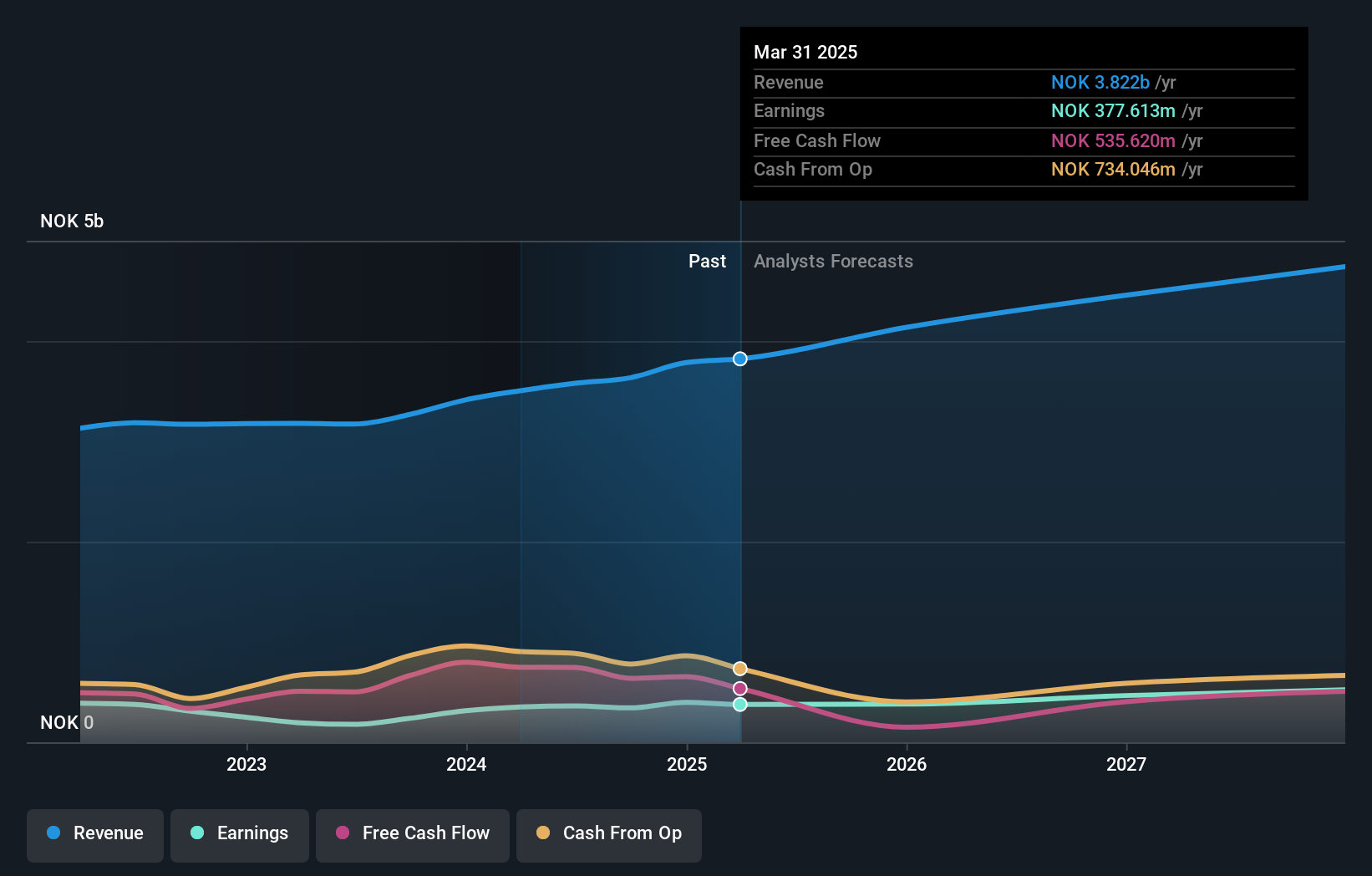

Operations: Kid ASA generates revenue primarily through its Hemtex and KID Interior segments, with revenues of NOK1.47 billion and NOK2.35 billion, respectively.

Kid ASA, a home textile retailer, is carving out its niche in the Nordic market with strategic investments in e-commerce and store expansions. The company's earnings growth of 7.5% last year outpaced the Specialty Retail industry average of -2.4%. Kid's debt to equity ratio has improved from 53.5% to 44.9% over five years, reflecting prudent financial management. Despite a net loss of NOK 30 million in Q1 2025, revenues climbed to NOK 734 million from NOK 697 million year-on-year. Trading at nearly 30% below fair value estimates suggests potential upside for investors seeking undervalued opportunities in this sector.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market capitalization of SEK6.49 billion.

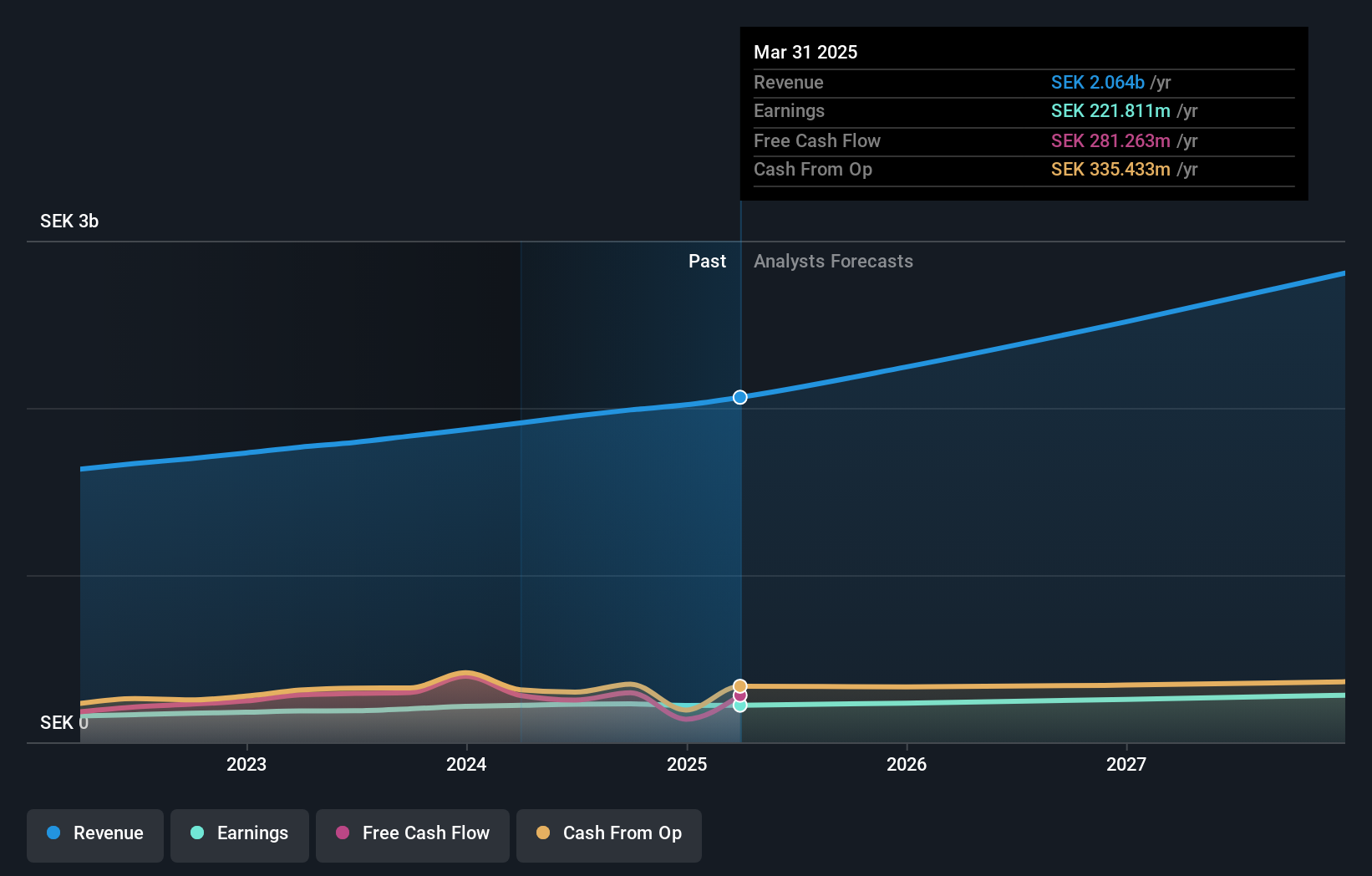

Operations: Bahnhof AB generates revenue primarily from its Retail Market segment, contributing SEK1.42 billion, and its Corporate Market segment (excluding Typhoon), which adds SEK639.39 million. The company operates with a focus on these key segments to drive its financial performance.

Bahnhof, a promising player in the European telecom sector, has shown consistent performance with earnings growing 13.5% annually over the past five years. Trading at 26.8% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company reported first-quarter sales of SEK 536 million, up from SEK 491 million last year, and net income rose to SEK 57.75 million from SEK 56.17 million previously. With no debt on its books and high-quality earnings, Bahnhof stands out as a financially sound entity in an industry where it slightly lags behind peers in annual growth rates but remains robust overall.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm focusing on various stages of venture and growth investments, with a market cap of SEK10.18 billion.

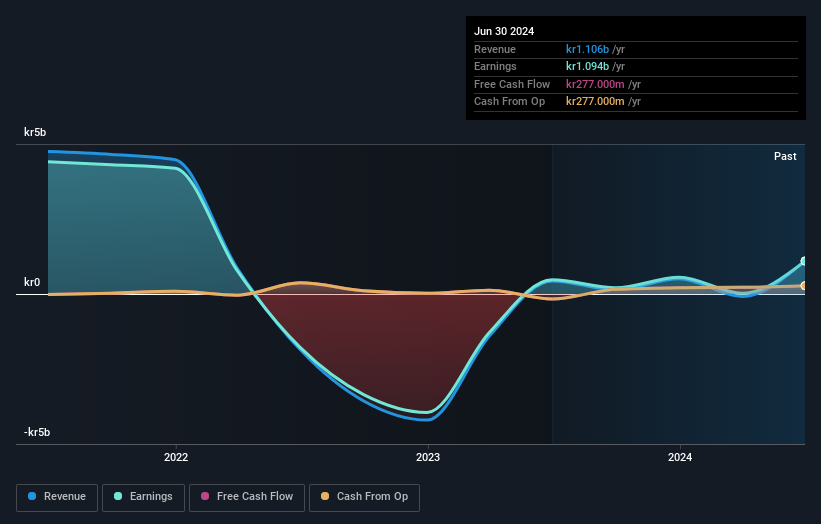

Operations: Creades AB generates revenue primarily from its investments in online retailers, amounting to SEK1.55 billion.

Creades, a nimble player in the financial sector, has shown remarkable earnings growth of 5812% over the past year, outpacing its industry peers. The company reported a turnaround in Q1 2025 with revenue hitting SEK 195 million from negative figures previously and net income soaring to SEK 178 million. Its price-to-earnings ratio stands attractively at 7.2x against the Swedish market's average of 23.1x. With no debt on its books for five years and high-quality earnings, Creades seems well-positioned despite historical declines in annual earnings by about 24%.

- Delve into the full analysis health report here for a deeper understanding of Creades.

Review our historical performance report to gain insights into Creades''s past performance.

Taking Advantage

- Reveal the 334 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KID

Kid

Operates as a home textile retailer in Norway, Sweden, Finland, and Estonia.

Solid track record and good value.

Market Insights

Community Narratives