Amid a backdrop of fluctuating global markets, Sweden's economy continues to attract attention for its resilience and potential growth opportunities. As investors navigate through the complexities of mixed economic signals worldwide, Swedish dividend stocks emerge as a noteworthy consideration for those seeking steady income streams in uncertain times. In this context, understanding the fundamentals that underpin strong dividend stocks—such as stable earnings, solid financial health, and a history of consistent payouts—is crucial. These attributes align well with current market conditions where prudent investment choices are paramount.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.13% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.18% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.27% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.17% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.11% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.71% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.11% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.61% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.28% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.55% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Axfood (OM:AXFO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB operates primarily in Sweden, focusing on food retail and wholesale, with a market capitalization of approximately SEK 58.93 billion.

Operations: Axfood AB's revenue is segmented into Dagab at SEK 74.94 billion, Willys at SEK 44.54 billion, Home Purchase at SEK 7.57 billion, and Snabbgross at SEK 5.35 billion.

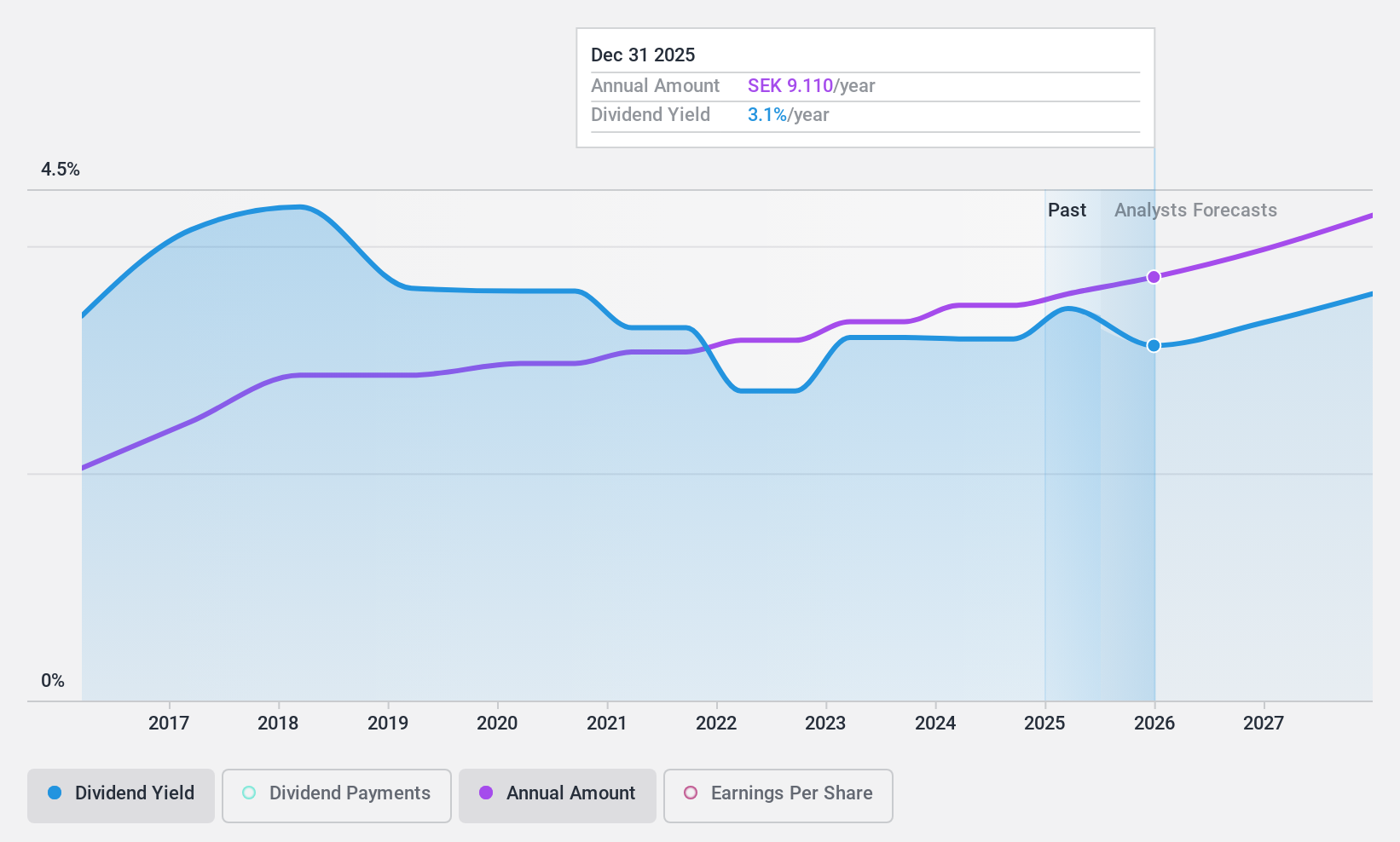

Dividend Yield: 3.1%

Axfood maintains a stable dividend yield of 3.11%, supported by a solid payout ratio of 75.1% from earnings and a comfortable cash payout ratio of 34.8%. Despite consistent growth in dividends over the last decade, its dividend yield remains modest compared to the top quartile of Swedish dividend stocks at 4.2%. Recent leadership changes, including Simone Margulies' appointment as CEO effective August 15, 2024, alongside strategic acquisitions like City Gross Sverige AB, could influence future financial stability and growth prospects.

- Click to explore a detailed breakdown of our findings in Axfood's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Axfood shares in the market.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB operates in the internet and telecommunications sector primarily in Sweden and across Europe, with a market capitalization of approximately SEK 5.43 billion.

Operations: Bahnhof AB generates revenue through its operations in the retail market, which brought in SEK 1.30 billion, and the corporate market (excluding Typhoon), contributing SEK 606.24 million.

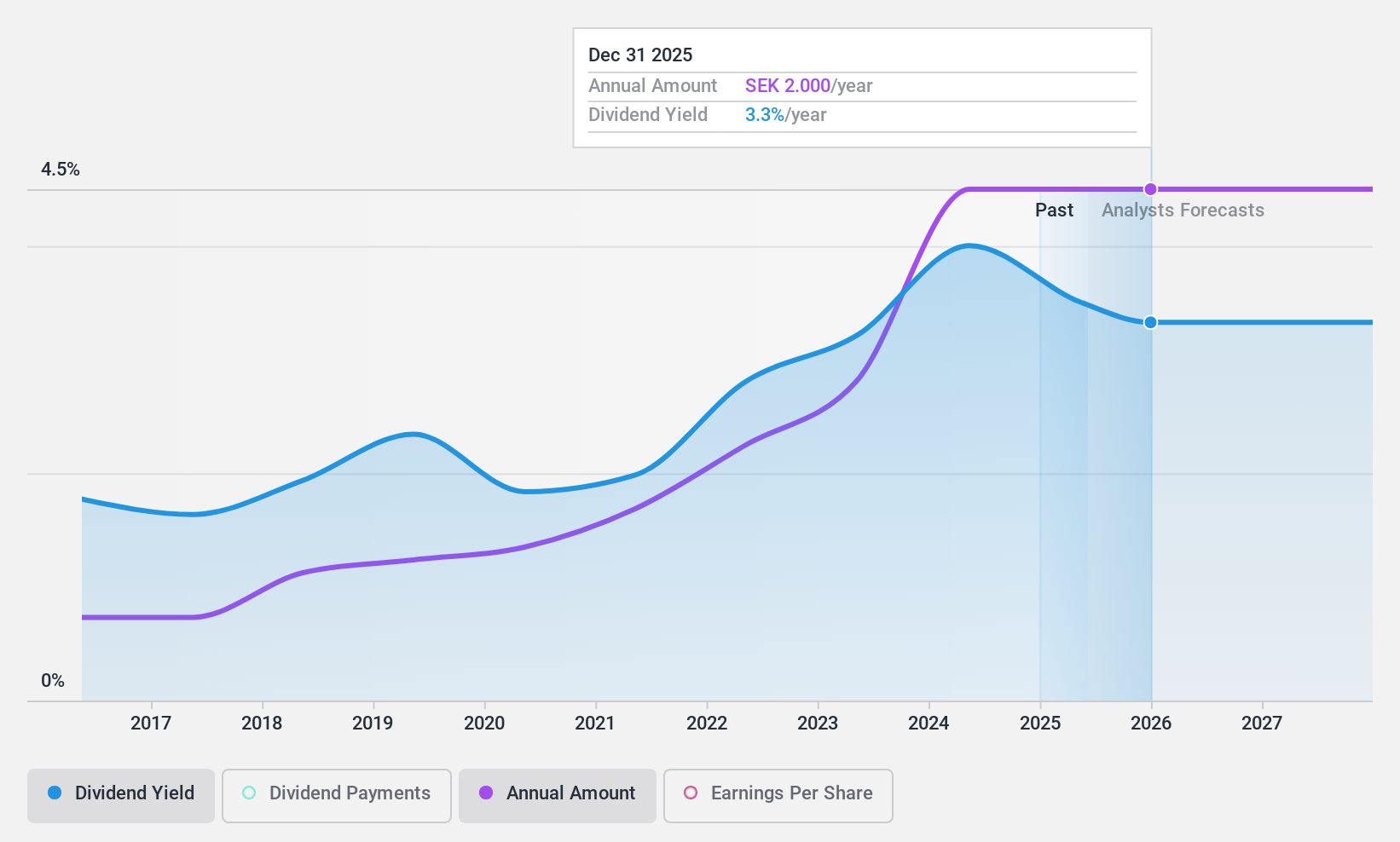

Dividend Yield: 4%

Bahnhof AB's recent earnings show a revenue increase to SEK 491.38 million and net income up to SEK 56.17 million, reflecting a growth of 17.7% over the past year. Despite this, its dividend yield of 3.96% remains below the Swedish market's top quartile at 4.2%. The dividend coverage is problematic with a high payout ratio of 97.5%, indicating that dividends are not well-covered by earnings, posing risks to sustainability despite a decade of reliable payments.

- Delve into the full analysis dividend report here for a deeper understanding of Bahnhof.

- Our valuation report unveils the possibility Bahnhof's shares may be trading at a discount.

Husqvarna (OM:HUSQ B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB (publ) specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 51.27 billion.

Operations: Husqvarna AB generates revenue primarily through three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

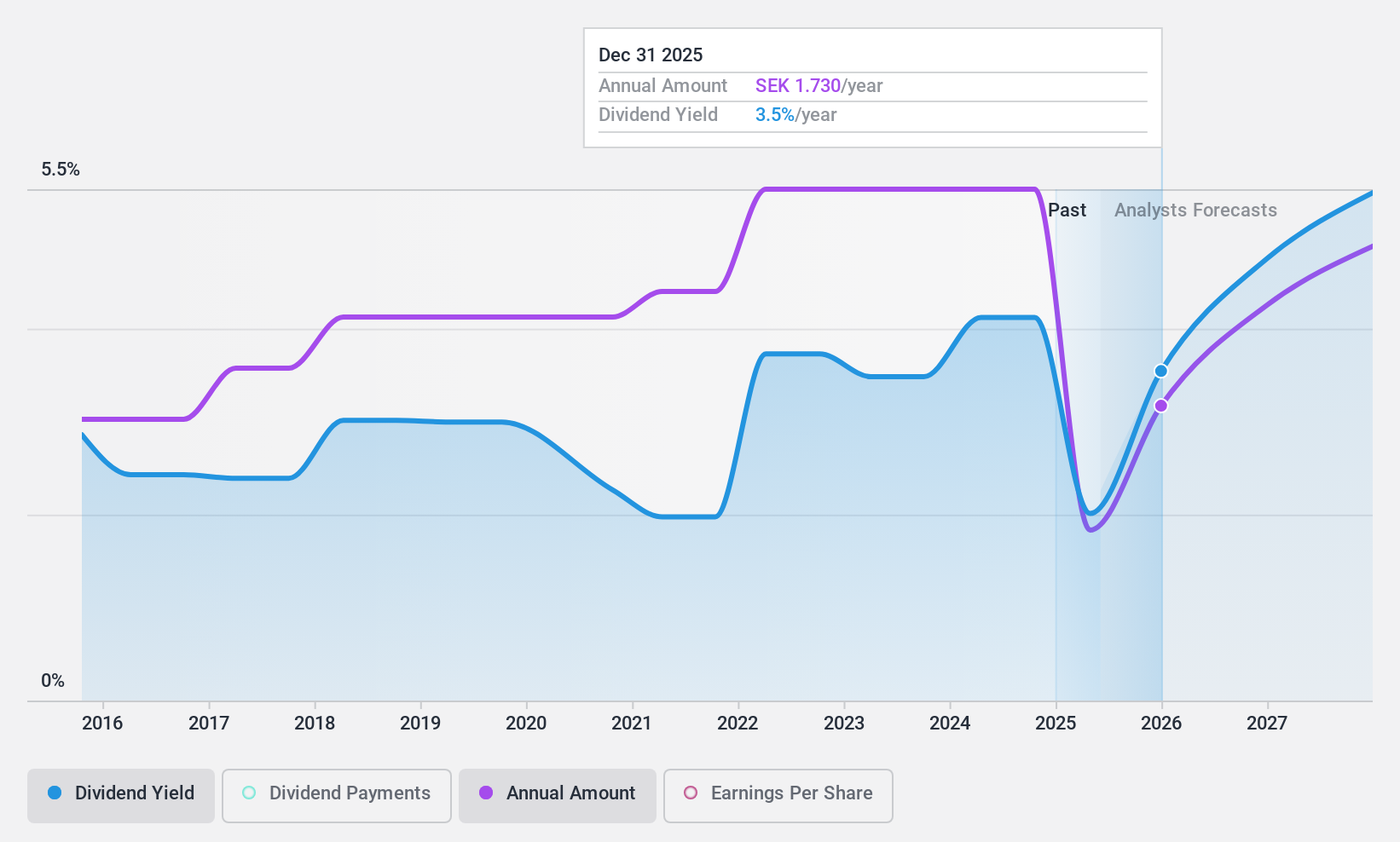

Dividend Yield: 3.3%

Husqvarna AB's financial performance has seen a decline, with Q1 2024 sales dropping to SEK 14.72 billion from SEK 17.17 billion the previous year, and net income falling to SEK 1.32 billion from SEK 1.65 billion. Despite this downturn, the company maintains a dividend of SEK 3.00 per share for the year, distributed in two installments. However, its high payout ratio of 92.8% suggests dividends are not well covered by earnings, raising concerns about sustainability despite a stable dividend history over the past decade and reasonable cash flow coverage with a cash payout ratio of 58.6%.

- Get an in-depth perspective on Husqvarna's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Husqvarna is trading behind its estimated value.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 21 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Husqvarna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUSQ B

Husqvarna

Produces and sells outdoor power products, watering products, and lawn care power equipment.

Flawless balance sheet established dividend payer.