- Sweden

- /

- Electronic Equipment and Components

- /

- OM:UNIBAP

Unibap Space Solutions AB (publ) (STO:UNIBAP) Looks Just Right With A 27% Price Jump

Unibap Space Solutions AB (publ) (STO:UNIBAP) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last month tops off a massive increase of 173% in the last year.

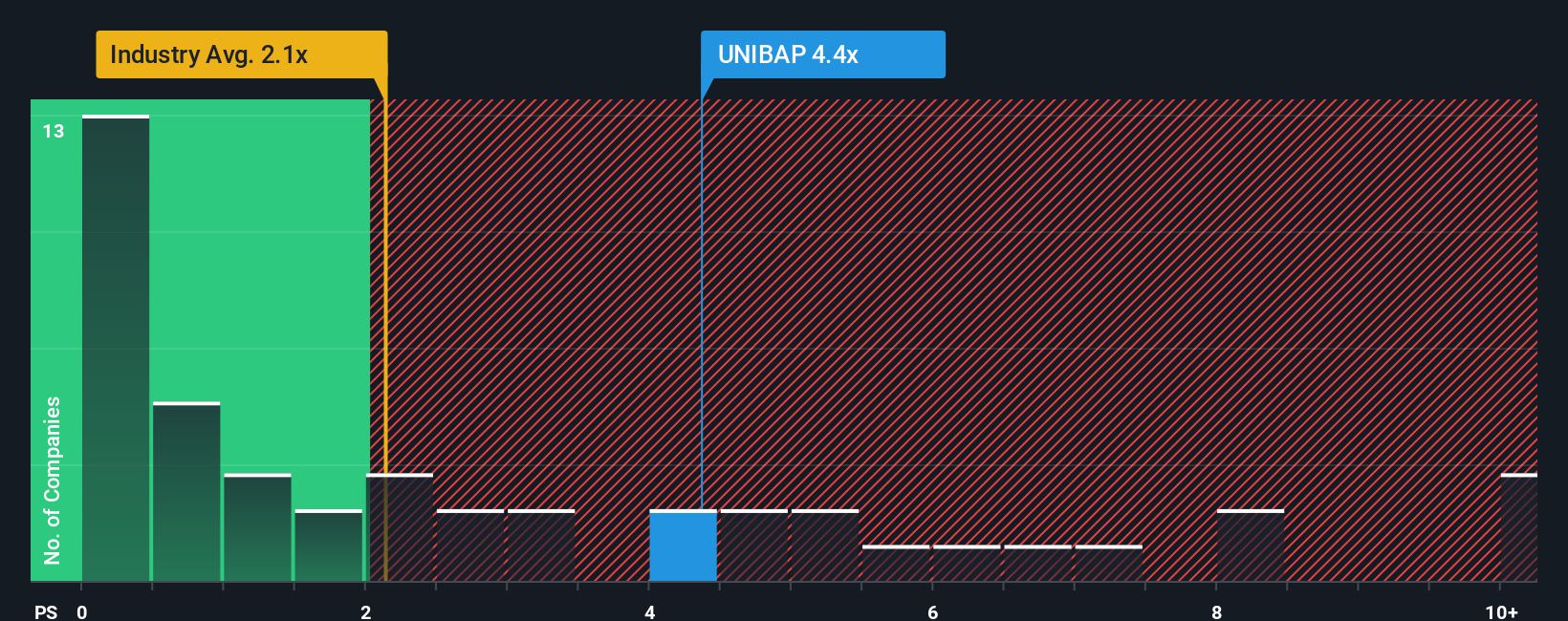

Following the firm bounce in price, given around half the companies in Sweden's Electronic industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Unibap Space Solutions as a stock to avoid entirely with its 4.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Unibap Space Solutions

What Does Unibap Space Solutions' P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Unibap Space Solutions' revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Unibap Space Solutions' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Unibap Space Solutions?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Unibap Space Solutions' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 232% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 5.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Unibap Space Solutions is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Unibap Space Solutions' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Unibap Space Solutions maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Unibap Space Solutions (1 is significant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:UNIBAP

Unibap Space Solutions

Develops, produces, and sells computing hardware, software, and services for space missions in Sweden.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success