- Sweden

- /

- Tech Hardware

- /

- OM:TOBII

Risks Still Elevated At These Prices As Tobii AB (publ) (STO:TOBII) Shares Dive 35%

To the annoyance of some shareholders, Tobii AB (publ) (STO:TOBII) shares are down a considerable 35% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

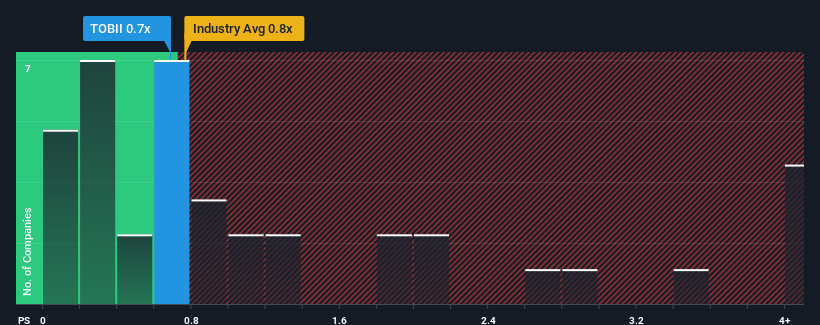

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Tobii's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Tech industry in Sweden is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tobii

How Has Tobii Performed Recently?

Recent times haven't been great for Tobii as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Tobii will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Tobii's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 48% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.8% as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to expand by 2.1%, which paints a poor picture.

In light of this, it's somewhat alarming that Tobii's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Tobii's P/S Mean For Investors?

Tobii's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Tobii currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Tobii that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tobii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TOBII

Tobii

Develops and sells eye-tracking technology and solutions in Sweden, Europe, Middle East, Africa, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026