- Sweden

- /

- Communications

- /

- OM:TAGM B

TagMaster AB (publ)'s (STO:TAGM B) 26% Dip In Price Shows Sentiment Is Matching Revenues

The TagMaster AB (publ) (STO:TAGM B) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

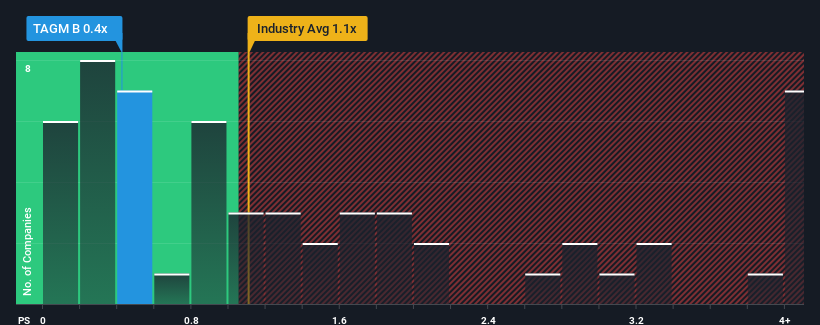

After such a large drop in price, TagMaster's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Communications industry in Sweden, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for TagMaster

What Does TagMaster's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, TagMaster has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TagMaster.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like TagMaster's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.9% last year. The latest three year period has also seen an excellent 32% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 4.2% over the next year. Meanwhile, the broader industry is forecast to expand by 4.4%, which paints a poor picture.

With this information, we are not surprised that TagMaster is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On TagMaster's P/S

TagMaster's recently weak share price has pulled its P/S back below other Communications companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that TagMaster's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, TagMaster's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for TagMaster that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TagMaster might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TAGM B

TagMaster

An application oriented technical company, develops and sells advanced sensor systems and solutions based on radio, radar, magnetic and camera technologies under the TagMaster, Sensys Networks, and Citilog brand names.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion