- Sweden

- /

- Communications

- /

- OM:TAGM B

Positive Sentiment Still Eludes TagMaster AB (publ) (STO:TAGM B) Following 31% Share Price Slump

TagMaster AB (publ) (STO:TAGM B) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

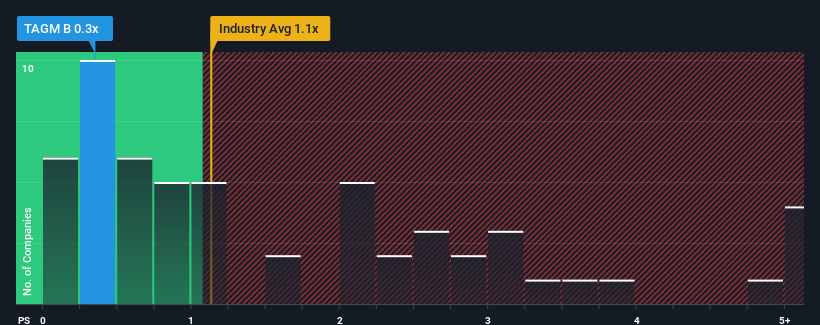

Although its price has dipped substantially, when close to half the companies operating in Sweden's Communications industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider TagMaster as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Our free stock report includes 4 warning signs investors should be aware of before investing in TagMaster. Read for free now.See our latest analysis for TagMaster

What Does TagMaster's Recent Performance Look Like?

TagMaster certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on TagMaster will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think TagMaster's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For TagMaster?

TagMaster's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 3.2% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 27% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.1%, which is noticeably less attractive.

With this information, we find it odd that TagMaster is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of TagMaster's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at TagMaster's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for TagMaster that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TagMaster might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TAGM B

TagMaster

An application oriented technical company, develops and sells advanced sensor systems and solutions based on radio, radar, magnetic and camera technologies under the TagMaster, Sensys Networks, and Citilog brand names.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives