NCAB Group (OM:NCAB) Valuation in Focus Following Q3 Earnings Growth and Market Reaction

Reviewed by Simply Wall St

NCAB Group (OM:NCAB) just released its third quarter and nine-month earnings update. This gives investors a clearer picture of the company’s performance and direction after reporting growth in quarterly sales, revenue, and net income.

See our latest analysis for NCAB Group.

Shares of NCAB Group have rallied strongly in recent weeks, with a 17.99% 1-month share price return following its upbeat quarterly results. This has built positive momentum even as the year-to-date share price remains down. While the 1-year total shareholder return is -11.16%, the longer-term story looks much brighter. Over five years, there has been a 146.8% total return, reflecting sustained growth for patient investors.

If this rebound has you thinking about where else growth and strong ownership might intersect, now is a great moment to discover fast growing stocks with high insider ownership

With strong quarterly results driving recent gains, the question now is whether NCAB Group’s shares are still trading at an attractive valuation or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 5.6% Overvalued

NCAB Group’s last close of SEK 58.10 sits above the narrative fair value estimate, hinting the market may be pricing in more optimism than analysts project. The following perspective gives insight into the assumptions behind this valuation stance.

Ongoing shift towards high-value, complex, and engineering-supported PCB applications (especially in segments like aerospace, defense, and high-tech) is resulting in higher-margin business and better gross margin resilience. This occurs even as standard product pricing remains under pressure. The accelerating adoption of digitalization, IoT, and electrification across industrial, transportation, and telecom sectors underpins sustained future demand for advanced PCBs, expanding NCAB's addressable market and supporting long-term organic revenue growth.

Curious about the math and market dynamics that lead to this valuation? The narrative hinges on NCAB making big strides in its product mix, sector growth, and strong profit momentum. What surprising forecasts and bold financial assumptions do analysts use to reach their price target? Find out how these key numbers combine to shape the fair value story.

Result: Fair Value of $55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent foreign exchange volatility and ongoing supply chain risks could present challenges to NCAB Group's profitability outlook and test the strength of its growth narrative.

Find out about the key risks to this NCAB Group narrative.

Another View: Testing the Valuation from a Different Angle

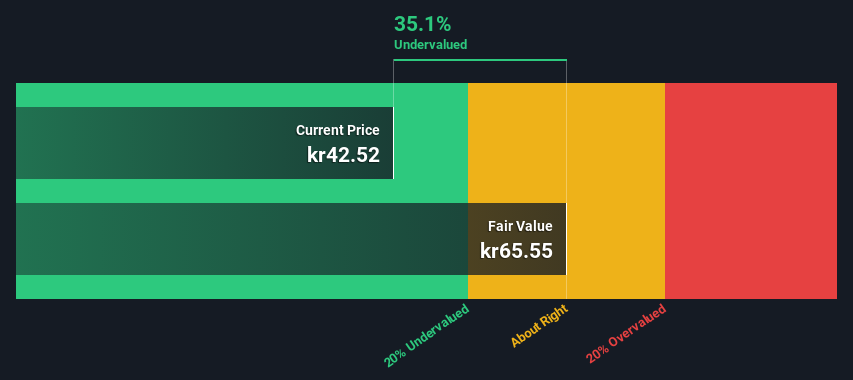

While the first valuation suggests NCAB Group may be overvalued, our SWS DCF model offers a different perspective. This approach indicates NCAB is currently trading below its estimated fair value, which could point to an opportunity if the assumptions behind the cash flow projections prove accurate. Does this split verdict suggest the market is underestimating NCAB’s long-term prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NCAB Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NCAB Group Narrative

If you want to chart your own path or take a hands-on approach with the data, you can independently craft your own story for NCAB Group in under three minutes. Do it your way

A great starting point for your NCAB Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for fresh opportunities. Don’t let potential winners slip by when you can target breakthrough themes and long-term value today. Here are three standout ways to take action right now:

- Unlock affordable market entrants and spot hidden potential by checking out these 3586 penny stocks with strong financials, which deliver standout balance sheets and growth traction.

- Position your portfolio for innovation by tapping into these 26 AI penny stocks, shaping the next wave of artificial intelligence solutions.

- Secure your path to value with these 856 undervalued stocks based on cash flows, featuring companies priced for upside based on robust future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCAB

NCAB Group

Engages in the manufacture and sale of printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives