Shareholders May Be More Conservative With Mycronic AB (publ)'s (STO:MYCR) CEO Compensation For Now

Key Insights

- Mycronic to hold its Annual General Meeting on 8th of May

- Total pay for CEO Anders Lindqvist includes kr6.70m salary

- Total compensation is 49% above industry average

- Mycronic's total shareholder return over the past three years was 61% while its EPS grew by 8.6% over the past three years

Performance at Mycronic AB (publ) (STO:MYCR) has been reasonably good and CEO Anders Lindqvist has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 8th of May. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Mycronic

Comparing Mycronic AB (publ)'s CEO Compensation With The Industry

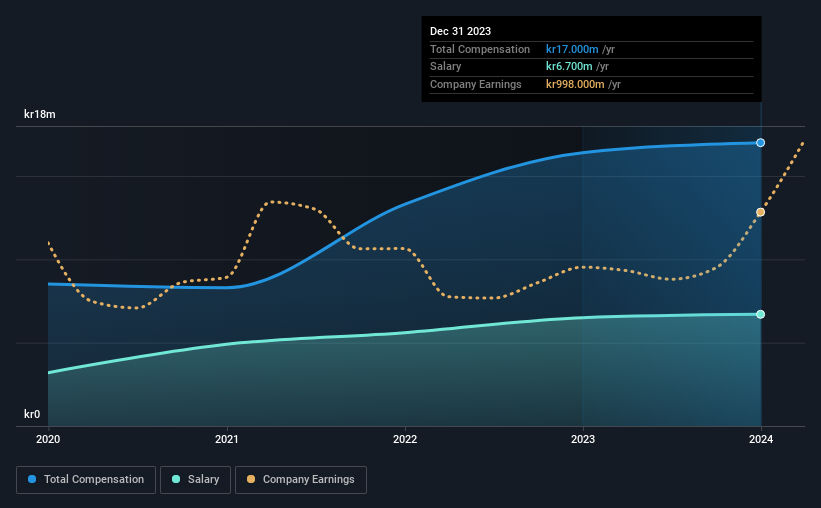

Our data indicates that Mycronic AB (publ) has a market capitalization of kr38b, and total annual CEO compensation was reported as kr17m for the year to December 2023. That's a fairly small increase of 3.7% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at kr6.7m.

For comparison, other companies in the Swedish Electronic industry with market capitalizations ranging between kr22b and kr70b had a median total CEO compensation of kr11m. This suggests that Anders Lindqvist is paid more than the median for the industry. What's more, Anders Lindqvist holds kr6.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr6.7m | kr6.5m | 39% |

| Other | kr10m | kr9.9m | 61% |

| Total Compensation | kr17m | kr16m | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. Mycronic pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Mycronic AB (publ)'s Growth

Over the past three years, Mycronic AB (publ) has seen its earnings per share (EPS) grow by 8.6% per year. Its revenue is up 19% over the last year.

We would argue that the modest growth in revenue is a notable positive. And the modest growth in EPS isn't bad, either. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Mycronic AB (publ) Been A Good Investment?

Boasting a total shareholder return of 61% over three years, Mycronic AB (publ) has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Mycronic that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MYCR

Mycronic

Develops, manufactures, and sells production equipment for electronics industry in Sweden, rest of Europe, the United States, other Americas, China, South Korea, rest of Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success