Mycronic (OM:MYCR) Net Margin Hits 24.5%, Surpassing Bullish Market Expectations

Reviewed by Simply Wall St

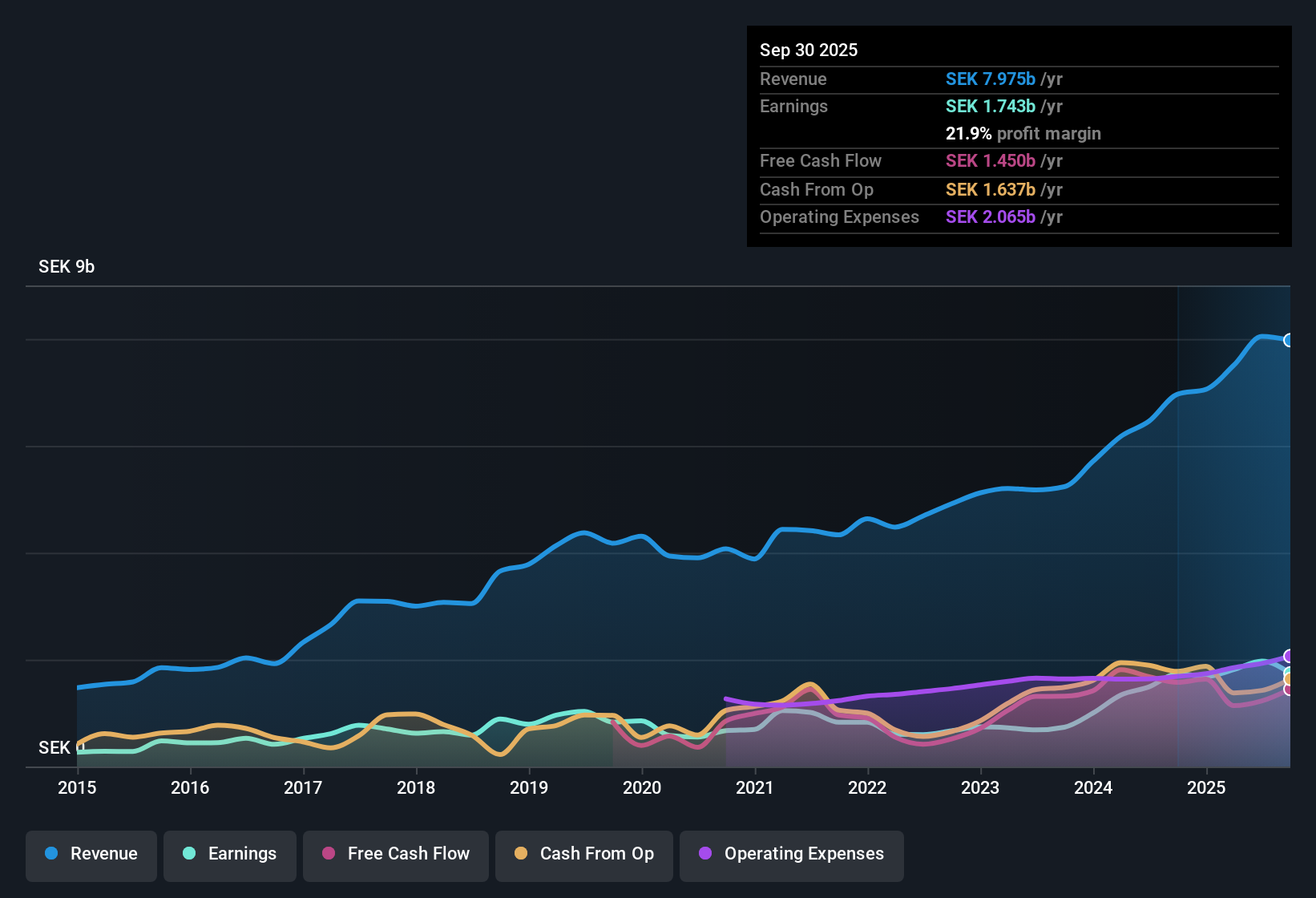

Mycronic (OM:MYCR) delivered a net profit margin of 24.5%, surpassing last year’s 23.1%, while earnings are forecast to climb by 8.44% per year. Revenue is projected to rise 4.1% annually, ahead of the Swedish market’s expected 3.6%. Over the last five years, the company’s earnings have grown by an impressive 22.5% annually, with the most recent year showing 32.5% earnings growth, easily topping the five-year average. The stock is trading at a 20.8x price-to-earnings ratio, which is well below industry peers. Investors are seeing a strong mix of accelerating profit growth, expanding margins, and compelling valuation metrics.

See our full analysis for Mycronic.Let’s take these latest earnings and put them side by side with the most widely discussed narratives about Mycronic. It is here that consensus may be confirmed or start to shift.

See what the community is saying about Mycronic

Margins Widen Despite Cost Challenges

- Net profit margin reached 24.5%, above last year’s 23.1%, reflecting strong operational leverage even as earnings forecasts suggest profit margins may shrink to 21.2% within three years.

- Analysts' consensus view holds that margins remain resilient, despite short-term pressures from tariffs and weaker demand in the High Flex division.

- Consensus narrative points to the High Flex division’s exposure to new tariffs in the U.S., which delayed deliveries and trimmed quarterly earnings by SEK 15 million. At the same time, core business units are noted for sustaining overall margin expansion.

- Analysts also note that continued R&D investments and successful product launches, like the Prexision 8000 Evo, may offset some of the near-term cost pressures and support future margin quality.

- What’s unexpected: net margin growth occurs against a backdrop of anticipated margin pressure, suggesting Mycronic’s operating model is adapting faster than consensus expects.

- See how analysts are debating whether Mycronic's margin expansion can last in the full consensus narrative. 📊 Read the full Mycronic Consensus Narrative.

Tech Investments Drive Revenue Mix

- Mycronic’s acquisitions and new technology launches are reshaping the revenue split, with moves like the purchase of Hprobe and RoBAT expected to strengthen the Global Technologies division and boost medium-term sales.

- Analysts' consensus view highlights that strategic expansion, especially into Southeast Asia and new product innovations in Pattern Generators, underpins long-term revenue growth potential but adds execution risk.

- Consensus narrative flags the company’s R&D focus and order pipeline in China as immediate drivers. At the same time, overall revenue growth guidance of 4.1% annually remains only modestly above the Swedish market average.

- Analysts are weighing the impact of market and currency volatility, especially in historically volatile segments like High Flex, as potential brakes on the full revenue benefit.

Valuation Still Trails Industry Peers

- Mycronic trades at a 20.8x price-to-earnings multiple, undercutting the European electronic industry’s 25.5x average and the direct peer group at 31.9x. This suggests the stock is priced at a relative discount.

- Analysts' consensus view contends that the current share price of 209.45 is only slightly below their average price target of 208.33, framing Mycronic as fairly valued but with some upside if the firm maintains recent growth and margin trends.

- Consensus narrative calls out that the analyst price target is just 0.5% above the current share price, which may signal muted expectations or confidence in the company’s steady financial trajectory.

- Observers are looking for evidence such as sustained high margins or surprise order growth that could push the valuation premium closer to peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mycronic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Share your angle and put together your own narrative in minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mycronic.

See What Else Is Out There

Despite robust margin expansion, Mycronic's long-term revenue projections hover only slightly above the market average, and volatile segments could constrain consistent performance.

If you want steadier prospects, check out stable growth stocks screener (2090 results) to focus on companies with a proven record of delivering reliable results across all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MYCR

Mycronic

Develops, manufactures, and sells production equipment for electronics industry in Sweden, rest of Europe, the United States, other Americas, China, South Korea, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives