As European markets face fluctuations amid global tensions and economic uncertainties, the pan-European STOXX Europe 600 Index recently saw a decline of 1.54%, reflecting broader concerns impacting investor sentiment. In this environment, identifying high growth tech stocks requires a focus on companies with robust innovation capabilities and adaptability to shifting market dynamics, which can potentially offer resilience in times of volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| Innate Pharma | 22.84% | 41.22% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

74Software (ENXTPA:74SW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: 74Software is a French software company with a market capitalization of approximately €1.11 billion.

Operations: 74Software generates revenue primarily from four segments: Subscription (€215.30 million), Maintenance (€68.40 million), Services excluding Subscription (€35.82 million), and License (€10.24 million).

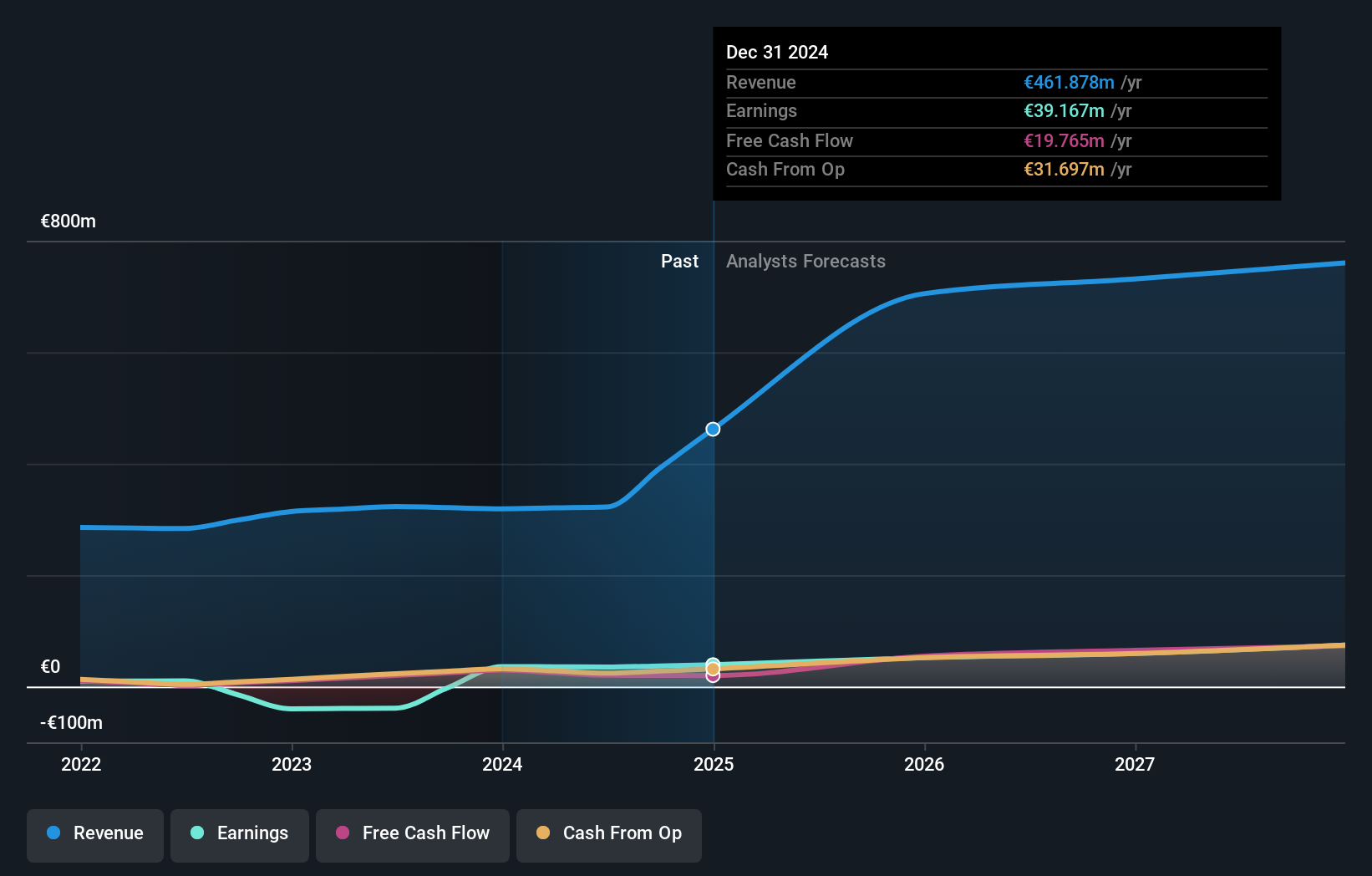

74Software, in the competitive landscape of European tech, demonstrates robust financial health with a notable annual revenue growth forecast at 11.4%, outpacing the French market's 5%. This growth is complemented by an ambitious earnings projection, expected to surge by 20.1% annually, significantly higher than the broader market's 12.1%. Despite challenges like shareholder dilution over the past year and a low forecasted return on equity at 11.9%, the company maintains strong fundamentals with positive free cash flow and high-quality earnings. Recent corporate guidance confirms these trends, targeting a revenue increase between 2% and 4% for 2025, aiming for approximately €700 million with an operating margin projected between 14% and 16%. This strategic financial management positions them well within a fiercely innovative sector where they continue to invest in growth while navigating market dynamics effectively.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market cap of SEK26.16 billion.

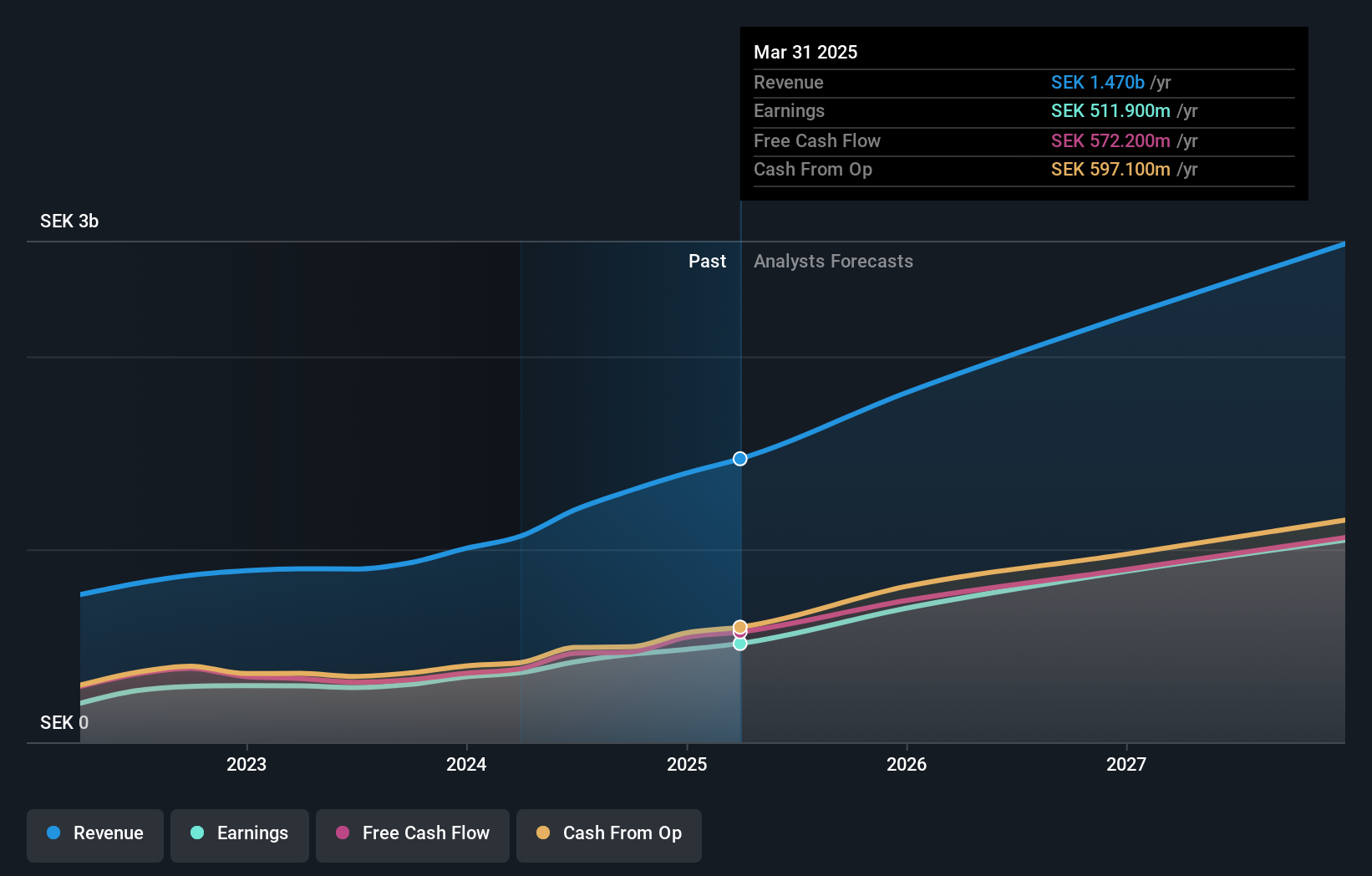

Operations: The company generates revenue primarily from its internet information provider services, amounting to SEK1.47 billion.

Hemnet Group, amidst a vibrant European tech scene, underscores its growth trajectory with an 18.6% annual revenue increase and a notable 22.3% rise in earnings per year. The company's strategic share repurchase program, involving up to SEK 600 million for approximately 8.57% of its share capital, reflects a proactive approach to optimizing capital structure. With robust R&D investments positioning it at the forefront of innovation in interactive media and services, Hemnet not only outpaces the Swedish market's growth by over fourfold but also demonstrates resilience with high-quality earnings and an impressive forecasted Return on Equity of 67%. This blend of financial vigor and strategic market maneuvers positions Hemnet as a dynamic participant in Europe’s tech expansion.

- Click to explore a detailed breakdown of our findings in Hemnet Group's health report.

Explore historical data to track Hemnet Group's performance over time in our Past section.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) specializes in providing products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK19.78 billion.

Operations: HMS Networks AB (publ) generates revenue by offering solutions that enable seamless communication and information exchange for industrial equipment worldwide. The company operates with a focus on facilitating connectivity in industrial environments, contributing to its market cap of SEK19.78 billion.

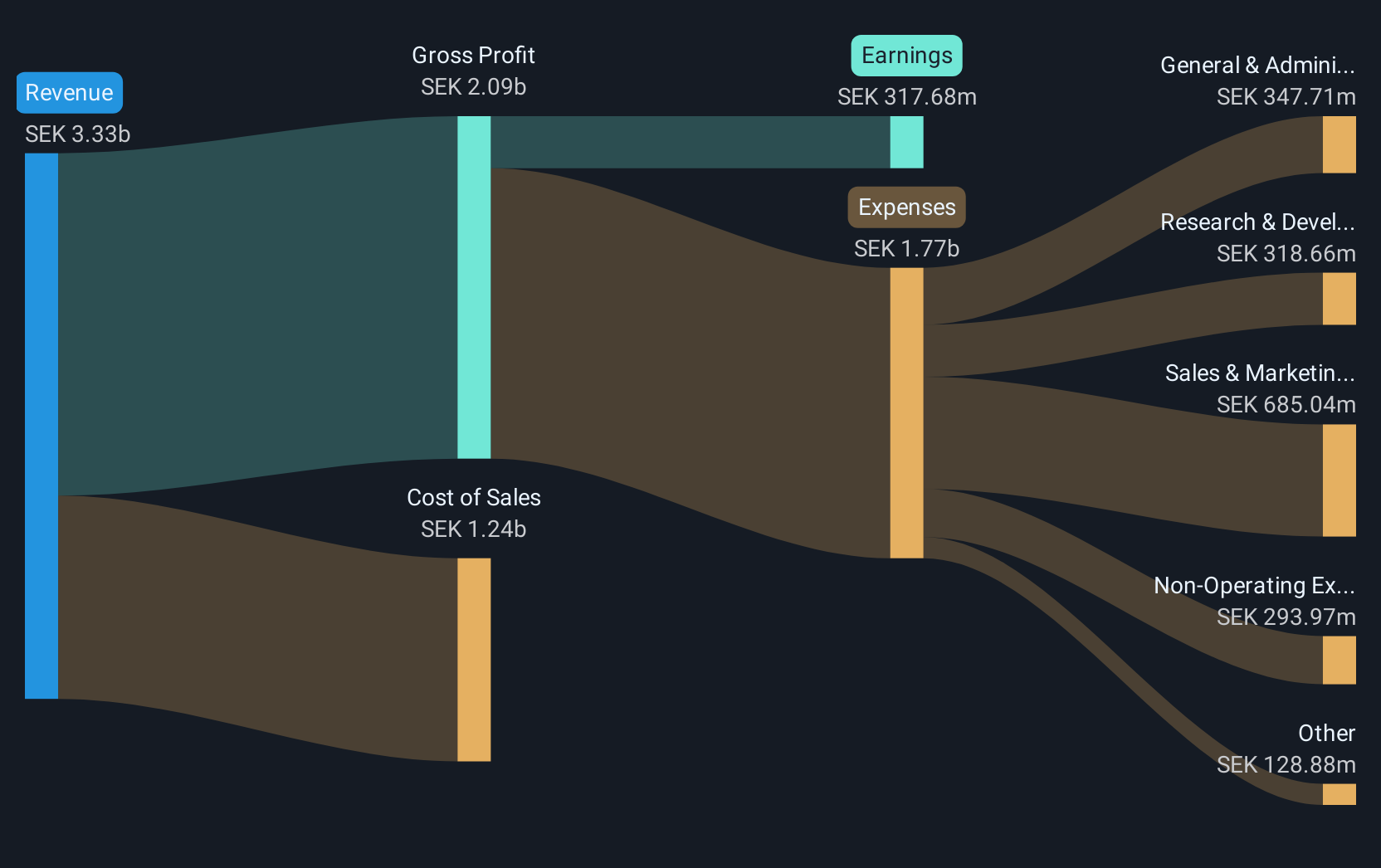

HMS Networks, in the pulsating heart of Europe's tech sector, shows robust growth with a 14.8% annual revenue increase and a more impressive 34.3% rise in earnings per year. Despite not paying dividends this year as profits are reinvested, the company's strategic focus on innovation is evident from its R&D expenses which significantly bolster its competitive edge in industrial communication solutions. With recent quarterly sales jumping from SEK 616 million to SEK 890 million and net income improving to SEK 115 million, HMS is setting a strong pace against its European peers, although it faces challenges like high debt levels and fluctuating profit margins.

- Delve into the full analysis health report here for a deeper understanding of HMS Networks.

Evaluate HMS Networks' historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 227 European High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemnet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEM

Outstanding track record with high growth potential.

Market Insights

Community Narratives