Hanza (OM:HANZA) EPS Growth Outlook Surpasses Bullish Narratives, With One-Off Gain in Focus

Reviewed by Simply Wall St

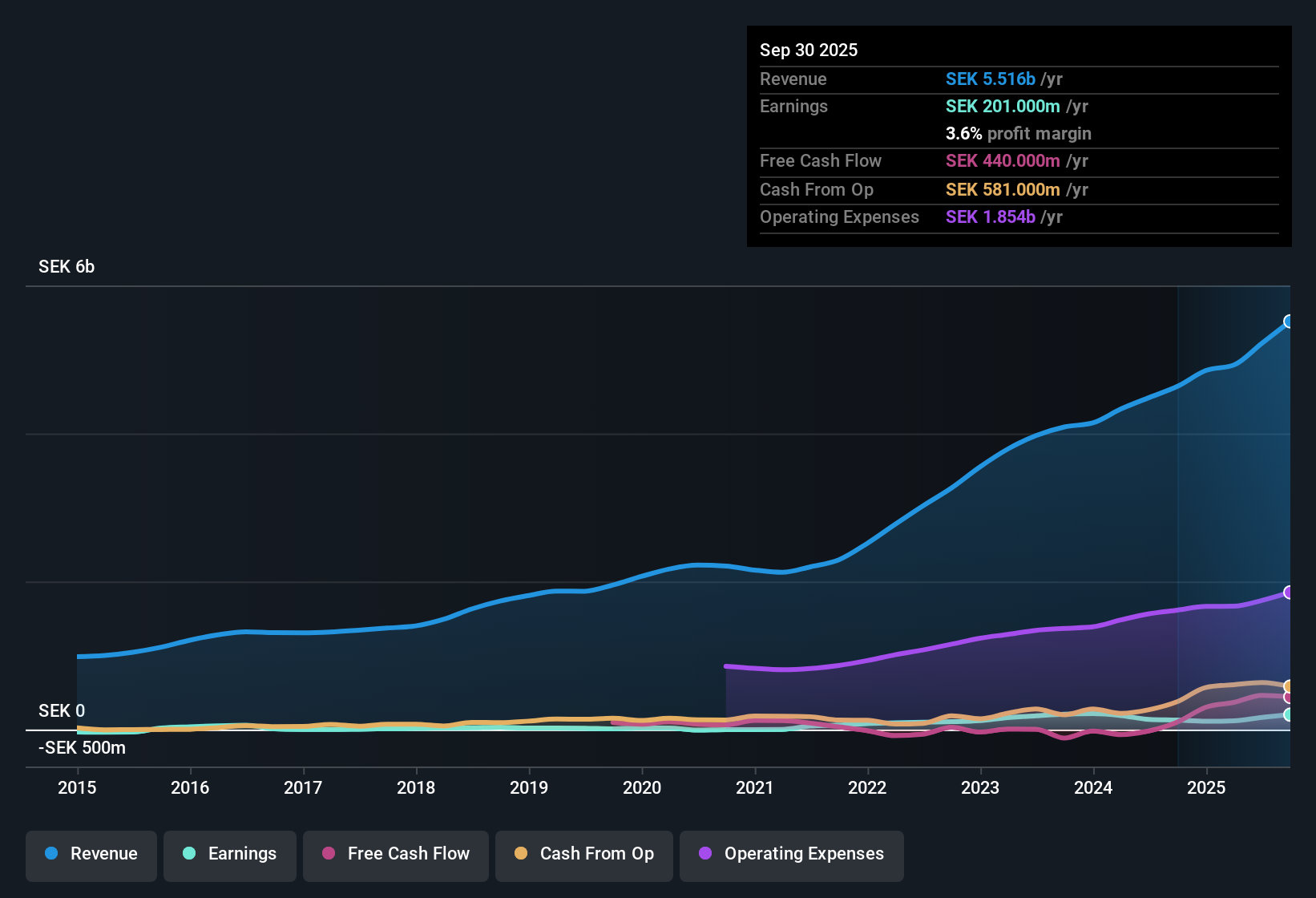

Hanza (OM:HANZA) delivered standout numbers this quarter, with EPS forecast to grow at 50.7% per year, which is sharply ahead of the company’s own five-year average of 29.6% and the wider Swedish market at 13%. Revenue is also set to climb at an impressive 26.1% per year, surpassing the market’s 3.8% pace, while net profit margin improved to 3.6% from last year’s 2.7%. Investors will want to keep an eye on the recent SEK43 million one-off gain, but the uptick in margins points to robust underlying performance.

See our full analysis for Hanza.The next step is to see how these numbers compare to the dominant narratives around Hanza and where the latest results might challenge or confirm existing stories.

See what the community is saying about Hanza

Margin Expansion Driven by Smart Factory Investments

- Net profit margin stands at 3.6%, showing improvement from last year's 2.7%. However, this still trails the anticipated 6.4% margin projected for the next three years.

- The consensus narrative points to HANZA's integration of acquisitions and expansion of smart factory capabilities as key drivers for future margin gains.

- Synergies from integrating Leden and Milectria are expected to materialize as integration costs ease, which could support further group-level margin growth.

- Continued focus on automation and efficiency programs is already boosting operational efficiency and gross margin performance.

Valuation Discount Despite Premium to Industry

- HANZA is trading at a price-to-earnings ratio of 28.9x, which is above the European Electronic industry average of 25.6x but significantly below the peer average of 44.8x. The company is also trading at a sharp discount to the DCF fair value of 246.23 per share, with the current share price at 126.40.

- According to the consensus narrative, analysts see HANZA as fairly priced relative to growth and sector risks, but note ongoing tension with the fair value estimate.

- The relatively small gap between the current share price and the consensus target (120.25) suggests analysts believe upside is already priced in.

- Despite the DCF fair value running much higher, analysts urge investors to validate these valuation assumptions independently.

Acquisition Integration and Cost Risks in Focus

- Recent acquisitions, including Leden and Milectria, introduce integration and cost-related risks that could pose challenges to sustaining margin growth and earnings improvements going forward.

- The consensus narrative underlines several possible pressure points for HANZA’s outlook.

- Rising labor and energy costs across Europe threaten to increase operating expenses and erode competitive edge compared to lower-cost rivals.

- Dependency on key clients in sectors such as energy and defense could amplify earnings volatility if contract wins or sector momentum slow down.

Strong execution on automation and integration is set to define whether HANZA’s growth run continues or hits operational speed bumps. 📊 Read the full Hanza Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hanza on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the results tell a different story? Share your outlook and publish your own take in just a few minutes: Do it your way.

A great starting point for your Hanza research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Despite recent gains, HANZA faces uncertainty from integration risks, cost pressures, and a valuation that already prices in much of the expected upside.

Concerned about paying too much for growth that might not materialize? Find better value opportunities among these 850 undervalued stocks based on cash flows right now and position yourself ahead of the curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives