European Insider-Owned Growth Companies To Watch In November 2025

Reviewed by Simply Wall St

As European markets experience a cautious optimism with the pan-European STOXX Europe 600 Index rising by 1.77% amid relief from the U.S. government's reopening, investors are keeping a close eye on growth companies, especially those with high insider ownership. In this context, stocks that combine robust growth potential with significant insider investment can offer unique insights into market confidence and strategic alignment during these uncertain times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 42.6% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

We'll examine a selection from our screener results.

Roche Bobois (ENXTPA:RBO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roche Bobois S.A. operates in the furniture design and distribution sector both in France and globally, with a market cap of €352.38 million.

Operations: The company's revenue is primarily derived from Roche Bobois USA/Canada (€138.48 million), Roche Bobois France (€108.61 million), Roche Bobois Europe (Excluding France) (€101.65 million), Cuir Center (€42.37 million), and Roche Bobois Others (Overseas) (€20.80 million).

Insider Ownership: 32.7%

Earnings Growth Forecast: 23.6% p.a.

Roche Bobois, with substantial insider ownership, is forecast to experience significant earnings growth of 23.63% annually, outpacing the French market's profit growth expectations. However, its revenue growth lags behind market averages and recent guidance indicates stable or slightly declining revenue for 2025. Despite trading below estimated fair value and a high future return on equity forecast (21%), profit margins have decreased from last year. Recent executive board changes may influence strategic direction moving forward.

- Click here and access our complete growth analysis report to understand the dynamics of Roche Bobois.

- Our comprehensive valuation report raises the possibility that Roche Bobois is priced higher than what may be justified by its financials.

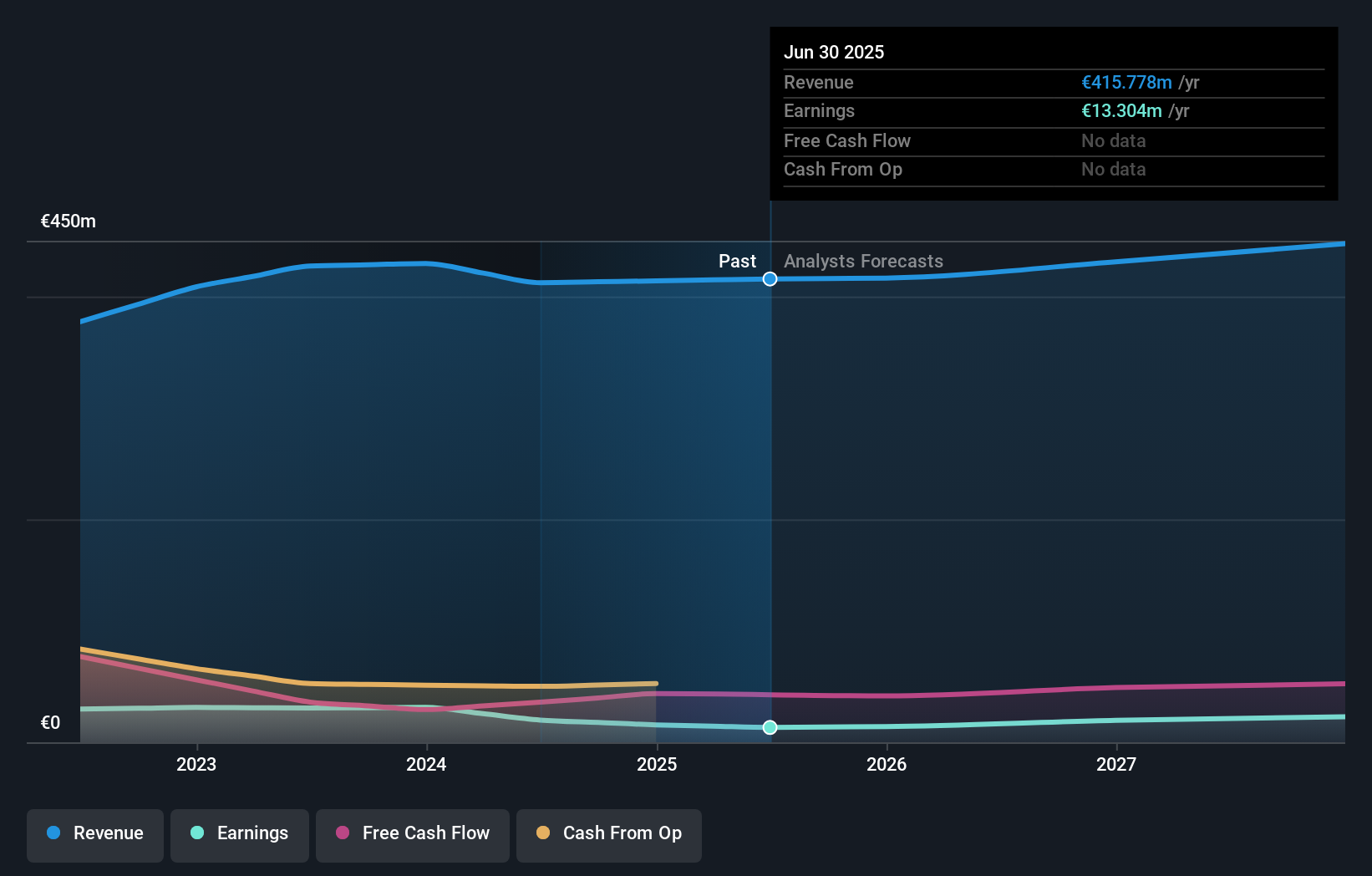

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanza AB (publ) offers contract manufacturing solutions across various regions including Europe and North America, with a market cap of SEK5.63 billion.

Operations: The company's revenue is primarily derived from its Main Markets segment, which generated SEK3.30 billion, and Other Markets segment, contributing SEK2.27 billion, with additional income of SEK32 million from Business Development and Services.

Insider Ownership: 33.4%

Earnings Growth Forecast: 44.4% p.a.

HANZA AB, with significant insider ownership and recent insider buying, is poised for robust growth. Earnings are forecast to grow at 44.4% annually, surpassing the Swedish market's growth rate of 12.7%. Recent business expansions in Finland and strategic acquisitions bolster its manufacturing capabilities, particularly in the defense sector. Despite high debt levels and share price volatility, HANZA trades at a discount to its estimated fair value while demonstrating strong revenue growth potential of 26.1% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Hanza.

- Our comprehensive valuation report raises the possibility that Hanza is priced lower than what may be justified by its financials.

Peab (OM:PEAB B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Peab AB (publ) is a construction and civil engineering company operating in Sweden, Norway, Finland, Denmark, and internationally with a market cap of SEK21.97 billion.

Operations: The company's revenue segments include SEK20.49 billion from Industry, SEK23.05 billion from Construction, SEK17.24 billion from Civil Engineering, SEK3.59 billion from Project Development - Housing Development, and SEK777 million from Project Development - Property Development.

Insider Ownership: 13.3%

Earnings Growth Forecast: 23% p.a.

Peab, with high insider ownership, is positioned for growth as its earnings are forecast to increase significantly at 23% annually, outpacing the Swedish market. Recent contracts like the SEK 438 million school project in Solna and SEK 159 million reservoir renovation in Stockholm bolster its order book. Despite concerns over interest coverage and an unstable dividend track record, Peab trades below estimated fair value and shows promising revenue growth prospects of 4.8% per year.

- Dive into the specifics of Peab here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Peab is trading behind its estimated value.

Next Steps

- Click this link to deep-dive into the 196 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Ready For A Different Approach? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Hanza

Provides contract manufacturing solutions in Sweden, Finland, Estonia, Germany, Poland, the Czech Republic, rest of the European Union, Norway, rest of Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives