3 European Stocks Estimated To Be Up To 47.5% Below Intrinsic Value

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have faced significant challenges, with the pan-European STOXX Europe 600 Index ending 1.57% lower recently. In this environment of volatility and cautious sentiment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1021.40 | 49.3% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.325 | RON8.46 | 48.9% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK364.91 | 49.7% |

| Qt Group Oyj (HLSE:QTCOM) | €55.45 | €107.99 | 48.7% |

| Lectra (ENXTPA:LSS) | €23.80 | €46.62 | 49% |

| Koskisen Oyj (HLSE:KOSKI) | €8.78 | €17.36 | 49.4% |

| Just Eat Takeaway.com (ENXTAM:TKWY) | €19.50 | €38.97 | 50% |

| dormakaba Holding (SWX:DOKA) | CHF705.00 | CHF1399.39 | 49.6% |

| CTT Systems (OM:CTT) | SEK208.00 | SEK408.94 | 49.1% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.30 | €71.39 | 49.2% |

We'll examine a selection from our screener results.

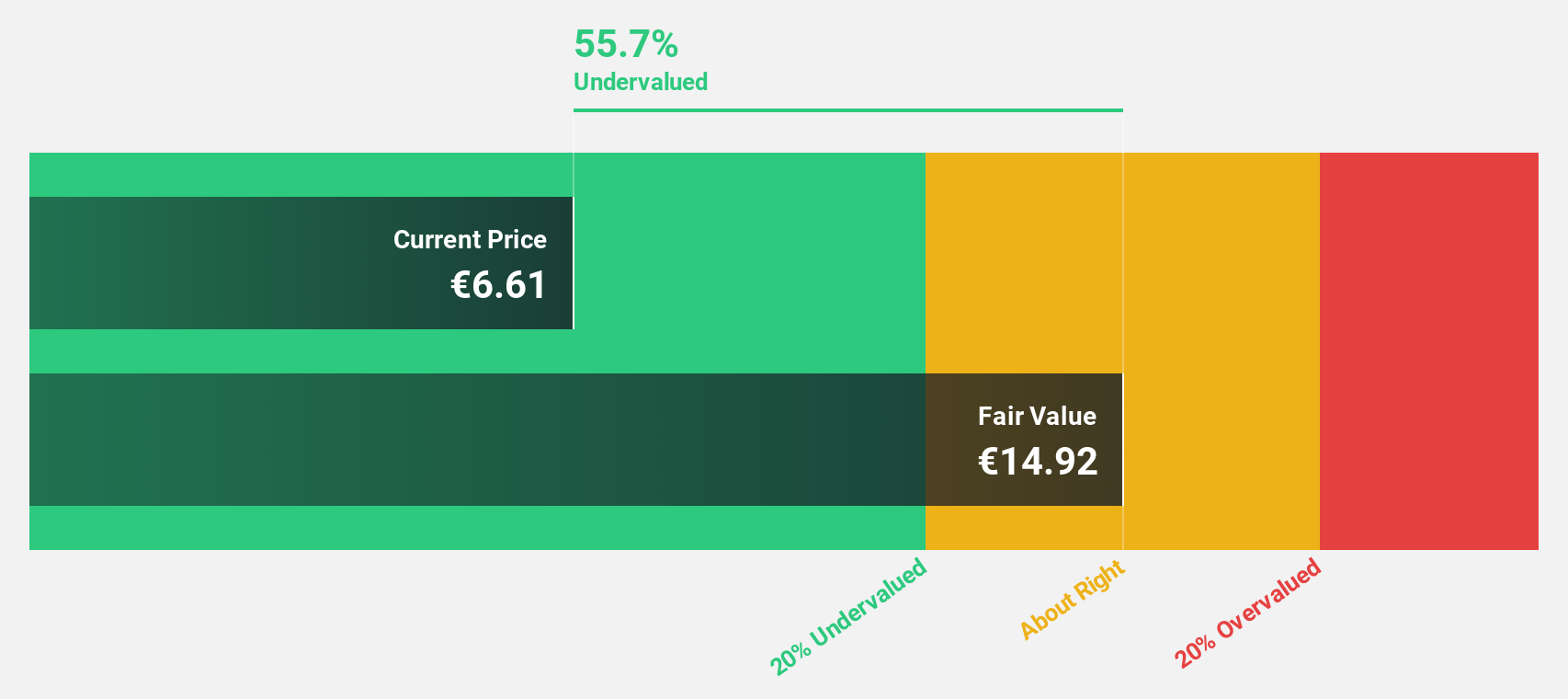

About You Holding (DB:YOU)

Overview: About You Holding SE is a fashion and technology company that operates e-commerce platforms across Europe, with a market cap of €1.18 billion.

Operations: The company's revenue segments include TME at €191 million, ABOUT YOU RoE at €935 million, and ABOUT YOU DACH at €990.40 million.

Estimated Discount To Fair Value: 47.5%

About You Holding SE is trading at €6.71, significantly below its estimated fair value of €12.79, indicating it may be undervalued based on cash flows. The company reported sales of €2 billion for the year ending February 2025, with a reduced net loss compared to the previous year. Although removed from the Germany SDAX Index, About You's earnings are forecast to grow substantially at 92.69% annually and it is expected to become profitable in three years.

- In light of our recent growth report, it seems possible that About You Holding's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of About You Holding.

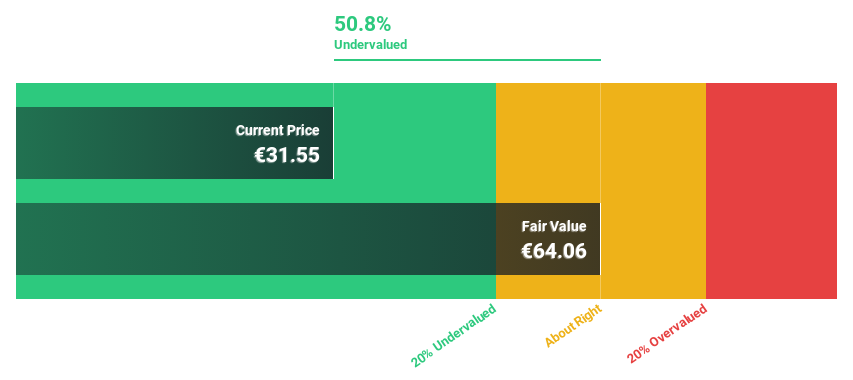

Sword Group (ENXTPA:SWP)

Overview: Sword Group S.E. is a global provider of IT and software solutions with a market cap of €344.88 million.

Operations: The company's revenue segments include €109.25 million from Services in Belux, €116.37 million from Services in Switzerland, and €97.39 million from Services in the United Kingdom.

Estimated Discount To Fair Value: 41.6%

Sword Group is trading at €36.55, well below its estimated fair value of €62.59, suggesting it is undervalued based on cash flows. Recent strategic contracts worth up to €200 million enhance its revenue visibility and align with forecasted earnings growth of 13.06% annually, outpacing the French market's 12.1%. Despite a dividend not fully covered by free cash flow, Sword Group's focus on technological solutions in cybersecurity and AI supports its long-term strategy.

- Upon reviewing our latest growth report, Sword Group's projected financial performance appears quite optimistic.

- Take a closer look at Sword Group's balance sheet health here in our report.

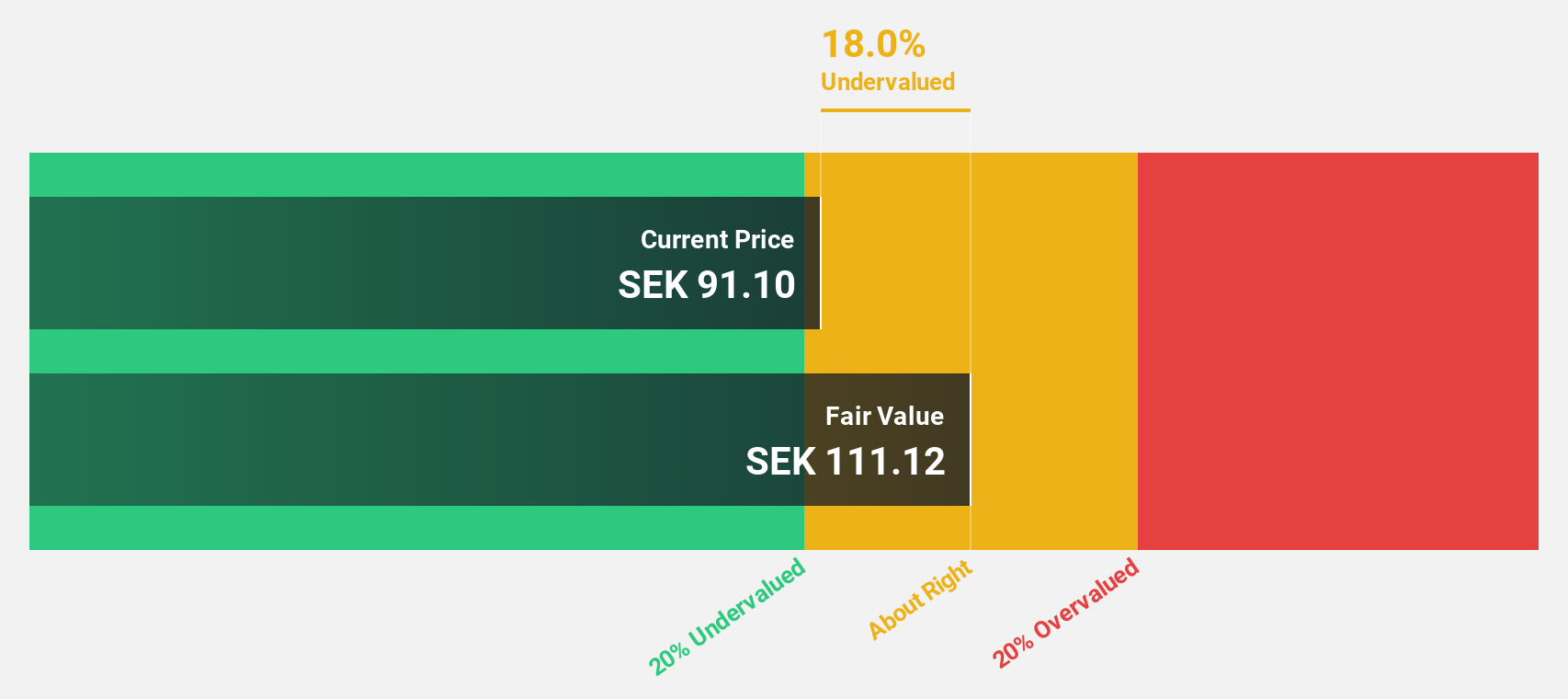

Hanza (OM:HANZA)

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.67 billion.

Operations: The company's revenue segments are comprised of Main Markets at SEK2.92 billion, Other Markets at SEK2.06 billion, and Business Development and Services at SEK32 million.

Estimated Discount To Fair Value: 27%

Hanza is trading at SEK 79.9, below its estimated fair value of SEK 109.49, indicating it is undervalued based on cash flows. The company anticipates significant annual earnings growth of 36.3%, surpassing the Swedish market's average. Despite lower profit margins this year and interest payments not well covered by earnings, recent Q1 results show improved net income at SEK 40 million from SEK 34 million last year, supporting its growth trajectory.

- Our growth report here indicates Hanza may be poised for an improving outlook.

- Dive into the specifics of Hanza here with our thorough financial health report.

Next Steps

- Access the full spectrum of 175 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion