- Sweden

- /

- Auto Components

- /

- OM:DOM

Swedish Stocks Estimated To Be Trading Below Fair Value In October 2024

Reviewed by Simply Wall St

In October 2024, the Swedish stock market is navigating a complex landscape influenced by the European Central Bank's recent interest rate cuts, which have bolstered expectations for further monetary easing across Europe. Amidst this economic environment, identifying stocks that may be trading below their fair value can offer potential opportunities for investors looking to capitalize on market inefficiencies. In such conditions, a good stock might be characterized by strong fundamentals and resilience to broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK45.54 | SEK89.84 | 49.3% |

| Husqvarna (OM:HUSQ B) | SEK67.16 | SEK124.54 | 46.1% |

| Svedbergs Group (OM:SVED B) | SEK42.10 | SEK77.26 | 45.5% |

| Lindab International (OM:LIAB) | SEK266.00 | SEK526.58 | 49.5% |

| TF Bank (OM:TFBANK) | SEK315.00 | SEK612.86 | 48.6% |

| Nolato (OM:NOLA B) | SEK52.80 | SEK102.59 | 48.5% |

| Wall to Wall Group (OM:WTW A) | SEK53.80 | SEK104.25 | 48.4% |

| Securitas (OM:SECU B) | SEK130.60 | SEK260.52 | 49.9% |

| BHG Group (OM:BHG) | SEK14.40 | SEK26.71 | 46.1% |

| Bactiguard Holding (OM:BACTI B) | SEK44.60 | SEK85.58 | 47.9% |

Underneath we present a selection of stocks filtered out by our screen.

Concentric (OM:COIC)

Overview: Concentric AB (publ) designs, develops, manufactures, and distributes hydraulic and engine solutions in Sweden and internationally, with a market cap of SEK8.52 billion.

Operations: The company's revenue is derived from two main segments: Engines, contributing SEK2.71 billion, and Hydraulics, accounting for SEK1.25 billion.

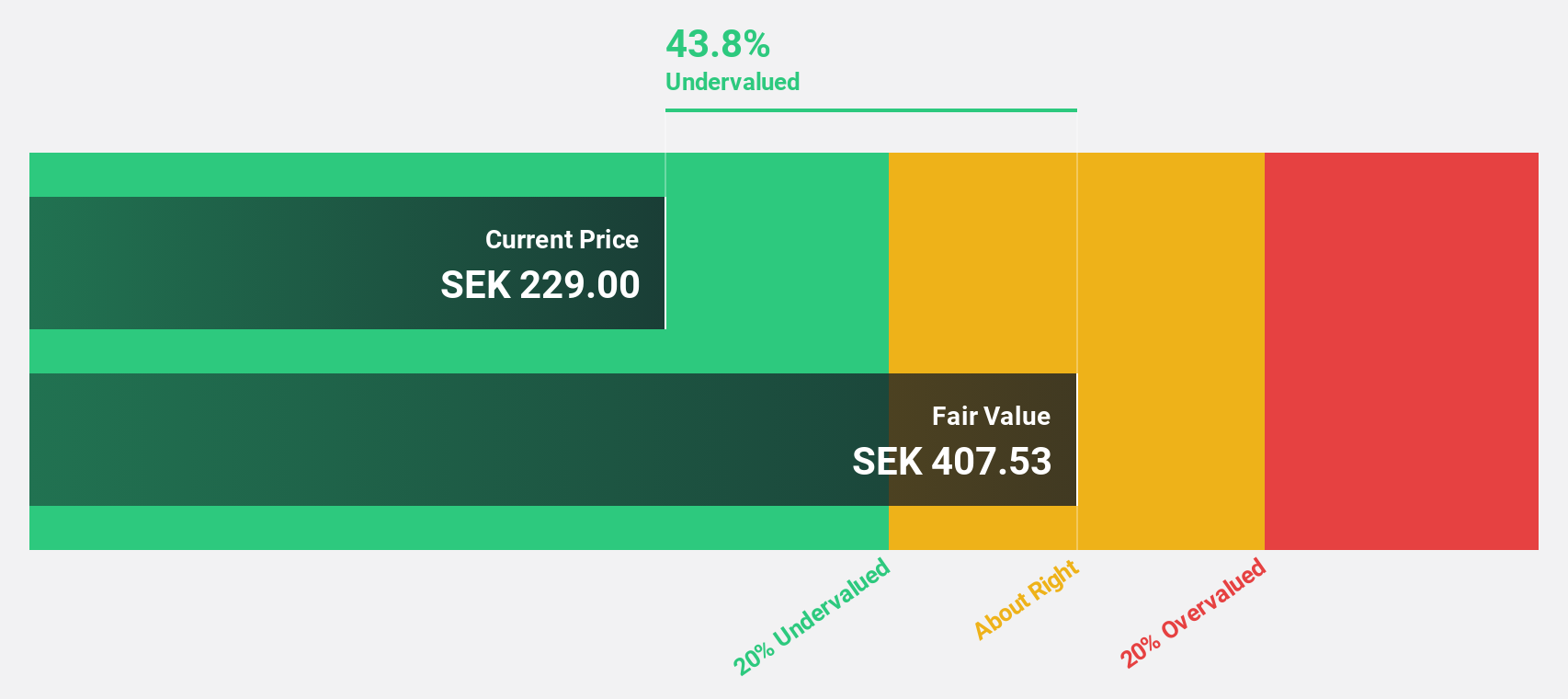

Estimated Discount To Fair Value: 43.6%

Concentric AB is trading significantly below its estimated fair value of SEK 406.57, with a current price of SEK 229.5, suggesting potential undervaluation based on cash flows. Despite recent volatility and lower profit margins compared to last year, earnings are projected to grow substantially over the next three years. A.P. Møller Holding's acquisition offer at SEK 230 per share has been accepted by over 95% of shareholders, indicating strong market interest despite mixed financial performance recently.

- Insights from our recent growth report point to a promising forecast for Concentric's business outlook.

- Get an in-depth perspective on Concentric's balance sheet by reading our health report here.

Dometic Group (OM:DOM)

Overview: Dometic Group AB (publ) offers mobile living solutions focusing on food and beverage, climate, power and control, among other applications, with a market cap of approximately SEK19.33 billion.

Operations: The company's revenue segments include Marine at SEK6.25 billion, Global Ventures at SEK5.88 billion, Land Vehicles APAC at SEK4.52 billion, Land Vehicles EMEA at SEK8.11 billion, and Land Vehicles Americas at SEK5.00 billion.

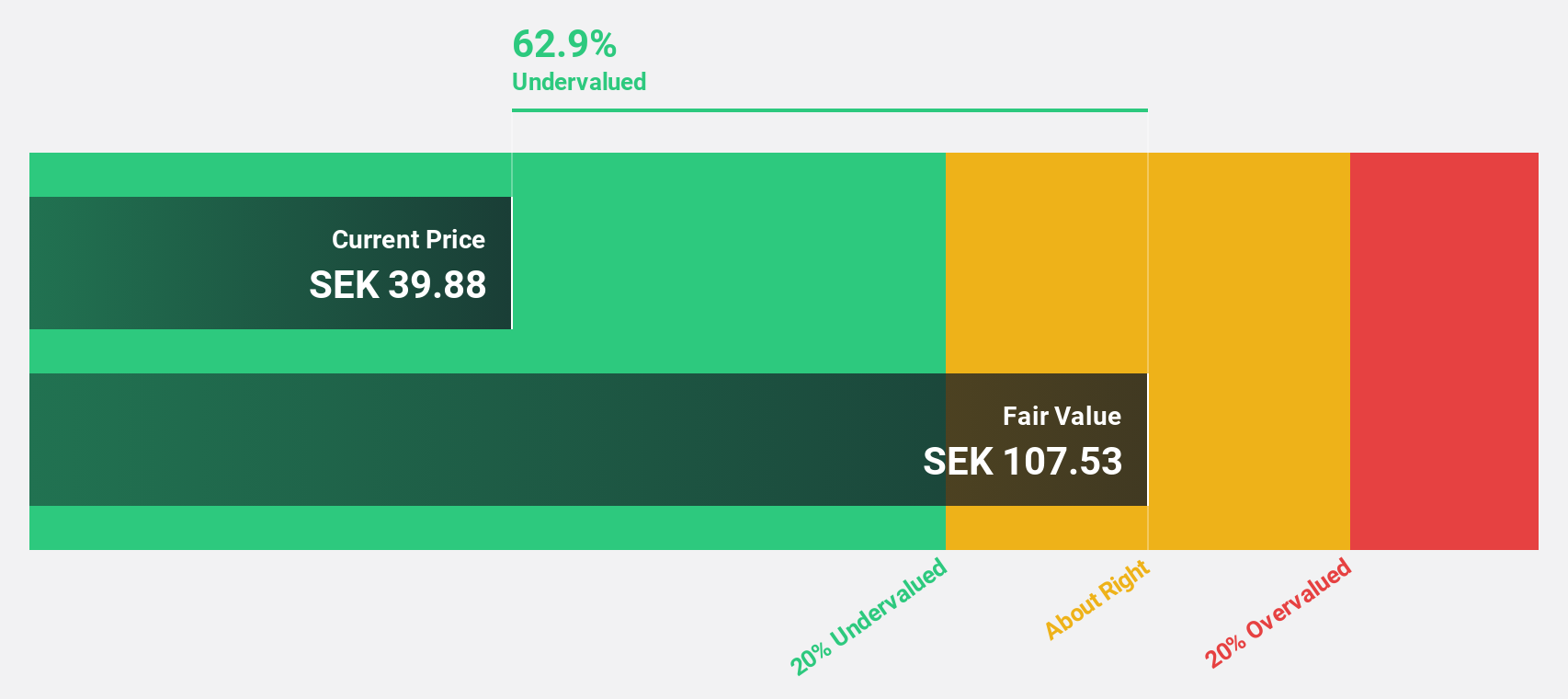

Estimated Discount To Fair Value: 45.3%

Dometic Group is trading at SEK 60.5, significantly below its estimated fair value of SEK 110.66, highlighting potential undervaluation based on cash flows. Despite a high debt level and recent SEK 2 billion goodwill impairment impacting EBIT in Q3 2024, earnings are forecast to grow by over 25% annually, outpacing the Swedish market's growth rate. However, revenue growth remains modest at 1.6% per year with an unstable dividend track record and low return on equity projections.

- Our expertly prepared growth report on Dometic Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Dometic Group with our detailed financial health report.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions to telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, Asia, Oceania, and India with a market cap of approximately SEK295.57 billion.

Operations: Ericsson's revenue is segmented into Networks at SEK156.41 billion, Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion.

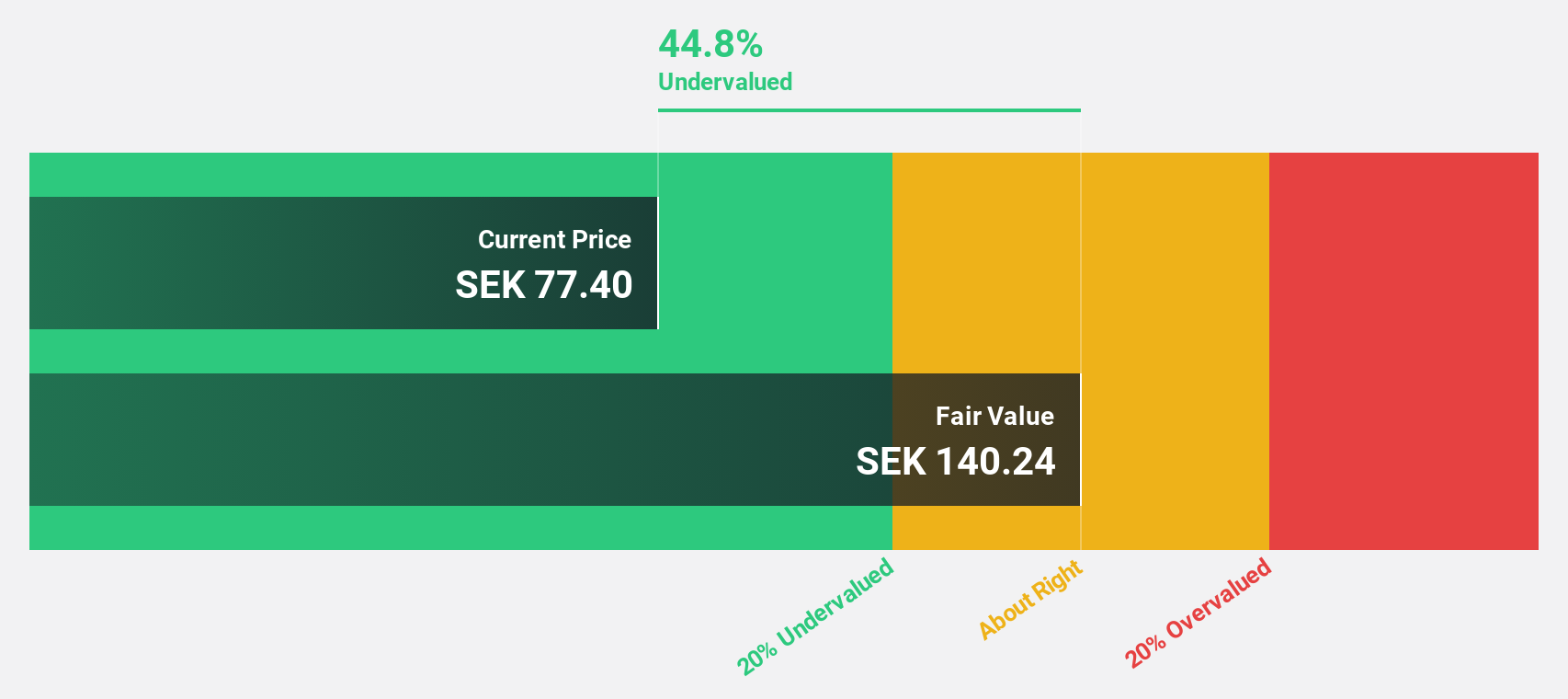

Estimated Discount To Fair Value: 35.5%

Telefonaktiebolaget LM Ericsson is trading at SEK 88.68, substantially below its estimated fair value of SEK 137.51, indicating undervaluation based on cash flows. Recent earnings show a return to profitability with a net income of SEK 3.81 billion for Q3 2024, contrasting with the previous year's loss. Despite slower revenue growth forecasts at 2.6% annually, Ericsson's strategic initiatives in cloud billing and partnerships in microelectronics bolster its future prospects and operational efficiency.

- Our earnings growth report unveils the potential for significant increases in Telefonaktiebolaget LM Ericsson's future results.

- Unlock comprehensive insights into our analysis of Telefonaktiebolaget LM Ericsson stock in this financial health report.

Next Steps

- Unlock more gems! Our Undervalued Swedish Stocks Based On Cash Flows screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 47 Undervalued Swedish Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DOM

Dometic Group

Provides mobile living solutions for food and beverage, climate, power and control, and other applications in the United States, Germany, Australia, Italy, France, the United Kingdom, Japan, Canada, the Netherlands, Sweden, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives