- Sweden

- /

- Communications

- /

- OM:ERIC B

Could Ericsson’s (OM:ERIC B) Renewed Telia Deal Reveal Its Edge in Nordic Digital Infrastructure?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Telia Company announced a four-year extension of its Radio Access Network partnership with Ericsson, covering Sweden, Norway, Lithuania, and Estonia to enhance network performance and deploy advanced 5G capabilities across multiple sectors.

- This expanded collaboration underscores Ericsson’s role in supporting mission-critical communications, 5G innovation, and digital infrastructure modernization for industries and public services throughout the Nordic and Baltic regions.

- We’ll examine how the broadened Telia partnership may strengthen Ericsson’s industry positioning and outlook for technology-driven growth opportunities.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Telefonaktiebolaget LM Ericsson Investment Narrative Recap

Ericsson’s investment story centers on continued 5G adoption, new enterprise use cases, and operational streamlining in a competitive, highly regulated global market. The recent Telia partnership extension could reinforce Ericsson’s position in Northern Europe, but does not immediately offset risks such as margin pressure from tough pricing competition and potential delays in emerging market deployments. In the short term, this announcement should strengthen the company’s deal momentum, yet pricing power and profitability remain closely watched catalysts as the core challenges for investors have not materially shifted.

The executive transition, with Moti Gyamlani stepping down as Senior Vice President and Head of Global Operations, adds operational focus to the announced Telia agreement. As Ericsson restructures to bring functions closer to its business lines, investors may keep an eye on execution around these partnerships. In contrast, investors should be mindful of heightened competitive risks posed by both global and regional network vendors, as pricing volatility and industry consolidation...

Read the full narrative on Telefonaktiebolaget LM Ericsson (it's free!)

Telefonaktiebolaget LM Ericsson is projected to deliver SEK242.3 billion in revenue and SEK18.2 billion in earnings by 2028. This outlook is based on a 0.5% annual revenue decline and an earnings increase of SEK0.9 billion from the current figure of SEK17.3 billion.

Uncover how Telefonaktiebolaget LM Ericsson's forecasts yield a SEK87.22 fair value, a 3% downside to its current price.

Exploring Other Perspectives

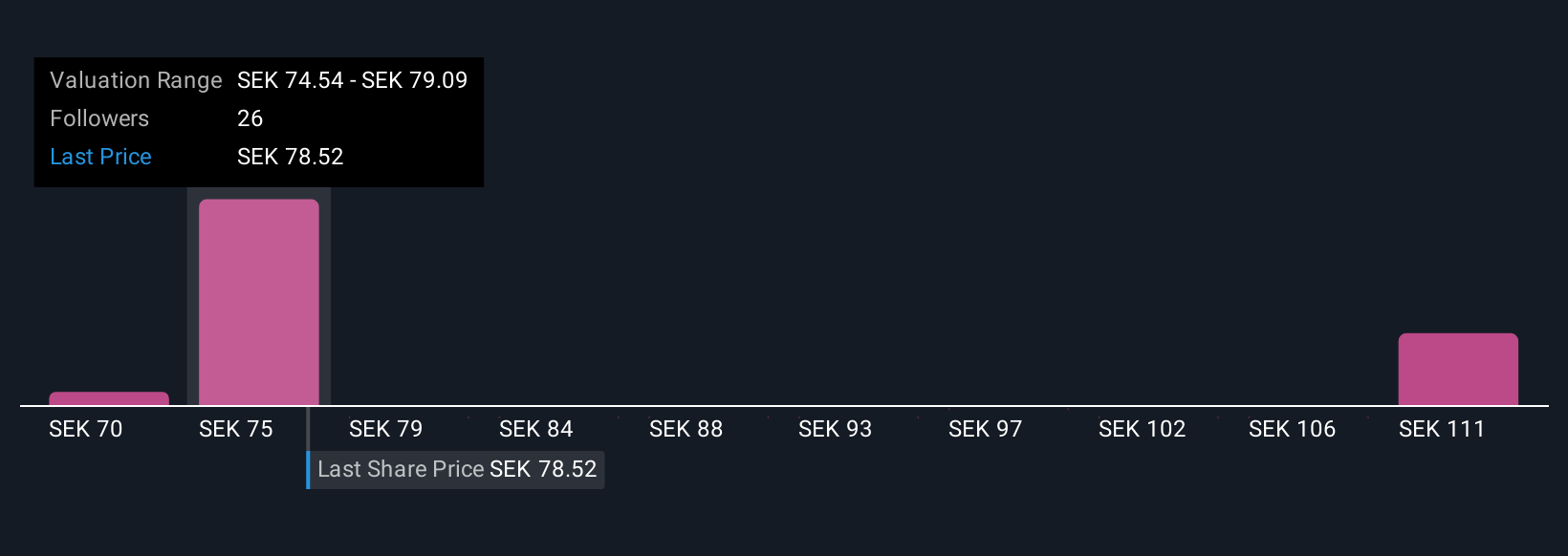

Five members of the Simply Wall St Community place Ericsson’s fair value between SEK 71.08 and SEK 140.33, reflecting a wide range of potential outcomes. Amid this diversity, industry competition and price pressures could remain top of mind for those weighing the company’s portfolio strategy and long-term profitability, see how other community members frame their outlooks and compare your own perspective.

Explore 5 other fair value estimates on Telefonaktiebolaget LM Ericsson - why the stock might be worth as much as 56% more than the current price!

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telefonaktiebolaget LM Ericsson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telefonaktiebolaget LM Ericsson's overall financial health at a glance.

No Opportunity In Telefonaktiebolaget LM Ericsson?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives