Ependion AB's (STO:EPEN) Shares Bounce 28% But Its Business Still Trails The Market

Ependion AB (STO:EPEN) shares have continued their recent momentum with a 28% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 7.0% isn't as impressive.

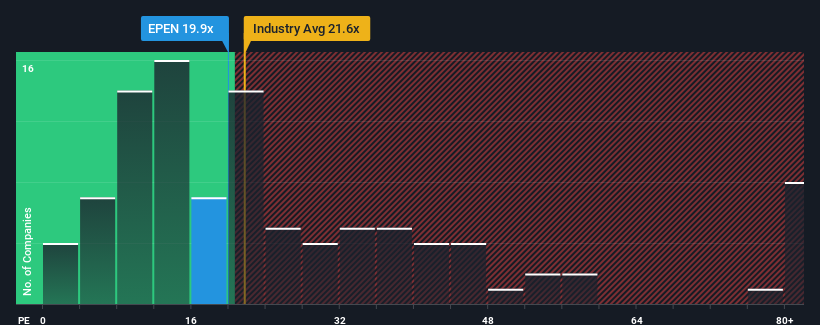

Even after such a large jump in price, Ependion's price-to-earnings (or "P/E") ratio of 19.9x might still make it look like a buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 23x and even P/E's above 42x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Ependion has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Ependion

What Are Growth Metrics Telling Us About The Low P/E?

Ependion's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 4.9% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 13% per annum over the next three years. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Ependion's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Ependion's P/E?

The latest share price surge wasn't enough to lift Ependion's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ependion's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Ependion with six simple checks.

Of course, you might also be able to find a better stock than Ependion. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ependion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EPEN

Ependion

Provides digital solutions for secure control, management, visualization, and data communication for industrial applications.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives