High Growth Tech Stocks in Sweden to Watch This September 2024

Reviewed by Simply Wall St

As global markets respond to the U.S. Federal Reserve's recent rate cut, smaller-cap indexes have shown notable resilience, including those in Europe and Japan. Against this backdrop of shifting monetary policy and economic indicators, identifying high-growth tech stocks in Sweden can be particularly rewarding for investors seeking opportunities within a dynamic market environment. A good stock in this context typically exhibits strong revenue growth potential, innovative capabilities, and a solid market position that aligns well with current economic trends.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.07% | 22.47% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Yubico | 20.52% | 42.35% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for communication in Sweden and internationally, with a market cap of SEK6.25 billion.

Operations: Dynavox Group AB (publ) generates revenue primarily from its Computer Hardware segment, amounting to SEK1.80 billion. The company focuses on assistive technology products for communication, catering to both domestic and international markets.

Dynavox Group, recently rebranded from Tobii Dynavox, has demonstrated robust financial growth with a notable 124.6% increase in earnings over the past year. This surge is underpinned by a strategic emphasis on R&D, which not only fuels innovation but also aligns with anticipated revenue growth of 13.6% per annum, outpacing the broader Swedish market's 0.9%. Looking ahead, earnings are projected to climb by 36.6% annually, reflecting both the company’s dynamic adaptation to market demands and its effective capital deployment in technology advancements. Such financial health and forward-looking investments suggest Dynavox is navigating its competitive tech landscape adeptly, poised for continued expansion amidst evolving industry challenges and opportunities.

- Click to explore a detailed breakdown of our findings in Dynavox Group's health report.

Understand Dynavox Group's track record by examining our Past report.

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company that engages in the development of digital solutions, with a market cap of SEK4.16 billion.

Operations: Knowit AB (publ) generates revenue primarily through its Solutions segment, which contributes SEK3.90 billion, followed by Experience at SEK1.44 billion, Connectivity at SEK1.02 billion, and Insight at SEK898.95 million.

Despite a challenging year with earnings dropping by 28.1%, Knowit is poised for recovery with an anticipated earnings growth of 31.6% per year, outstripping the Swedish market's forecast of 15.1%. This resilience can be partly attributed to its strategic focus on R&D, which remains robust even in downturns, ensuring continuous innovation and adaptation within the tech sector. Moreover, with revenue projected to increase by 3% annually—triple the national market rate—Knowit demonstrates a potential for sustainable growth driven by its ability to stay relevant and competitive in evolving technological landscapes. These projections underscore not just recovery but also an opportunity for significant advancement in the coming years.

- Dive into the specifics of Knowit here with our thorough health report.

Evaluate Knowit's historical performance by accessing our past performance report.

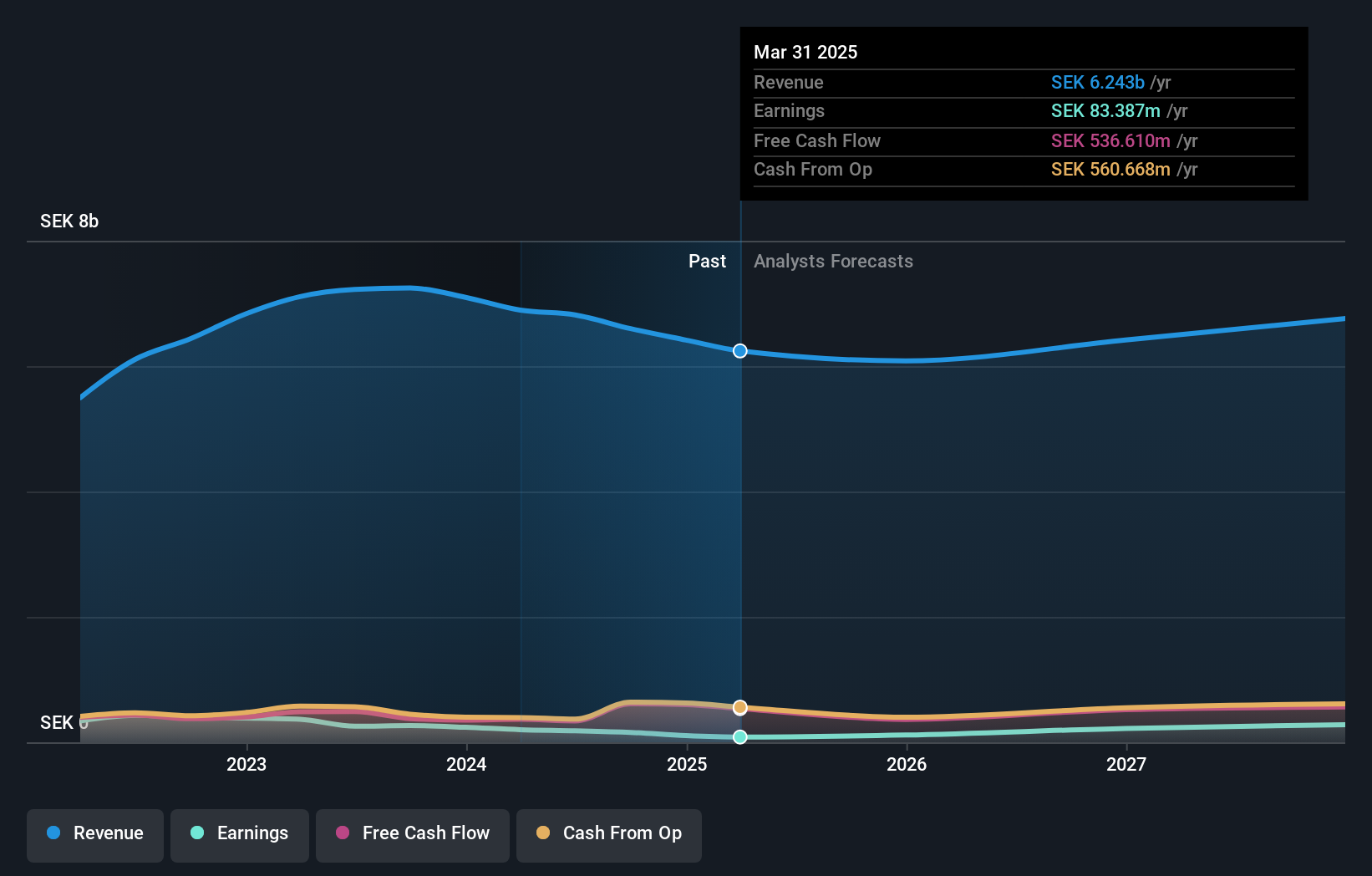

Probi (OM:PROB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Probi AB (publ) researches, manufactures, and sells probiotics for dietary supplements and food companies across various global markets including North America, South America, Europe, Sweden, the Middle East, Africa, and Asia Pacific with a market cap of SEK2.95 billion.

Operations: Probi AB (publ) generates revenue by researching, manufacturing, and selling probiotics for dietary supplements and food companies across various global markets. The company operates internationally, with a market cap of SEK2.95 billion.

Probi AB, reflecting a robust turnaround, reported a significant recovery in its Q2 2024 earnings with sales soaring to SEK 178.88 million from SEK 143.72 million year-over-year and transforming a net loss into a profit of SEK 8.04 million. This resurgence is underscored by an aggressive R&D strategy, which is pivotal as the company expands into new markets like Denmark through strategic partnerships with retailers such as Matas. These expansions are not just geographical but also tap into the growing consumer awareness around preventive health measures, particularly gut health—a segment where Probi is setting benchmarks with clinically backed probiotic solutions. With an expected annual earnings growth of 50%, outpacing the Swedish market's forecast of 15.1%, and revenue growth projections at 6.1% annually—highlighting its potential to outperform market averages—Probi is strategically positioned to capitalize on emerging health trends and demographic shifts towards an aging population seeking wellness-focused solutions.

- Unlock comprehensive insights into our analysis of Probi stock in this health report.

Explore historical data to track Probi's performance over time in our Past section.

Make It Happen

- Click this link to deep-dive into the 82 companies within our Swedish High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PROB

Probi

Researches, manufactures, and sells probiotics for dietary supplements and food companies in North America, South America, Europe, Sweden, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives