In recent weeks, European markets have shown resilience with the pan-European STOXX Europe 600 Index rising by 3.93%, buoyed by the European Central Bank's decision to cut rates amid trade uncertainties and President Trump's delay in imposing higher tariffs. As investor sentiment improves, particularly for smaller-cap indexes which have outperformed larger counterparts, identifying high-growth tech stocks becomes crucial; these are typically characterized by strong innovation potential and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions across fashion, automotive, and furniture markets globally, with a market cap of €971.03 million.

Operations: The company generates revenue from industrial intelligence solutions across fashion, automotive, and furniture sectors, with regional revenues of €176.10 million from the Americas, €131.53 million from Asia-Pacific, and €219.05 million from EMEA.

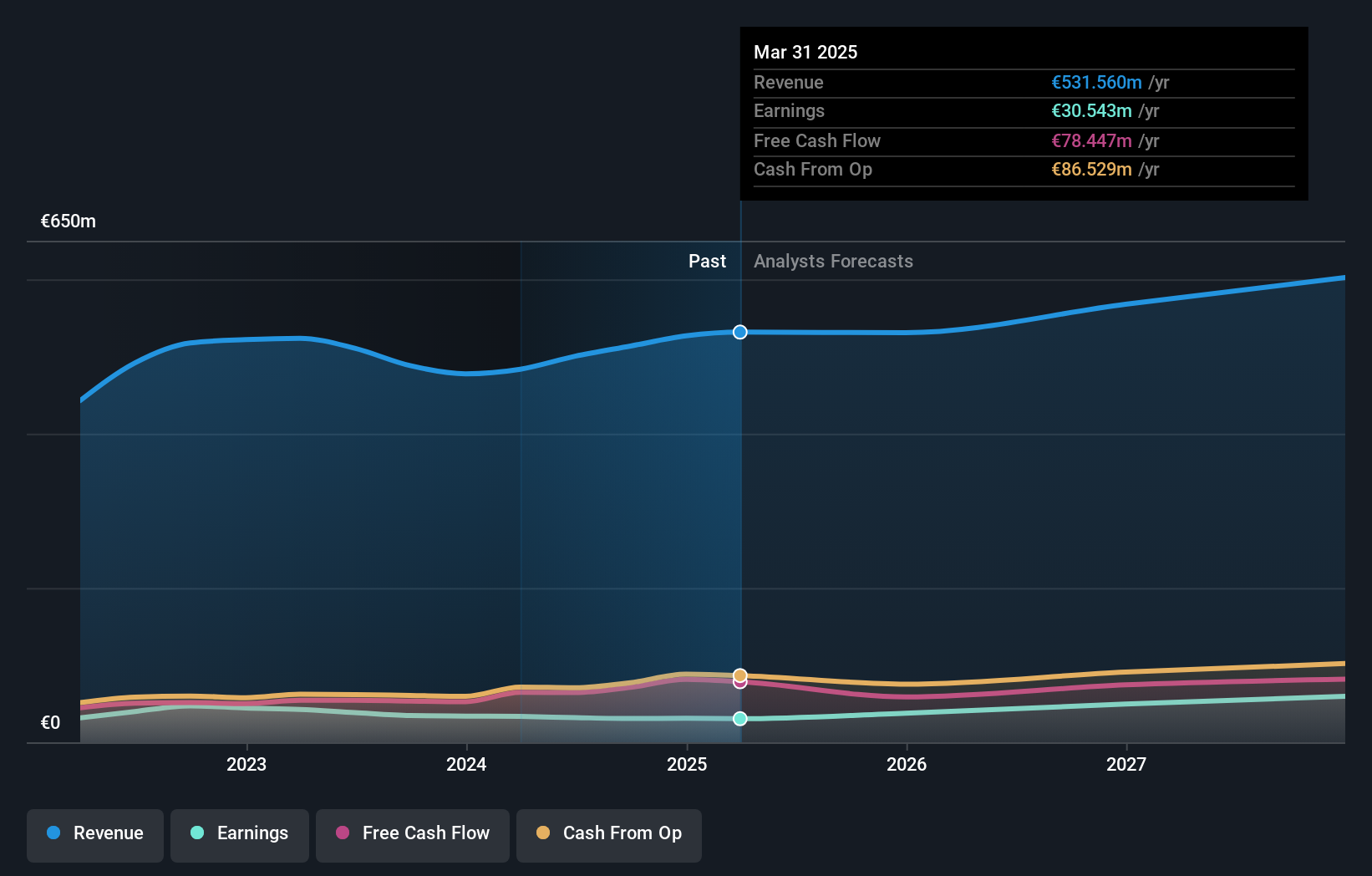

Lectra SA, amidst a dynamic tech landscape, showcases robust growth with its annual revenue up 10.3% to EUR 526.67 million and an earnings forecast promising a 23.2% increase per year, outpacing the French market's average. This growth is underpinned by a dividend proposal of €0.40 per share and strategic board reshuffles aiming to refine governance and drive innovation further. With expected revenues between EUR 550 million and EUR 600 million for 2025, Lectra is not just navigating but also shaping the technological fabric of Europe through its commitment to R&D and market-responsive strategies.

- Navigate through the intricacies of Lectra with our comprehensive health report here.

Gain insights into Lectra's historical performance by reviewing our past performance report.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Better Collective A/S, along with its subsidiaries, functions as a digital sports media company with operations across Europe, North America, and internationally, and has a market capitalization of SEK6.92 billion.

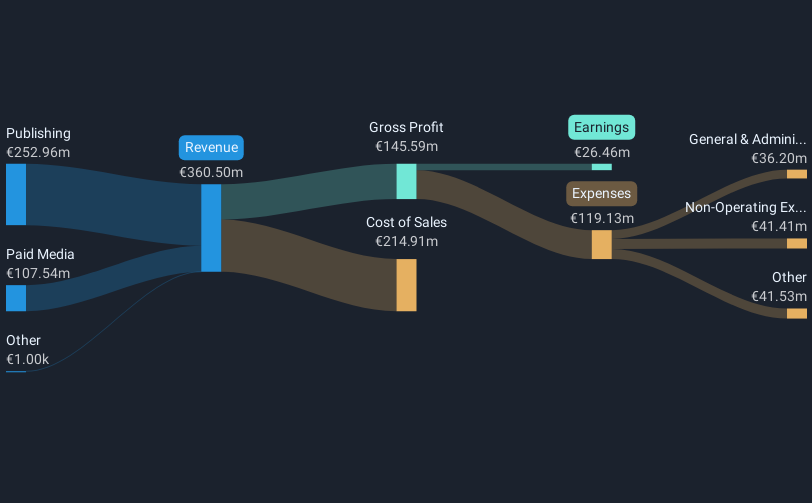

Operations: The company generates revenue through two primary segments: Publishing, contributing €264.70 million, and Paid Media, accounting for €106.79 million.

Better Collective, navigating through a competitive tech landscape, has demonstrated resilience with a 4% annual revenue growth and an impressive 23.5% forecast in earnings growth per year. This performance is bolstered by a robust R&D focus, evident from their recent financials showing significant investment in innovation to stay ahead in the interactive media and services sector. Despite facing challenges like a one-off loss of €10.9 million last year, the company's strategic adjustments and strong projected earnings suggest it is well-positioned to capitalize on market opportunities. With upcoming minor changes to its bylaws aimed at enhancing operational clarity, Better Collective is gearing up for sustained growth amidst evolving industry dynamics.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with communication impairments, with a market capitalization of SEK5.86 billion.

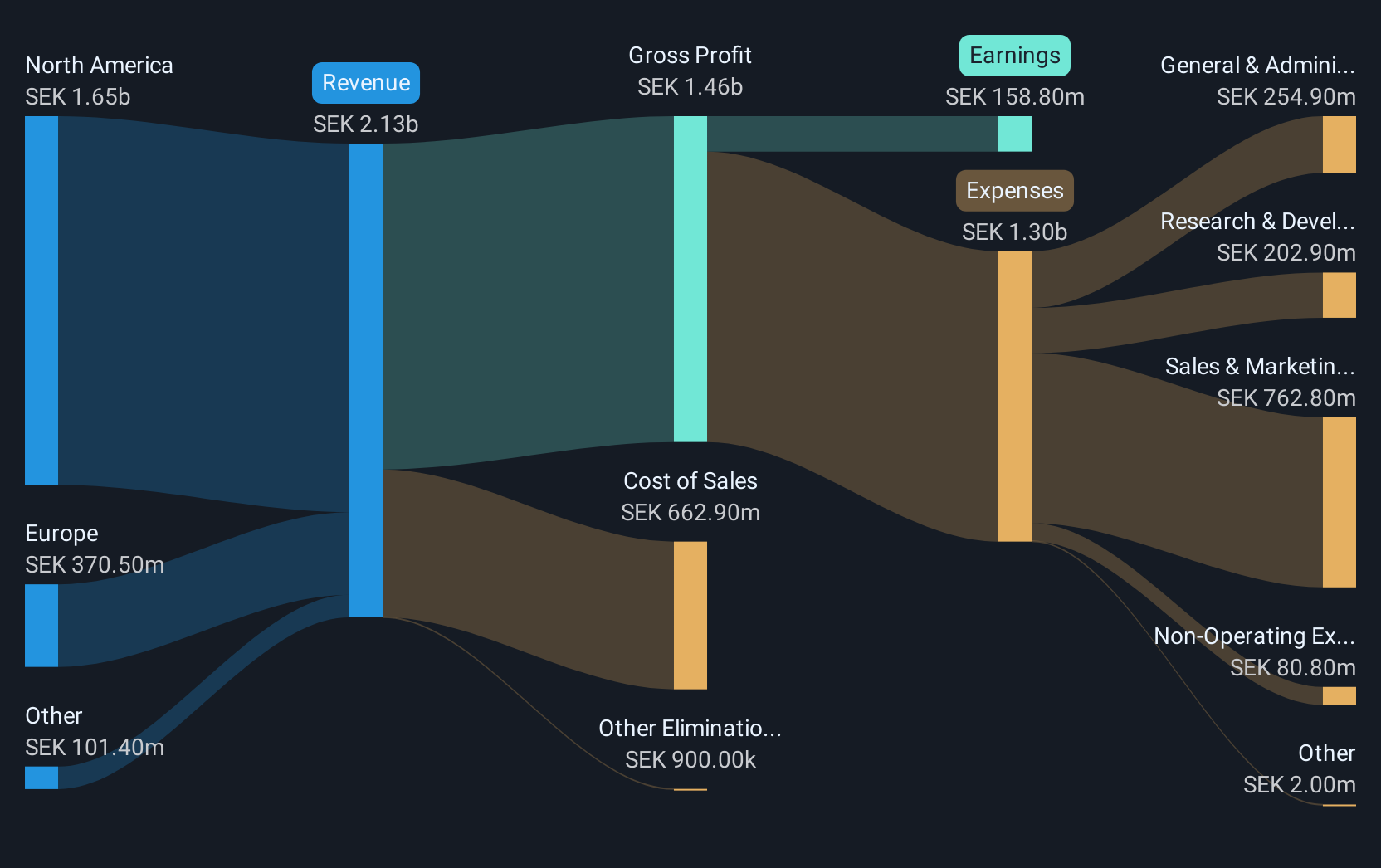

Operations: The company generates revenue primarily from its computer hardware segment, amounting to SEK1.97 billion.

Dynavox Group, with its strategic moves and robust performance metrics, is carving a niche in the high-growth tech sector in Europe. The company's recent extension of its credit facility by SEK 200 million underscores its aggressive approach towards acquisitions, aimed at scaling operations further. This financial maneuver is supported by a solid track record of revenue growth to SEK 1.97 billion, up from SEK 1.61 billion the previous year, and an increase in net income from SEK 104 million to SEK 146 million. Moreover, Dynavox's commitment to innovation is evident as it channels resources into R&D, aligning with industry trends towards enhanced technological offerings. With earnings projected to surge by 29.3% annually and revenue growth expected at a steady pace of 13.5% per year—surpassing the Swedish market average—Dynavox appears well-positioned for sustained advancement in the competitive tech landscape.

- Take a closer look at Dynavox Group's potential here in our health report.

Assess Dynavox Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Unlock more gems! Our European High Growth Tech and AI Stocks screener has unearthed 228 more companies for you to explore.Click here to unveil our expertly curated list of 231 European High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives