Stock Analysis

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Doro AB (publ) (STO:DORO) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Doro

What Is Doro's Debt?

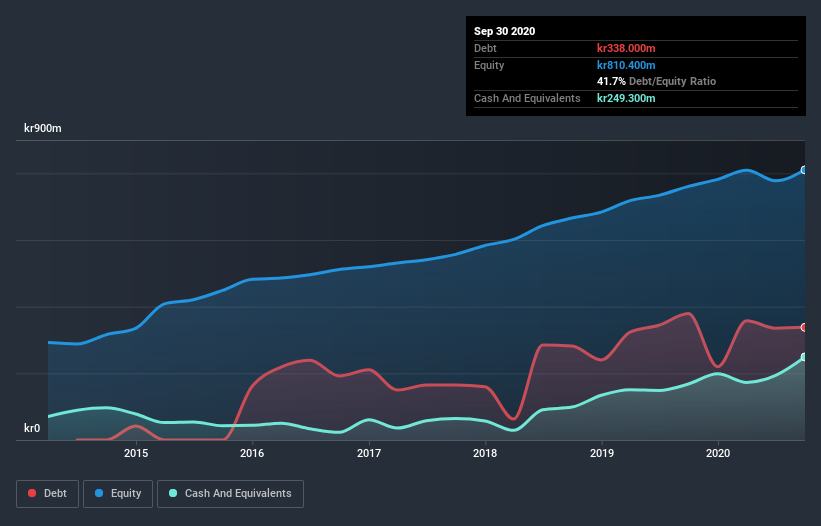

The image below, which you can click on for greater detail, shows that Doro had debt of kr275.4m at the end of September 2020, a reduction from kr379.4m over a year. However, because it has a cash reserve of kr249.3m, its net debt is less, at about kr26.1m.

How Healthy Is Doro's Balance Sheet?

According to the last reported balance sheet, Doro had liabilities of kr517.3m due within 12 months, and liabilities of kr338.0m due beyond 12 months. Offsetting this, it had kr249.3m in cash and kr303.6m in receivables that were due within 12 months. So it has liabilities totalling kr302.4m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Doro is worth kr1.14b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Doro has net debt of just 0.20 times EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.3 times the interest expense over the last year. The modesty of its debt load may become crucial for Doro if management cannot prevent a repeat of the 34% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Doro's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Doro actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Based on what we've seen Doro is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. Considering this range of data points, we think Doro is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Doro you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Doro or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Doro is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:DORO

Doro

A technology company, develops telecom and technology products and services for seniors in Nordic, West and South Europe, Africa, Central- and Eastern Europe, the United Kingdom, Ireland, and internationally.

Flawless balance sheet, undervalued and pays a dividend.