Exploring European Undervalued Small Caps With Insider Action In September 2025

Reviewed by Simply Wall St

As the European markets experience a modest uptick, with the STOXX Europe 600 Index rising by 1.03% amid expectations of U.S. interest rate cuts, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying stocks with strong fundamentals and insider activity can be particularly appealing to those looking for growth potential in undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 27.10% | ★★★★★★ |

| Kitwave Group | 12.4x | 0.3x | 39.55% | ★★★★★☆ |

| Bytes Technology Group | 17.8x | 4.5x | 9.82% | ★★★★☆☆ |

| Eleco | 30.6x | 3.3x | -23.50% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.6x | 4.4x | -209.02% | ★★★★☆☆ |

| Stelrad Group | 40.4x | 0.7x | 38.19% | ★★★☆☆☆ |

| Nyab | 22.3x | 1.0x | 35.25% | ★★★☆☆☆ |

| Oxford Instruments | 40.4x | 2.1x | 16.37% | ★★★☆☆☆ |

| CVS Group | 45.4x | 1.3x | 37.66% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.1x | 33.12% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

CLS Holdings (LSE:CLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CLS Holdings is a real estate investment company focusing on investment properties in the United Kingdom, Germany, and France with a market capitalization of £1.22 billion.

Operations: The company's revenue primarily stems from investment properties in the United Kingdom, Germany, and France. Gross profit margin has shown a general declining trend from 84.13% to 74.25% over recent periods, indicating changes in cost efficiency or pricing strategies. Operating expenses have remained relatively stable around £36 million, while non-operating expenses have significantly increased, impacting net income negatively.

PE: -4.0x

CLS Holdings, a European property company, has been navigating its small cap challenges with strategic moves. Despite reporting a net loss of £24.4 million for H1 2025, significantly reduced from the previous year's £61.1 million loss, insider confidence is evident as they have purchased shares in recent months. The company recently signed new leases at its Vauxhall and Cologne properties, reflecting strong demand for their office spaces. However, reliance on external borrowing poses some risk to financial stability. With an anticipated earnings growth of 58% annually, CLS remains a compelling option for those exploring undervalued opportunities in the market.

- Take a closer look at CLS Holdings' potential here in our valuation report.

Evaluate CLS Holdings' historical performance by accessing our past performance report.

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★☆☆

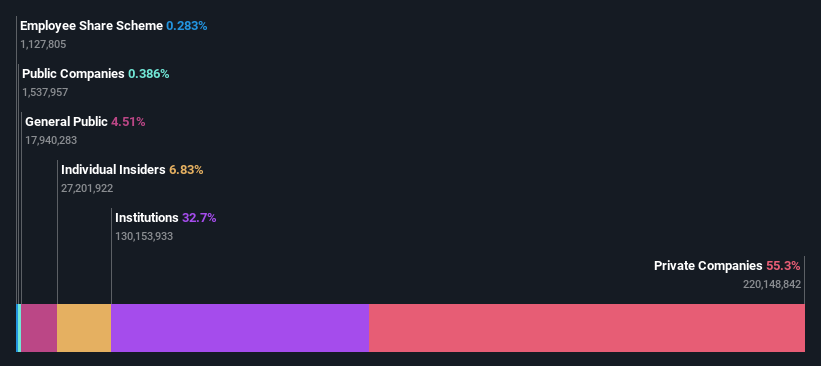

Overview: Nolato is a Swedish company specializing in developing and manufacturing polymer product systems for medical, automotive, and general industry sectors, with a market cap of approximately SEK 9.05 billion.

Operations: The company generates revenue primarily from its Medical Solutions and Engineered Solutions segments, with Medical Solutions contributing SEK 5.47 billion and Engineered Solutions SEK 4.18 billion. The gross profit margin has seen fluctuations, reaching as high as 17.60% in recent periods, indicating variability in cost management efficiency relative to revenue generation over time.

PE: 22.2x

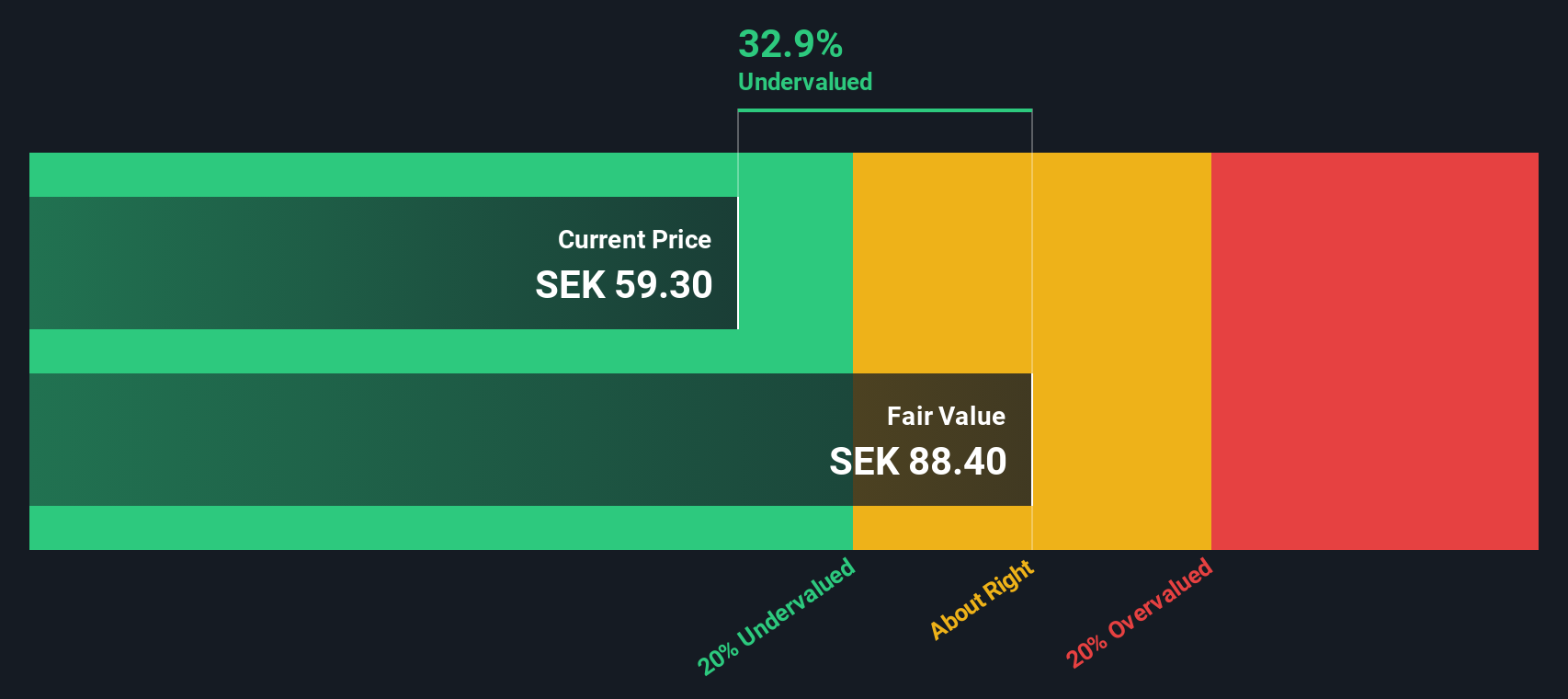

Nolato, a smaller European company, showcases potential with its earnings growth forecasted at 12% annually. Despite relying solely on external borrowing for funding, the company's recent financial results reveal resilience. For Q2 2025, Nolato's net income rose to SEK 212 million from SEK 169 million year-on-year. Insider confidence is evident as insiders have been purchasing shares consistently since early this year. These factors suggest a promising outlook amidst its current valuation challenges.

- Navigate through the intricacies of Nolato with our comprehensive valuation report here.

Explore historical data to track Nolato's performance over time in our Past section.

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★★

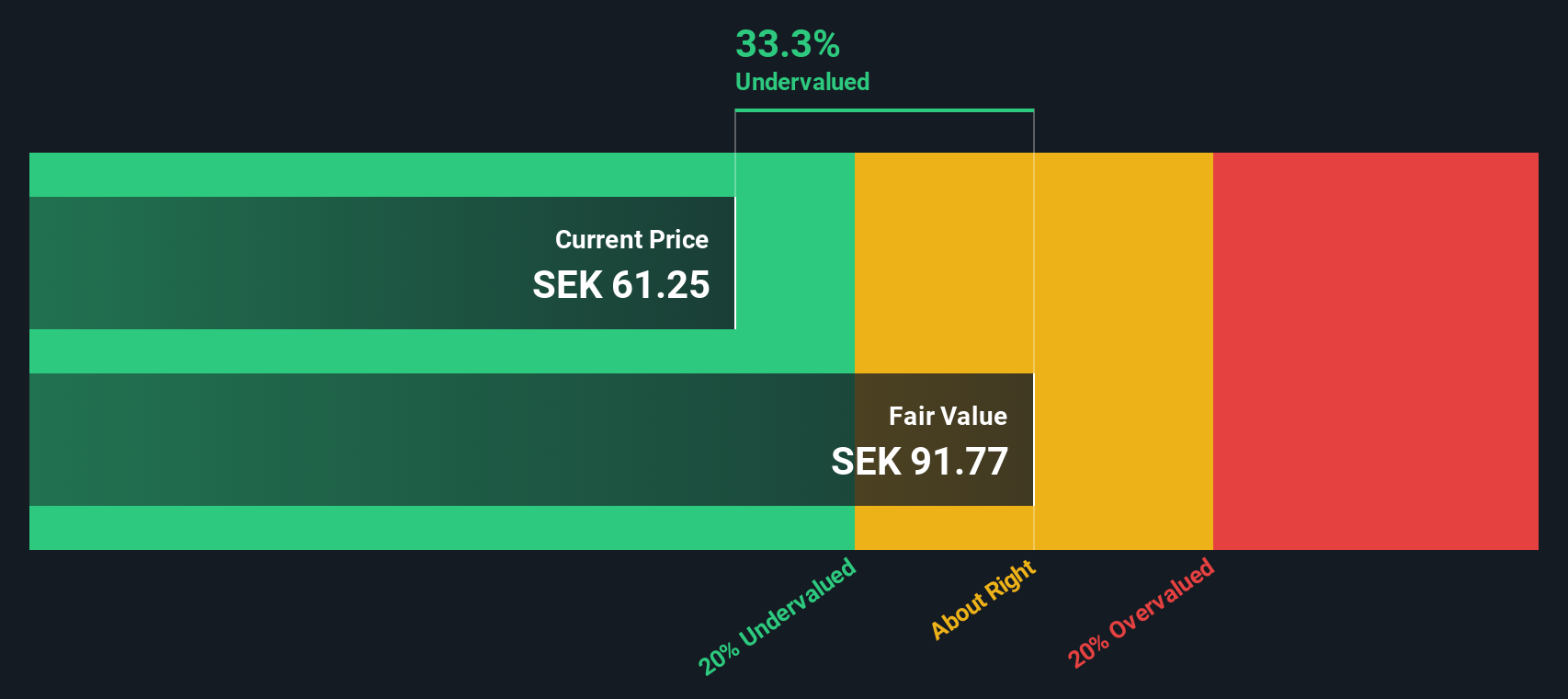

Overview: Truecaller is a communications software company focused on providing caller identification and spam blocking services, with a market cap of approximately SEK 16.92 billion.

Operations: The company generates revenue primarily from communications software, with a recent gross profit margin of 77.44%. Operating expenses are significant, with general and administrative expenses being a notable component.

PE: 31.8x

Truecaller, a European communications platform, is gaining attention in the investment community for its potential growth and insider confidence. Co-Founder & Chairman Nami Zarringhalam recently purchased 22,832 shares valued at approximately SEK 986,114. This move signals strong belief in the company's future prospects. Truecaller's earnings are forecasted to grow by over 24% annually despite relying on higher-risk external borrowing for funding. Recent strategic hires bolster its Ad Solutions business, aiming to enhance advertising capabilities with data-driven insights and transparent metrics.

Taking Advantage

- Reveal the 46 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives