- Sweden

- /

- Commercial Services

- /

- OM:NORVA

3 Stocks That May Be Trading Below Their Estimated Value By 38% To 50%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and a strong labor market boosting sentiment, investors are increasingly on the lookout for opportunities in undervalued stocks that might offer potential value amidst economic uncertainties. In this environment, identifying stocks trading below their estimated value can be appealing, as these investments may provide room for growth when broader market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Truecaller (OM:TRUE B) | SEK47.98 | SEK95.84 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.25 | 49.9% |

| Kitron (OB:KIT) | NOK31.18 | NOK62.32 | 50% |

| CS Wind (KOSE:A112610) | ₩41600.00 | ₩83136.08 | 50% |

| PLAIDInc (TSE:4165) | ¥1604.00 | ¥3207.80 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Neosperience (BIT:NSP) | €0.57 | €1.14 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.38 | 50% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2905.00 | ¥5793.18 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

CS Wind (KOSE:A112610)

Overview: CS Wind Corporation manufactures and sells wind towers across various countries including Vietnam, China, Canada, the United Kingdom, Turkey, Taiwan, Malaysia, and Australia with a market cap of ₩1.72 trillion.

Operations: Revenue segments for CS Wind include the manufacture and sale of wind towers in Vietnam, China, Canada, the United Kingdom, Turkey, Taiwan, Malaysia, Australia, and other international markets.

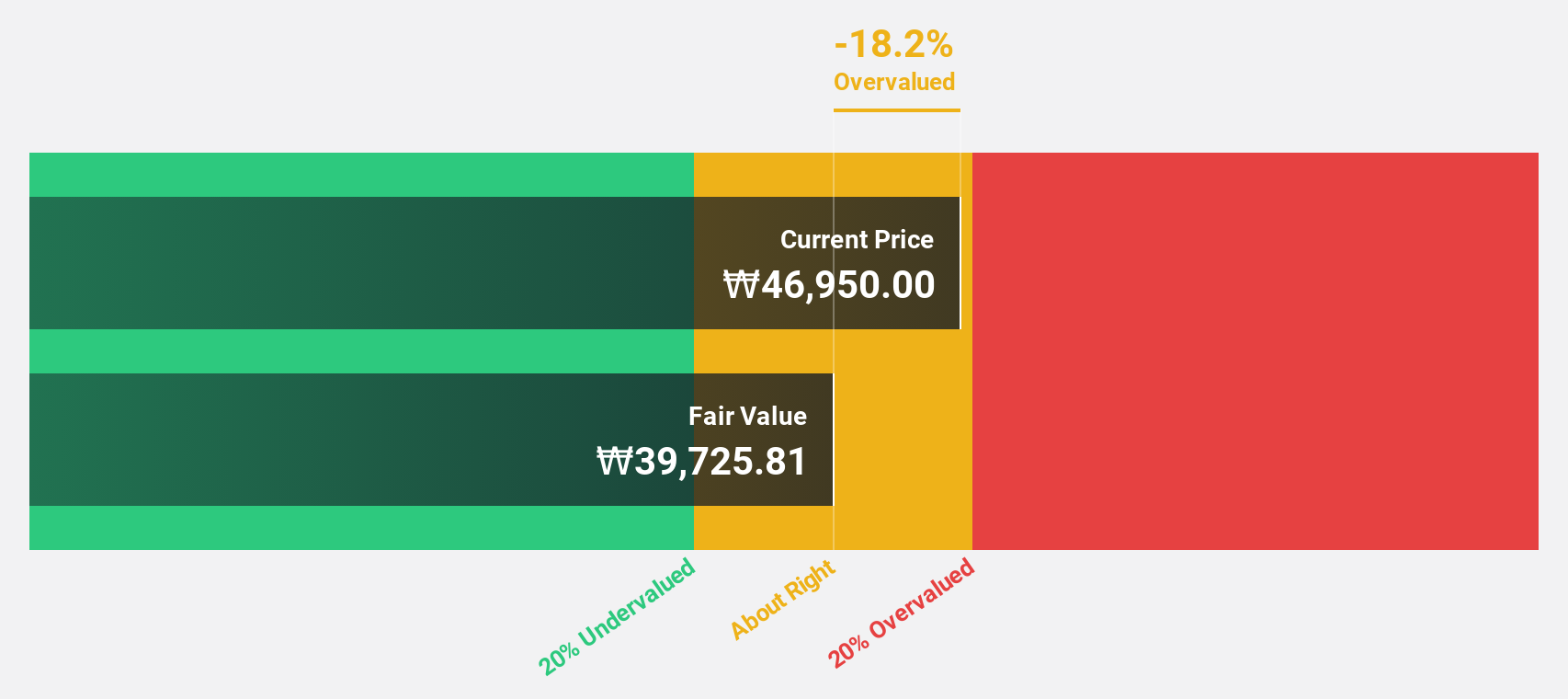

Estimated Discount To Fair Value: 50%

CS Wind is trading at 50% below its estimated fair value of ₩83,136.08, highlighting its potential undervaluation based on cash flows. Despite high non-cash earnings and debt not well covered by operating cash flow, the company's earnings grew significantly by 165.4% last year and are forecast to grow faster than the Korean market at 29.6% annually. Analysts agree on a potential stock price rise of nearly 90%, indicating strong growth prospects despite slower revenue growth expectations.

- In light of our recent growth report, it seems possible that CS Wind's financial performance will exceed current levels.

- Take a closer look at CS Wind's balance sheet health here in our report.

Norva24 Group (OM:NORVA)

Overview: Norva24 Group AB (Publ) operates in Northern Europe, offering underground infrastructure maintenance services, with a market cap of SEK5.23 billion.

Operations: The company generates revenue from its Waste Management segment, amounting to NOK3.50 billion.

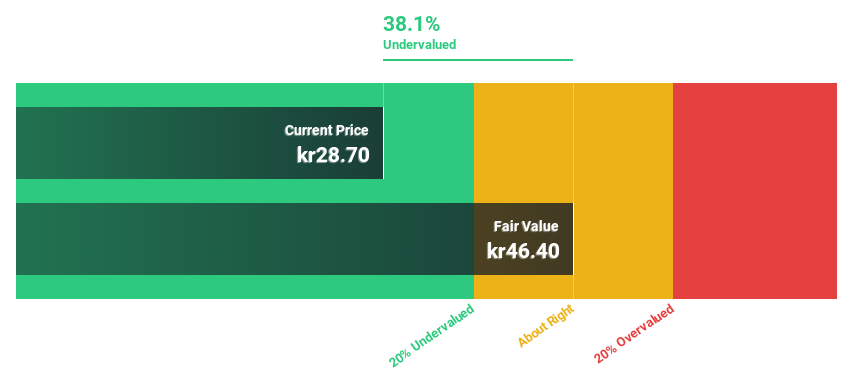

Estimated Discount To Fair Value: 38%

Norva24 Group is trading at 38% below its estimated fair value of SEK46.37, suggesting it may be undervalued based on cash flows. Despite a decline in net income to NOK 49 million for Q3 2024, earnings are forecast to grow significantly by over 20% annually, outpacing the Swedish market's growth rate. Revenue growth is expected at a slower pace of 7.8% per year, yet still above the market average, supporting its potential for future profitability improvements.

- Our earnings growth report unveils the potential for significant increases in Norva24 Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Norva24 Group.

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK16.46 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.78 billion.

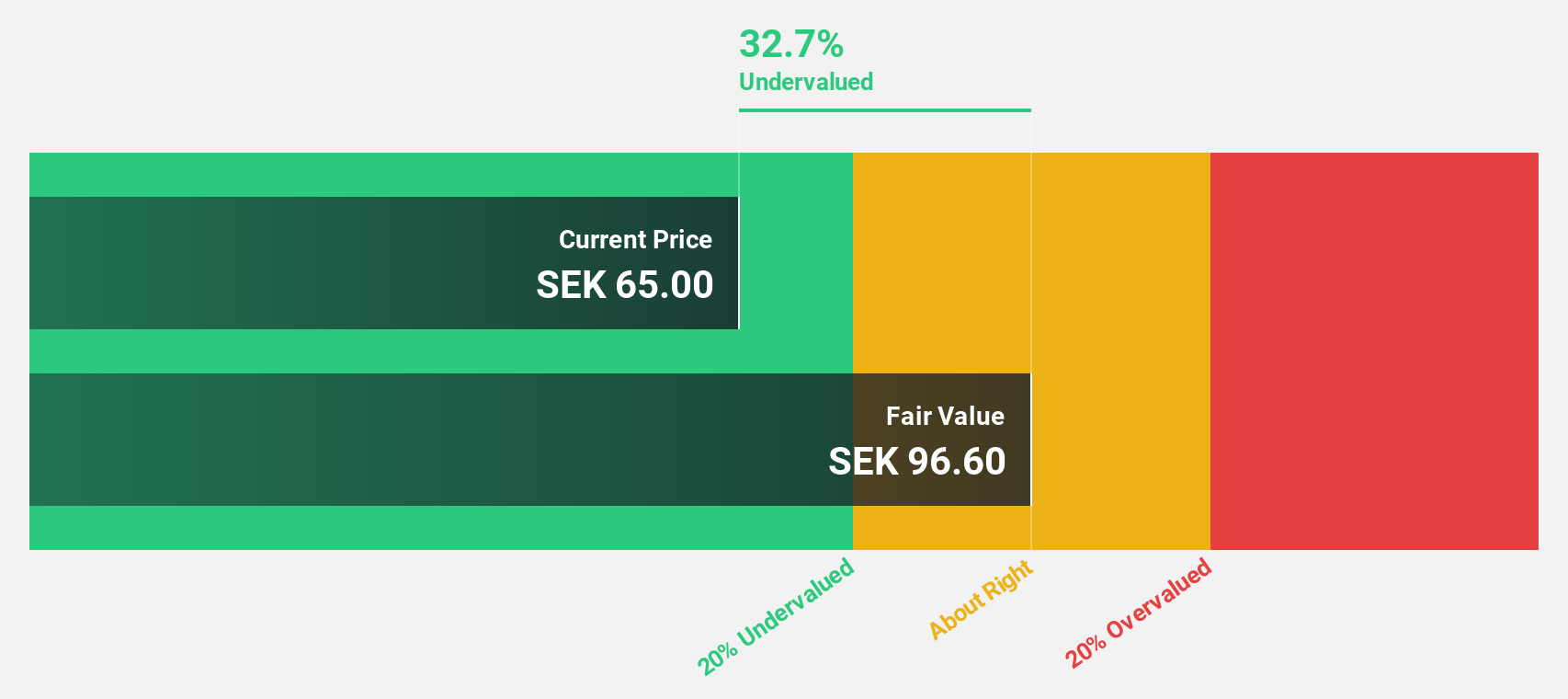

Estimated Discount To Fair Value: 49.9%

Truecaller is trading at SEK47.98, significantly below its estimated fair value of SEK95.84, indicating potential undervaluation based on cash flows. The company reported Q3 2024 sales of SEK458.83 million and net income of SEK117.83 million, reflecting growth from the previous year. With revenue and earnings expected to grow over 20% annually, Truecaller shows strong prospects compared to the Swedish market's average growth rates, bolstered by strategic partnerships enhancing business communication solutions globally.

- Insights from our recent growth report point to a promising forecast for Truecaller's business outlook.

- Get an in-depth perspective on Truecaller's balance sheet by reading our health report here.

Key Takeaways

- Discover the full array of 914 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norva24 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORVA

Norva24 Group

Provides underground infrastructure maintenance services in Northern Europe.

Excellent balance sheet with reasonable growth potential.