Terranet (STO:TERRNT B) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Terranet AB (STO:TERRNT B) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Terranet

What Is Terranet's Net Debt?

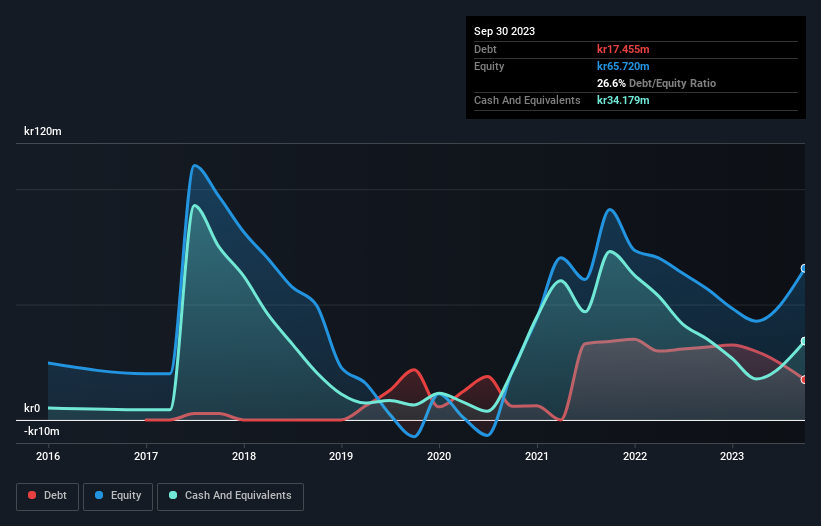

You can click the graphic below for the historical numbers, but it shows that Terranet had kr17.5m of debt in September 2023, down from kr31.6m, one year before. But it also has kr34.2m in cash to offset that, meaning it has kr16.7m net cash.

How Healthy Is Terranet's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Terranet had liabilities of kr28.6m due within 12 months and liabilities of kr2.65m due beyond that. Offsetting these obligations, it had cash of kr34.2m as well as receivables valued at kr584.0k due within 12 months. So it can boast kr3.55m more liquid assets than total liabilities.

This short term liquidity is a sign that Terranet could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Terranet has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Terranet's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Terranet had a loss before interest and tax, and actually shrunk its revenue by 43%, to kr2.5m. That makes us nervous, to say the least.

So How Risky Is Terranet?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Terranet had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through kr36m of cash and made a loss of kr39m. With only kr16.7m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Terranet you should be aware of, and 4 of them are a bit concerning.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Terranet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TERRNT B

Terranet

Engages in the development of technical solutions for Advanced Driver Assistance Systems (ADAS) in vehicles.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026